Singapore Airlines 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 53

Report by the Board of Directors

5 Directors of the Company (continued)

Neither at the end of the financial year, nor at any time during that financial year, did there subsist any arrangements to which the

Company is a party, whereby directors might acquire benefits by means of the acquisition of shares and share options in, or

debentures of, the Company or any other body corporate, other than pursuant to the Singapore Airlines Limited Employee Share

Option Plan.

(c) Since the end of the previous financial year no director has received or has become entitled to receive benefits under contracts

required to be disclosed by Section 201(8) of the Companies Act, Cap. 50, except for $0.9 million (2000-01 : $0.9 million) of

loans to directors of the Company and its subsidiary companies in accordance with schemes approved by shareholders of the

Company and $0.057 million (2000-01 : $0.003 million) paid by the Group and the Company to a firm of which one director is

a member.

6 Audit Committee

As at the date of this report, the Audit Committee comprises three members, two of whom are independent non–executive directors.

The members of the Audit Committee at the date of this report are:-

Edmund Cheng Wai Wing – Chairman

Koh Boon Hwee

Ho Kwon Ping

The Committee holds quarterly meetings with the internal auditors and the external auditors of the Company, and performs the

following functions:-

(a) reviews the audit plans of the internal auditors and external auditors of the Company, the results of their examination of the

Company’s system of internal accounting controls and the co-operation given by the Company’s officers to the external and

internal auditors;

(b) reviews the financial statements of the Group and the Company and the auditors’ report thereon before their submission to the

Board of Directors;

(c) nominates the external auditors for reappointment; and

(d) reviews interested persons transactions.

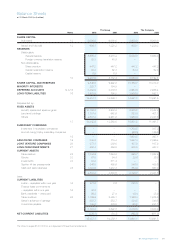

7 Share Capital and Debentures

During the financial year, the Company repurchased 2,054,000 ordinary shares at an average price of $12.48 each pursuant to the

share buyback scheme approved by the shareholders. The shares repurchased were cum dividends of $0.3 million.

At an extraordinary general meeting on 14 July 2001, the Company’s shareholders approved a capital reduction exercise to return

$0.50 in cash for each issued ordinary share, subject to approval of the High Court of Singapore. On 16 August 2001, sanction was

granted by the High Court. $609.0 million was paid to shareholders on 24 September 2001 based on 1,218,143,622 shares

outstanding on that date after accounting for share buyback.

On 19 December 2001, the Company issued $900,000,000 Fixed Rate Notes Due 2011 (Notes). The net proceeds from the issue of

the Notes were used to finance capital expenditure and working capital requirements.

During the financial year, the following subsidiary companies issued shares:

(a) Singapore Airlines Cargo Private Limited issued 1,405,000,000 ordinary shares of $1.00 each at par to the Company as partial

consideration for the net assets purchased.

(b) Singapore Jamco Private Limited increased its issued and paid up share capital through the issue of 400,000 new ordinary shares

of $1.00 each at par for cash to SIA Engineering Company Limited. The issue was to provide working capital.