Singapore Airlines 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02 85

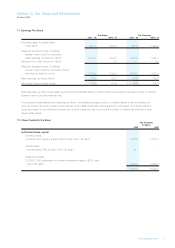

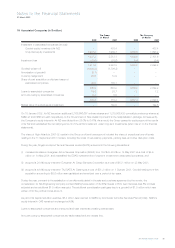

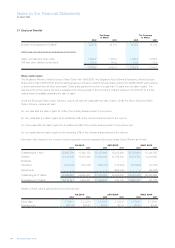

18 Subsidiary Companies (in $ million)

The Company

31 March

2002 2001

Investment in subsidiary companies (at cost)

Quoted equity investments **

Unquoted equity investments 1,710.3 317.0

1,710.3 317.0

Impairment loss (9.8) (9.8)

1,700.5 307.2

Loans to subsidiary companies 693.2 722.3

Funds from subsidiary companies (712.1) (349.4)

1,681.6 680.1

Amounts owing by subsidiary companies 196.5 18.9

Amounts owing to subsidiary companies (243.6) (231.9)

1,634.5 467.1

Market value of quoted equity investments 3,506.1 2,227.2

*The value is $2

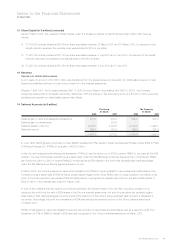

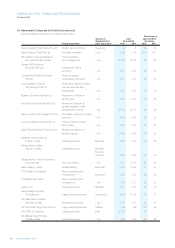

Loans to subsidiary companies are unsecured and have repayment terms of up to 10 years. Funds from subsidiary companies are

unsecured and have varying repayment terms. Interest on loans to subsidiary companies is computed using variously LIBOR, SIBOR

and SGD Swap-Offer Rates, and applying agreed margins. Interest on funds from subsidiary companies is computed using prevailing

market rates which range from 0.22% to 3.73% (2000-01: 1.06% to 3.88%) per annum for SGD funds, and from 1.70% to 5.25%

(2000-01: 4.92% to 6.80%) per annum for USD funds. Interest on loans to subsidiary companies is computed using variously LIBOR,

SIBOR and SGD Swap-Offer Rates, and applying agreed margins.

Amounts owing to/by subsidiary companies are trade-related and are interest-free.