Singapore Airlines 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02

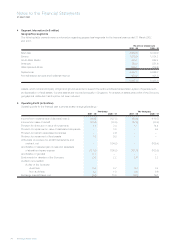

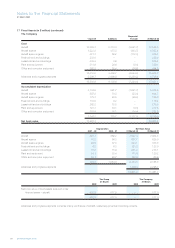

9 Taxation (in $ million)

The Group The Company

2001 - 02 2000 - 01 2001 - 02 2000 - 01

Current taxation 94.7 140.0 40.4 113.5

Overprovision in prior years (57.6) (1.9) (55.0) –

Deferred taxation 206.5 91.3 188.1 71.5

Share of joint venture companies’ taxation 3.0 2.9 – –

Share of associated companies’ taxation

– Current (42.1) 10.1 – –

– Underprovision in prior years 29.3 – – –

233.8 242.4 173.5 185.0

The current year’s taxation charge for the Group and the Company is computed after taking into account expenses not deductible for

tax purposes and income not assessable to tax and therefore differs from the amount determined by applying the statutory tax rate to

the financial year’s profit (refer note 34 to the financial statements for subsequent event in relation to taxation).

A reconciliation of the statutory tax rate to the Group and the Company’s effective tax rate applicable to pre-tax profits was as follows:

The Group The Company

2001 - 02 2000 - 01 2001 - 02 2000 - 01

Profit before taxation for the year 925.6 1,904.7 740.7 1,607.2

Taxation at statutory tax rate of 24.5% 226.8 466.7 181.5 393.8

Adjustments

Income not subject to tax (117.6) (178.1) (55.0) (166.9)

Expenses not deductible for tax purposes 162.2 21.3 101.0 19.8

Higher effective tax rates of other countries (2.2) 11.6 6.3 12.0

Overprovision in prior years (28.3) (1.9) (55.0) –

Effect of change in statutory tax rates – (90.9) – (87.3)

Others (7.1) 13.7 (5.3) 13.6

Current financial year’s taxation charge 233.8 242.4 173.5 185.0

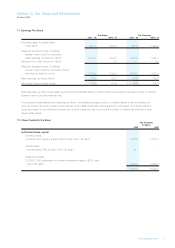

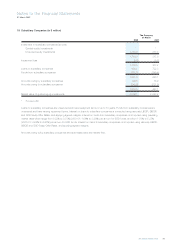

10 Dividends Paid and Proposed (in $ million)

The Group The Company

2001 - 02 2000 - 01 2001 - 02 2000 - 01

Dividends paid :

Final dividend of 20.0 cents per share

less 24.5% tax in respect of previous

financial year (1999-2000: 20.0 cents per share

less 25.5% tax) 184.2 186.3 184.2 186.3

Interim dividend of 3.0 cents per share

less 24.5% tax (2000-01: 15.0 cents

per share less 25.5% tax) 27.6 136.9 27.6 136.9

211.8 323.2 211.8 323.2

The directors propose that a final tax exempt dividend of 4.0 cents per share ($48.7 million) and a dividend of 8.0 cents per share less

tax at 22.0% ($76.0 million) amounting to a total of $124.7 million, be paid for the year ended 31 March 2002.