Singapore Airlines 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02

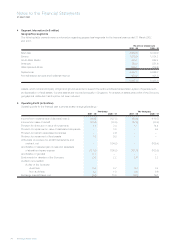

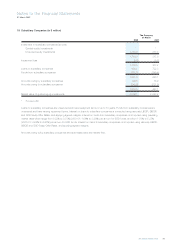

15 Deferred Taxation (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Balance at April 1

As previously reported 624.0 457.7 519.8 365.8

Change in accounting policies (see note 2) 1,816.3 1,876.6 1,789.8 1,860.8

As restated 2,440.3 2,334.3 2,309.6 2,226.6

Provided during the financial year 206.5 91.3 188.1 71.5

Transfer to Singapore Airlines Cargo – – (309.5) –

Underprovision of prior years 17.7 – 17.7 –

Balance at 31 March 2,664.5 2,425.6 2,205.9 2,298.1

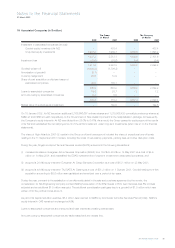

The deferred taxation arises as a result of:

Deferred tax liabilities

An excess of net book value over tax written

down value of fixed assets 2,769.2 2,554.2 2,257.0 2,379.8

Other timing differences 131.1 124.6 116.4 110.6

Gross deferred tax liabilities 2,900.3 2,678.8 2,373.4 2,490.4

Deferred tax assets

Unabsorbed capital allowances and tax losses 119.5 53.5 53.8 –

Other deferred tax assets 116.3 199.7 113.7 192.3

Gross deferred tax assets 235.8 253.2 167.5 192.3

Net deferred tax liability 2,664.5 2,425.6 2,205.9 2,298.1

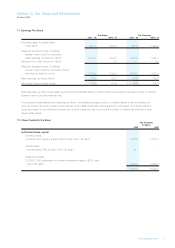

16 Long-Term Liabilities (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Notes payable 1,100.0 200.0 900.0 –

Repayable within one year ––––

Repayable after one year 1,100.0 200.0 900.0 –

Loans – unsecured 223.1 4.0 220.0 –

Repayable within one year (221.6) (0.6) (220.0) –

Repayable after one year 1.5 3.4 – –

Finance lease commitments 869.7 592.1 606.8 592.1

Repayable within one year (42.3) – – –

Repayable after one year 827.4 592.1 606.8 592.1

1,928.9 795.5 1,506.8 592.1

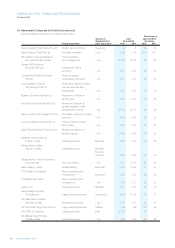

Notes payable comprise unsecured long-term notes issued by the Company, which bear interest at 4.15% (2000-01: nil) per annum

and are repayable on 19 December 2011, and unsecured medium-term notes issued by Singapore Airport Terminal Services Limited

(SATS), which bear interest at 2.94% (2000-01: 2.94%) per annum and are repayable on 29 March 2004.

Interest rates on unsecured loans are charged at a range from 0.87% to 2.38% (2000-01: 2.47% to 3.90%) per annum.