Singapore Airlines 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 79

Notes to the Financial Statements

31 March 2002

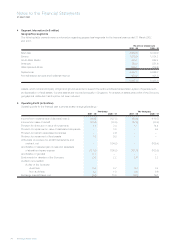

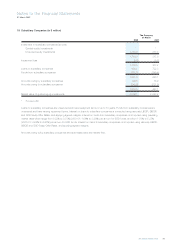

12 Share Capital (in $ million) (continued)

As at 31 March 2002, the unissued ordinary shares under The Singapore Airlines Limited Employee Share Option Plan were as

follows:

(i) 13,310,630 ordinary shares at $15.96 per share exercisable between 28 March 2001 and 27 March 2010. Consequent to the

capital reduction exercise, the exercise price was adjusted to $15.34 per share.

(ii) 11,973,150 ordinary shares at $17.32 per share exercisable between 3 July 2001 and 2 July 2010. Consequent to the capital

reduction exercise, the exercise price was adjusted to $16.65 per share.

(iii) 13,286,140 ordinary shares at $11.96 per share exercisable between 2 July 2002 and 1 July 2011.

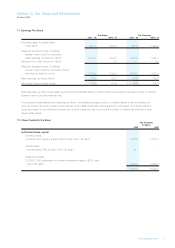

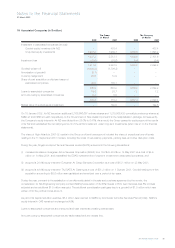

13 Reserves

Special non-distributable reserve

In prior years, an amount of $1,800.0 million was transferred from the general reserve to a special non-distributable reserve to meet

deferred tax liabilities that had not been fully provided for in the financial statements.

Effective 1 April 2001, the Company adopted SAS 12 (2001) Income Taxes. In accordance with SAS 12 (2001), the Company

recognizes deferred tax for all taxable temporary differences. With the change in this accounting policy, the $1,800.0 million previously

set-aside as a special non-distributable reserve was utilized.

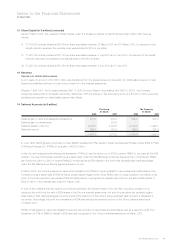

14 Deferred Accounts (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Deferred gain on sale and leaseback transactions 591.9 530.8 562.2 530.8

Deferred gain on divestments – 202.6 – –

Deferred taxation (note 15) 2,664.5 2,425.6 2,205.9 2,298.1

Deferred revenue 196.5 157.5 196.5 157.5

3,452.9 3,316.5 2,964.6 2,986.4

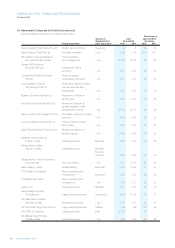

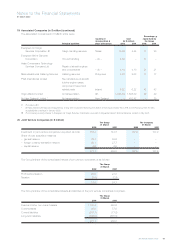

In June 1998, SIA Engineering Company Limited (SIAEC) divested its 51% interest in Eagle Services Asia Private Limited (ESA) to Pratt

& Whitney Holdings LLC (PWHLLC) at a gain of $202.6 million.

Under the various agreements effecting the transaction, PWHLLC had the option up to 2005 to require SIAEC to buy back all the ESA

shares in the event that certain specified engine base loads under the SIA Maintenance Service Agreement are not achieved. SIAEC

also holds the option to 2003 to require PWHLLC to sell back all its ESA shares in the event that specified fleet readiness targets

under the SIA Maintenance Service Agreement were not met.

In March 2000, the Company agreed to assume the obligations to PWHLLC requiring SIAEC to repurchase all the ESA shares if the

Company’s engine base loads to ESA fell below certain agreed trigger levels. Since SIAEC was no longer subject to conditions under

which it could be required to repurchase PWHLLC’s ESA shares, it recognized an exceptional profit from the sale of ESA shares of

$202.6 million in the financial year ended 31 March 2000.

In view of the possibility that the options could still be exercised, the directors were of the view that it would be prudent not to

recognize the profit from the sale of ESA shares in the Group’s financial statements until such time as either the specified engine

base loads or fleet readiness targets could be met and the likelihood of the options being exercised was removed or assessed to

be remote. Accordingly, the profit from divestment of ESA was reflected as deferred income on the Group balance sheet as at

31 March 2001.

PWHLLC has agreed to waive the obligations requiring the Company to repurchase the ESA shares, and as a result the profit from

divestment of 51% of SIAEC’s interest in ESA has been recognized in the Group’s financial statements for March 2002.