Singapore Airlines 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 59

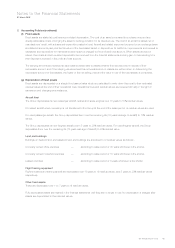

Auditors‘ Report

to the members of Singapore Airlines Limited

We have audited the financial statements of Singapore Airlines Limited and its subsidiary companies set out on pages 60 to 100. These

financial statements comprise the balance sheets of the Company and the Group as at 31 March 2002, and the profit and loss accounts,

the statements of changes in equity and the cash flow statements of the Company and the Group for the financial year then ended.

These financial statements are the responsibility of the Company’s directors. Our responsibility is to express an opinion on these financial

statements based on our audit.

We conducted our audit in accordance with Singapore Standards on Auditing. Those Standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing

the accounting principles used and significant estimates made by the directors, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion:-

(a) the financial statements are properly drawn up in accordance with the provisions of the Companies Act (“Act”) and Singapore

Statements of Accounting Standard and so as to give a true and fair view of:-

(i) the state of affairs of the Company and of the Group as at 31 March 2002, the results, the changes in equity and the cash flows

of the Company and of the Group for the financial year then ended; and

(ii) the other matters required by Section 201 of the Act to be dealt with in the financial statements and consolidated financial

statements;

(b) the accounting and other records, and the registers required by the Act to be kept by the Company and by those subsidiary

companies incorporated in Singapore of which we are the auditors have been properly kept in accordance with the provisions of

the Act.

We have considered the financial statements and auditors’ reports of all subsidiary companies of which we have not acted as auditors,

being financial statements included in the consolidated financial statements. The names of those subsidiary companies audited by our

associated firms and that audited by another firm are stated in note 18.

We are satisfied that the financial statements of the subsidiary companies that have been consolidated with the financial statements of the

Company are in form and content appropriate and proper for the purposes of the preparation of the consolidated financial statements and

we have received satisfactory information and explanations as required by us for those purposes.

The auditors’ reports on the financial statements of the subsidiary companies were not subject to any qualification and in respect of

subsidiary companies incorporated in Singapore did not include any comment made under Section 207(3) of the Act.

ERNST & YOUNG

Certified Public Accountants

Dated this 17th day of May 2002

Singapore