Singapore Airlines 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02

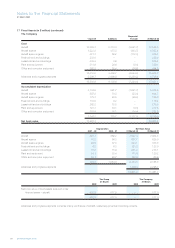

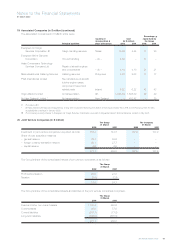

20 Joint Venture Companies (in $ million) (continued)

The joint venture companies at 31 March 2002 were:-

Percentage of

Country of Cost equity held by

incorporation & (in $ million) the Group

Principal activities place of business 2002 2001 2002 2001

Singapore Aircraft Leasing Aircraft leasing Singapore 107.92 107.92 35.5 35.5

Enterprise Pte Ltd

International Engine Component Repair of aircraft

Overhaul Pte Ltd components – do – 11.97 11.97 44 44

Singapore Aero Engine

Services Pte Ltd Repair and maintain

Trent aero engines – do – 38.52 24.88 44 44

During the financial year, SIA Engineering Company Limited (SIAEC) made additional capital contribution of $13.6 million in Singapore

Aero Engine Services Private Limited in accordance with the joint venture agreement.

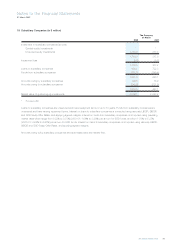

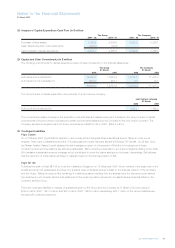

21 Long-Term Investments (in $ million)

The Group The Company

31 March 31 March

2002 2001 2002 2001

Quoted investments at cost

Equity investments 432.0 28.7 432.0 28.7

Amount written-down (380.6) – (380.6) –

51.4 28.7 51.4 28.7

Non-equity investments 375.6 340.9 375.6 340.9

427.0 369.6 427.0 369.6

Unquoted investments at cost

Trade investments 76.0 77.7 48.2 42.8

Non-equity investments 44.2 70.3 44.2 70.3

120.2 148.0 92.4 113.1

Amounts written-down (16.5) (20.3) (16.5) (15.4)

103.7 127.7 75.9 97.7

Long-term loan 59.7 58.7 – –

590.4 556.0 502.9 467.3

Market value of quoted investments

Equity investments 95.0 38.7 95.0 38.7

Non-equity investments 372.7 337.7 372.7 337.7

467.7 376.4 467.7 376.4

During the financial year, Air New Zealand (Air NZ) was reclassified as a long-term investment following the dilution of the Group’s

equity interest from 25% to 6.47% arising from Air NZ’s recapitalization package (refer note 19 to the financial statements).

Non-equity investments of $419.8 million (2001 : $411.2 million) relates to interest-bearing investments with an effective annual

interest rate of 4.21% (2000-01 : 6.68%).