Singapore Airlines 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 01/02 93

Notes to the Financial Statements

31 March 2002

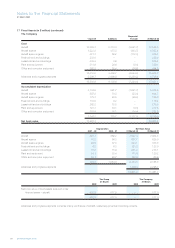

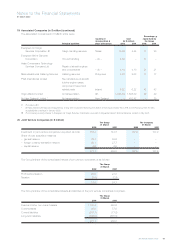

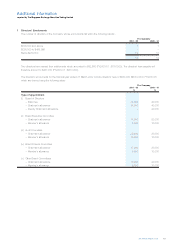

28 Analysis of Capital Expenditure Cash Flow (in $ million)

The Group The Company

2001 - 02 2000 - 01 2001 - 02 2000 - 01

Purchase of fixed assets 3,862.9 2,589.0 2,882.2 2,336.1

Less: Assets acquired under credit terms (330.5) (33.5) – –

Cash invested in capital expenditure 3,532.4 2,555.5 2,882.2 2,336.1

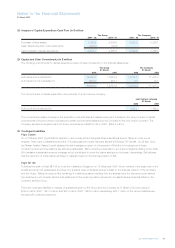

29 Capital and Other Commitments (in $ million)

The following commitments for capital expenditure have not been provided for in the financial statements:-

The Group The Company

31 March 31 March

2002 2001 2002 2001

Authorized and contracted for 16,267.0 17,638.5 14,501.8 17,333.5

Authorized but not contracted for 672.0 946.1 4.7 13.7

16,939.0 18,584.6 14,506.5 17,347.2

The Group’s share of capital expenditure commitments of a joint venture company:-

Joint venture company

31 March

2002 2001

Authorized and contracted for 1,021.2 1,169.2

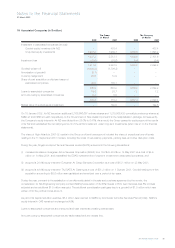

The commitments relate principally to the acquisition of aircraft fleet and related equipment. Included in the Group’s share of capital

commitments of the joint venture company are certain commitments assigned by the Company to the joint venture company. The

Company remains contingently liable for those commitments of $420.6 million (2001: $654.4 million).

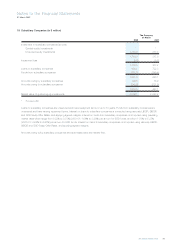

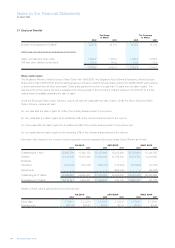

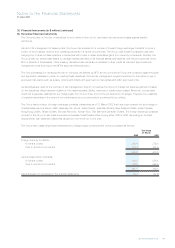

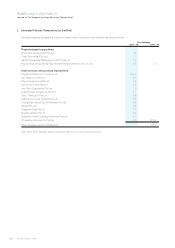

30 Contingent Liabilities

Flight SQ006

On 31 October 2000, Flight SQ006 crashed on the runway at the Chiang Kai-Shek International Airport, Taipei en route to Los

Angeles. There were 83 fatalities among the 179 passengers and crew members aboard the Boeing 747 aircraft. On 26 April 2002,

the Taiwan Aviation Safety Council released its final investigation report on the accident. Whilst the full implications of these

conclusions and recommendations are still being deliberated, SIA is currently a defendant in a number of lawsuits relating to the crash.

SIA maintains substantial insurance coverage which is sufficient to cover the claims arising from the crash. Accordingly, SIA believes

that the resolution of these claims will have no material impact on the financial position of SIA.

Flight MI 185

Following the crash of flight MI 185 en route from Jakarta to Singapore on 19 December 1997, which resulted in the tragic loss of the

aircraft and all its 104 passengers and crew, the directors have considered its likely impact on the financial position of the Company

and the Group. Taking into account the remaining 6 outstanding claims resulting from the accident and the insurance cover carried,

the directors do not consider that the final settlement of the remaining claims will result in a material adverse financial effect on the

Company and the Group.

There are contingent liabilities in respect of guarantees given by the Group and the Company at 31 March 2002 amounting to

$125.2 million (2001 : $47.3 million) and $52.8 million (2001 : $25.0 million) respectively. $34.7 million of the Group’s liabilities are

secured with a deposit placement.