Singapore Airlines 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expenditure (continued)

Expenditure on inflight meals and other passenger costs was $7 million less (–1.4%) chiefly as a result of lower passenger carriage and

new measures to reduce waste.

Aircraft maintenance and overhaul (AMO) costs rose $320 million (+75.3%) as costs are now recognized on an incurred basis. Last year’s

costs were also reduced by $91 million when overhaul costs for A343s were accounted as overhaul work done to meet “pre-delivery

condition” agreed with Boeing in the trade-in agreement and were not therefore treated as AMO costs. Also, there was a writeback of

$161 million in 2000-01 for overprovision of AMO in previous years while there was none this year. AMO costs would be 10.0% higher if

not for these differences.

Communications, IT and related expenses rose $61 million (+57.3%) because of higher costs of (i) IT contract fees, (ii) hire of computer

equipment, (iii) data transmission costs, (iv) depreciation of computer equipment, and (v) maintenance of computer equipment.

Rate hikes added $58 million (+8.2%) to handling charges.

Landing, parking and overflying charges were $20 million (+4.3%) higher. Rate increases caused the rise.

SIA Annual Report 01/02 39

Financial Review

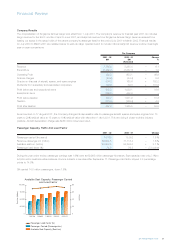

2001 - 02

10.2%

21.2%

15.5%

4.2%

2.3%

6.5%

7.0%

8.6%

3.7%

10.4%

10.1%

21.6%

17.9%

4.0%

1.5%

6.2%

7.0%

9.5%

3.3%

13.1%

5.8%

Company Expenditure Composition

2000 - 01

10.4%

2001 - 02 2000 - 01 Change

$M % $M % %

(Restated) R1

Fuel costs 1,540.9 21.2 1,587.5 21.6 –2.9

Staff costs 1,128.9 15.5 1,316.6 17.9 –14.3

Handling charges 756.5 10.4 699.0 9.5 + 8.2

Depreciation charges. R2 754.5 10.4 962.3 13.1 –21.6

Rentals on lease of aircraft 270.1 3.7 244.8 3.3 + 10.3

Aircraft maintenance and overhaul costs 745.1 10.2 425.1 5.8 + 75.3

Sales costs R3 625.6 8.6 745.4 10.1 –16.1

Inflight meal and other passenger costs 511.4 7.0 518.6 7.0 –1.4

Landing, parking and overflying charges 477.0 6.5 457.4 6.2 + 4.3

Communication and information

technology costs R4 166.3 2.3 105.7 1.5 + 57.3

Other costs R5 306.4 4.2 294.9 4.0 + 3.9

7,282.7 100.0 7,357.3 100.0 –1.0

R1 Restated as if Singapore Airlines Cargo corporatization took place in the previous year to allow meaningful year-

on-year comparisons.

R2 Excluding depreciation of computer equipment which is included as part of IT costs

R3 Sales costs include commissions and incentives payable, frequent flyer programme costs and advertising

expenses.

R4 Communication and information technology costs are for data transmission ($41M), contract service fees

($33M), depreciation of computer equipment ($25M), hire of computer equipment ($16M), maintenance of

computer equipment ($15M), maintenance/rental of software ($12M), professional fees ($9M) and other

related expenses ($15M).

R5 Other costs comprise crew expenses ($101M), company accommodation costs ($90M), insurance expenses

($79M), gain on exchange ($6M) and other miscellaneous expenses net of recoveries ($42M).