Singapore Airlines 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02

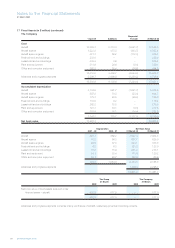

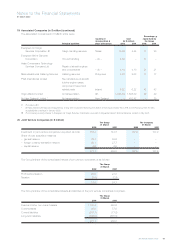

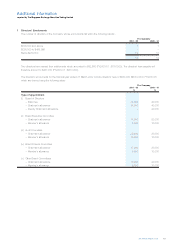

26 Trade Creditors (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Trade creditors 1,769.9 2,354.3 1,166.4 1,838.2

Provision for aircraft maintenance and overhaul – 110.8 – 97.7

1,769.9 2,465.1 1,166.4 1,935.9

Effective 1 April 2001, the Company and the Group recognize the cost incurred for engine overhaul and heavy maintenance visits on

an incurred basis. The change in the accounting policy resulted in a pre-tax write-back of $59.9 million for the Group and $46.8 million

for the Company to the opening balance of the general reserves for 2001-02. The tax effect of $14.8 million for the Group and $11.5

million for the Company had also been adjusted against the opening balance of the general reserves for 2001-02.

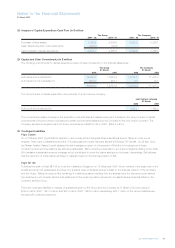

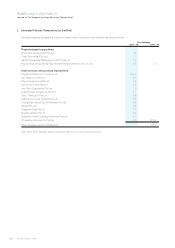

27 Cash Flow from Operating Activities (in $ million)

The Group The Company

2001 - 02 2000 - 01 2001 - 02 2000 - 01

Operating profit 983.4 1,346.7 482.3 983.4

Adjustments for:-

Depreciation of fixed assets 969.4 1,145.1 779.7 1,054.8

Income from investments and deposits (64.6) (127.5) (65.6) (110.7)

Write-back of provision for aircraft maintenance

and overhaul, net – (104.8) – (109.4)

Provision for diminution in value of long-term investments 1.1 14.4 1.1 14.4

Provision for impairment in value of associated companies – 3.5 – 9.4

Amortization of goodwill 5.1 – – –

Provision for loans to associated companies – 2.6 – –

Surplus on sale of long-term investments (5.0) (3.1) (4.3) (0.1)

Surplus on sale of fixed assets other than aircraft

and spares (2.9) (2.4) (0.1) (2.2)

Surplus on sale of associated companies – – (0.2) –

Exchange differences (0.8) (6.4) (9.4) (5.6)

Provision for impairment of fixed assets 1.8 9.0 – –

Amortization of deferred gain on sale and leaseback

of aircraft and spare engines (121.2) (100.8) (121.0) (100.8)

Operating profit before working capital changes 1,766.3 2,176.3 1,062.5 1,733.2

(Decrease)/Increase in trade creditors

and deferred accounts (765.4) 255.8 (813.2) 116.2

Decrease in investments 477.2 200.2 – –

Increase in sales in advance of carriage 34.0 67.6 59.7 65.5

(Increase)/decrease in debtors (117.6) (57.9) 185.4 (28.0)

(Increase)/decrease in stocks (12.6) 2.3 (3.1) 1.9

Increase in amounts owing to subsidiary

and associated companies – – 47.6 280.7

Increase in deferred revenue 39.0 – 39.0 –

Decrease in amounts owing by subsidiary and

associated companies 0.2 0.4 – –

Cash generated from operations 1,421.1 2,644.7 577.9 2,169.5

Interest paid (22.3) (37.2) (25.1) (44.1)

Income taxes paid (40.7) (280.5) (6.6) (224.7)

Interest/dividends received from investments and deposits 76.4 124.1 74.1 90.5

Net cash provided by operating activities 1,434.5 2,451.1 620.3 1,991.2