Singapore Airlines 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 69

Notes to the Financial Statements

31 March 2002

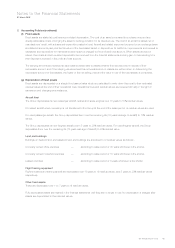

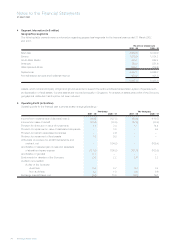

2 Accounting Policies (continued)

(m) Deferred taxation

Deferred tax is provided, using the liability method, on all temporary differences at the balance sheet date between the tax bases

of assets and liabilities and their carrying amounts for financial reporting purposes.

Additionally the Group’s deferred tax liabilities include all taxable temporary differences associated with investments in subsidiary,

joint venture and associated companies, except where the timing of the reversal of the temporary differences can be controlled

and it is probable that the temporary differences will not reverse in the foreseeable future.

Deferred tax assets are recognised for all deductible temporary differences, carry forward of unused tax assets and losses, to the

extent that it is probable that taxable profit will be available against which the deductible temporary differences, carry forward of

unused tax assets and losses, can be utilized. For deductible temporary differences associated with the Group’s investments in

subsidiary, joint venture and associated companies, deferred tax assets are only recognized to the extent that it is probable that

the temporary differences will reverse in the foreseeable future and taxable profit will be available against which the temporary

difference can be utilized.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow all or part of the deferred tax assets to be utilized.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realized

or the liability is settled, based on tax rates (and tax laws) that have been enacted at the balance sheet date.

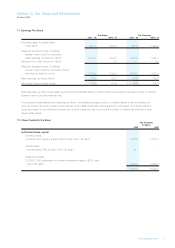

(n) Loans and borrowings

Loans, notes payable and other borrowings are recognized at cost.

(o) Aircraft maintenance and overhaul costs

The Company recognizes aircraft maintenance and overhaul expenses on an incurred basis.

(p) Employee Benefits

Equity compensation plan

The Group has in place the Singapore Airlines Limited Employee Share Option Plan, the Singapore Airport Terminal Services

Limited Employee Share Option Plan and the SIA Engineering Company Limited Employee Share Option Plan for granting of share

options to senior executives and all other employees. There are no charges to the profit and loss account upon the grant or

exercise of the options. The exercise price approximates the market value of the shares at the date of grant. Details of the plans

are disclosed in Note 31 to the financial statements.

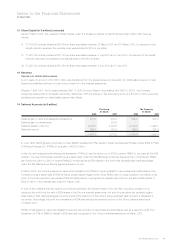

Defined contribution plan

As required by law, the companies in Singapore make contributions to the state pension scheme, the Central Provident Fund

(CPF). Certain of the Group’s companies and overseas stations outside Singapore make contributions to their respective

countries’ pension schemes. Such contributions are recognized as compensation expenses in the same period as the

employment that gave rise to the contributions.

Defined benefit plan

The Company contributes to several defined benefit pension and other post employment benefit plans for employees stationed in

certain overseas countries. The cost of providing benefits includes the company contribution for the year plus any unfunded

liabilities under the plans, which is determined separately for each plan. Contributions to the plans over the expected average

remaining working lives of the employees participating in the plans are expensed off.