Singapore Airlines 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 87

Notes to the Financial Statements

31 March 2002

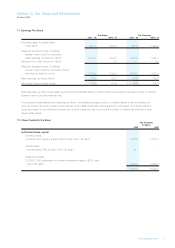

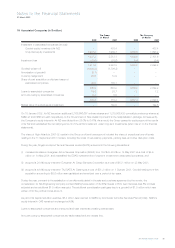

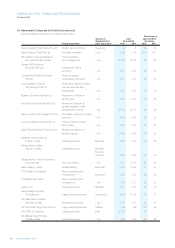

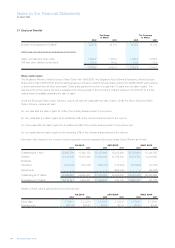

19 Associated Companies (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Investment in associated companies (at cost)

Quoted equity investment (Air NZ) – 403.4 – 403.4

Unquoted equity investments 1,937.2 1,909.7 1,689.6 1,698.2

1,937.2 2,313.1 1,689.6 2,101.6

Impairment loss (25.6) (25.6) (9.4) (9.4)

1,911.6 2,287.5 1,680.2 2,092.2

Goodwill written-off (1,604.4) (1,706.3) – –

Amortization of goodwill (5.1) – – –

Currency realignment 20.8 12.9 – –

Share of post acquisition profits less losses of

associated companies 43.0 100.1 – –

365.9 694.2 1,680.2 2,092.2

Loans to associated companies 19.6 20.7 7.2 7.2

Amounts owing by associated companies 0.3 0.5 – –

385.8 715.4 1,687.4 2,099.4

Market value of quoted equity investment – 192.5 – 192.5

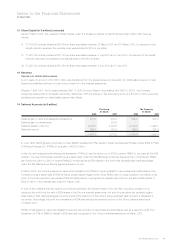

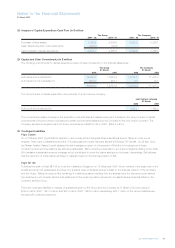

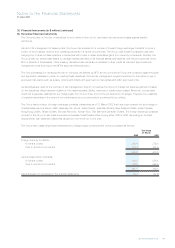

On 18 January 2002, Air NZ issued an additional 2,166,666,667 ordinary shares and 1,279,866,438 convertible preference shares at

NZ$0.27 and NZ$0.24 each respectively, to the Government of New Zealand pursuant to the recapitalization package. Consequently,

the Company’s equity interest in Air NZ was diluted from 25.0% to 6.47%. As a result, the Group ceased to equity account the results

of Air NZ and reclassified the net carrying amount of the Air NZ investment under long-term investments (refer note 21 to the financial

statements).

The share of Virgin Atlantic’s 2001-02 results in the Group profit and loss account included the share of exceptional one-off costs

relating to the 11 September 2001 incident, including the costs of redundancy payments, parking fees, and other disruption costs.

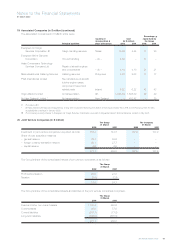

During the year, Singapore Airport Terminal Services Limited (SATS) entered into the following transactions:

(i) increased its stake in Evergreen Airline Services Corporation (EGAS) from 19.2% to 20.0% on 14 May 2001 at a cost of $4.9

million on 14 May 2001, and reclassified the EGAS investment from long-term investment to associated companies; and

(ii) acquired a 20.0% equity interest in Evergreen Air Cargo Services Corporation at a cost of $13.1 million on 23 May 2001.

(iii) acquired a 49.0% equity interest in TAJ SATS Air Catering at a cost of $31.3 million on 1 October 2001. Goodwill arising from this

acquisition amounting to $8.6 million was capitalized and amortized over a period of ten years.

During the year, pursuant to the satisfaction of conditions stipulated in the sale and purchase agreement by the vendor, the

consideration for SIA Engineering Company Limited (SIAEC)’s acquisition of its 30% interest in Rohr Aero Services-Asia Pte Ltd was

adjusted and an additional $1.0 million was paid. The additional consideration paid gave rise to a goodwill of $1.0 million which was

written off to the profit and loss account.

As part of its capital reduction exercise, $5.4 million was returned to SIAEC by Combustor Airmotive Services Pte Ltd (CAS). SIAEC’s

equity interest in CAS remained unchanged at 49%.

Loans to associated companies are unsecured and bear interest at prevailing market rates.

Amounts owing by associated companies are trade-related and are interest free.