Singapore Airlines 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

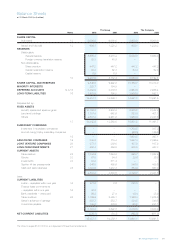

62 SIA Annual Report 01/02

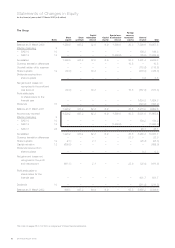

The Group

F

oreign

Capital Special non- currency

Share Share redemption Capital distributable translation General

Notes capital premium reserve reserve reserve reserve reserve Tota

l

Balance at 31 March 2000 1,250.5 447.2 32.0 6.9 1,800.0 30.3 7,390.6 10,957.5

Effects of adopting 2

– SAS 10 10 ––––––186.3 186.3

– SAS 12 15 ––––(1,800.0) – (75.5) (1,875.5)

As restated 1,250.5 447.2 32.0 6.9 – 30.3 7,501.4 9,268.3

Currency translation differences –––––10.5 – 10.5

Goodwill written-off to reserves ––––––(115.6) (115.6)

Share buyback 12 (30.3) – 30.3 – – – (476.0) (476.0)

Dividends received from

share buyback ––––––3.83.8

Net gains and losses not

recognized in the profit and

loss account (30.3) – 30.3 – – 10.5 (587.8) (577.3)

Profit attributable

to shareholders for the

financial year ––––––1,624.8 1,624.8

Dividends 10 ––––––(323.2) (323.2)

Balance at 31 March 2001 1,220.2 447.2 62.3 6.9 – 40.8 8,215.2 9,992.6

As previously reported 1,220.2 447.2 62.3 6.9 1,800.0 40.8 8,031.0 11,608.4

Effects of adopting 2

– SAS 10 10 ––––––184.2 184.2

– SAS 12 15 ––––(1,800.0) – – (1,800.0)

– SAS 31 26 ––––––45.1 45.1

As restated 1,220.2 447.2 62.3 6.9 – 40.8 8,260.3 10,037.7

Currency translation differences –––––23.0 – 23.0

Share buyback 12 (2.1) – 2.1 – – – (25.3) (25.3)

Capital reduction 12 (609.0) ––––––(609.0)

Dividends received from

share buyback ––––––0.30.3

Net gains and losses not

recognized in the profit

and loss account (611.1) – 2.1 – – 23.0 (25.0) (611.0)

Profit attributable to

shareholders for the

financial year ––––––631.7 631.7

Dividends 10 ––––––(211.8) (211.8)

Balance at 31 March 2002 609.1 447.2 64.4 6.9 – 63.8 8,655.2 9,846.6

The notes on pages 65 to 100 form an integral part of these financial statements.

Statements of Changes in Equity

for the financial year ended 31 March 2002 (in $ million)