Singapore Airlines 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SIA Annual Report 01/02

Report by the Board of Directors

8 Acquisition/Disposal of Subsidiary Companies

A new subsidiary company, Aerolog Express Pte Ltd, was incorporated with a paid-up capital of $1.8 million in October 2001 by

Singapore Airport Terminal Services Limited (SATS). SATS owns 70% equity interest in the new subsidiary company.

During the financial year, SIA Engineering Company Limited increased its equity interests in its subsidiary company, Singapore Jamco

Private Limited, from 51% to 65%. The cost of acquisition for the additional 14% equity interest was $1.0 million and the net tangible

assets acquired was $0.9 million.

Two subsidiary companies, Auspice Limited and SH Tours Ltd, were liquidated during the financial year. In addition, another subsidiary

company, Star Kingdom Investment Limited is undergoing members’ voluntary liquidation.

9 Other Significant Changes in Group Structure

On 18 January 2002, Air New Zealand (Air NZ) announced the completion of its recapitalization package, where 2,166,666,667 new

ordinary shares and 1,279,866,438 new convertible preference shares were issued to the Government of New Zealand at NZ$0.27

per share and NZ$0.24 per share respectively. With the issuance of the new ordinary and preference shares to the Government of

New Zealand, SIA’s equity interest in Air NZ was diluted to 6.47%. If the new convertible preference shares are subsequently

converted into ordinary shares, SIA’s equity interest in Air NZ will be further diluted to 4.50%. Arising from the dilution, the Group no

longer equity accounts for Air NZ’s financial results and reclassified the net carrying value of Air NZ from associated companies to

long-term investment from January 2002.

10 Flight SQ006 Accident in Taipei on 31 October 2000

On 31 October 2000, Flight SQ006 crashed on the runway at the Chiang Kai-Shek International Airport, Taipei en route to Los

Angeles. There were 83 fatalities among the 179 passengers and crew members aboard the Boeing 747 aircraft. On 26 April 2002,

the Taiwan Aviation Safety Council released its final investigation report on the accident. Whilst the full implications of these

conclusions and recommendations are still being deliberated, SIA is currently a defendant in a number of lawsuits relating to the

crash. SIA maintains substantial insurance coverage which is sufficient to cover the claims arising from the crash. Accordingly, SIA

believes that the resolution of these claims will have no material impact on the financial position of SIA.

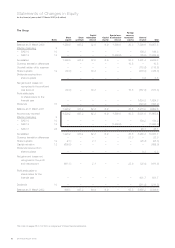

11 Options on Shares in the Company

The Singapore Airlines Limited Employee Share Option Plan (“the Plan”), which comprises the Senior Executive Share Option Scheme

and the Employee Share Option Scheme for senior executives and all other employees respectively, was approved by shareholders

on 8 March 2000.

Under the Plan, all options to be issued will have a term no longer than 10 years from the date of grant. The exercise price of the

option will be the average of the closing prices of the Company’s ordinary shares on the SGX-ST for the five market days immediately

preceding the date of grant.

Under the Employee Share Option Scheme, options will vest two years after the date of grant. Under the Senior Executive Share

Option Scheme, options will vest:-

(a) one year after the date of grant for 25% of the ordinary shares subject to the options;

(b) two years after the date of grant for an additional 25% of the ordinary shares subject to the options;

(c) three years after the date of grant for an additional 25% of the ordinary shares subject to the options; and

(d) four years after the date of grant for the remaining 25% of the ordinary shares subject to the options.