Singapore Airlines 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

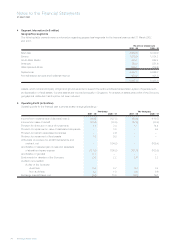

64 SIA Annual Report 01/02

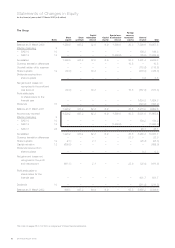

Cash Flow Statements

For the financial year ended 31 March 2002 (in $ million)

The Group The Company

Notes 2001 - 02 2000 - 01 2001 - 02 2000 - 01

NET CASH PROVIDED BY

OPERATING ACTIVITIES 27 1,434.5 2,451.1 620.3 1,991.2

CASH FLOW FROM INVESTING

ACTIVITIES

Capital expenditure 28 (3,532.4) (2,555.5) (2,882.2) (2,336.1)

Proceeds from disposal of aircraft and

other fixed assets 1,601.8 772.1 1,302.0 752.3

Returns on capital from associated companies 5.4 – – –

Investments in associated companies (37.9) (448.8) – (403.2)

Investments in joint venture companies (13.6) (19.3) – –

Additional long-term investments (3.6) (41.9) (3.5) (38.4)

Additional long-term loans (1.1) (0.8) – –

Advances to associated companies (0.1) (2.6) – –

Loans to subsidiary companies – – (313.2) (83.3)

Repayment of loans by subsidiary companies – – 624.7 216.7

Repayment of loans by associated companies 1.4 1.4 – –

Proceeds from liquidation of

subsidiary companies – – 191.4 –

Proceeds from sale of long-term investments 32.9 2.3 31.4 2.3

Proceeds from disposal of associated

companies 6.1 – 8.8 –

Proceeds from disposal of 13% equity

interests in SATS/SIAEC – 574.6 – 574.6

Dividends from subsidiary and

associated companies 31.2 21.9 106.2 46.4

Repayment of loans 2.7 1.7 – –

Investment in subsidiary by minority interests 0.6 – – –

Investment in subsidiary (0.6) – – –

NET CASH USED IN INVESTING ACTIVITIES (1,907.2) (1,694.9) (934.4) (1,268.7)

CASH FLOW FROM FINANCING ACTIVITIES

Share buyback (25.3) (476.0) (25.3) (476.0)

Dividends paid (211.8) (323.2) (211.8) (323.2)

Dividends paid by subsidiary companies

to minority interests (16.0) (6.0) – –

Dividends received from share buyback 0.3 3.8 0.3 3.8

Proceeds from/(repayment of) borrowings 1,119.1 (16.3) 1,120.0 –

Issuance of financial instruments – notes payable – 200.0 – –

Increase in long-term lease liabilities 2.1 2.5 2.1 2.5

Capital reduction (609.0) – (609.0) –

NET CASH PROVIDED BY/(USED IN)

FINANCING ACTIVITIES 259.4 (615.2) 276.3 (792.9)

NET CASH (OUTFLOW)/INFLOW (213.3) 141.0 (37.8) (70.4)

CASH AND CASH EQUIVALENTS AT

BEGINNING OF FINANCIAL YEAR 1,244.9 1,092.9 841.1 900.5

Effect of exchange rate changes 3.2 11.0 3.2 11.0

CASH AND CASH EQUIVALENTS AT END OF

FINANCIAL YEAR 1,034.8 1,244.9 806.5 841.1

ANALYSIS OF CASH AND CASH EQUIVALENTS

Fixed deposits 531.5 1,136.1 438.0 760.4

Cash and bank 560.1 136.2 416.9 106.6

Bank overdrafts – unsecured (56.8) (27.4) (48.4) (25.9)

CASH AND CASH EQUIVALENTS AT END OF

FINANCIAL YEAR 1,034.8 1,244.9 806.5 841.1

The notes on pages 65 to 100 form an integral part of these financial statements.