Singapore Airlines 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02

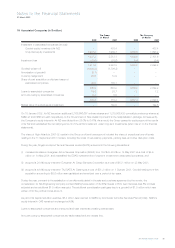

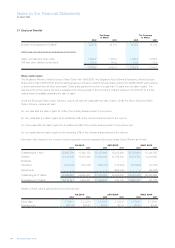

32 Financial Instruments (in $ million)

(a) Financial risk management objectives and policies

The Group operates globally and generates revenue in various currencies. The Group’s airline operations carry certain financial and

commodity risks, including the effects of changes in jet fuel prices, foreign currency exchange rates, interest rates and the market

value of its investments. The Group’s overall risk management approach is to minimize the effects of such volatility on its financial

performance.

Financial risk management policies are periodically reviewed and approved by the Board Finance Committee (“BFC”).

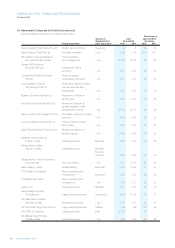

(b) Jet fuel price risk

The Group’s earnings are affected by changes in the price of jet fuel. The Group manages this risk by using swap and option

contracts up to 24 months forward. A change in price of one US cent per American gallon affects the Group’s annual fuel costs by

US$13.1 million, before accounting for US Dollar (“USD”) exchange rate movements and changes in volume of fuel consumed.

(c) Foreign currency risk

The Group is exposed to the effects of foreign exchange rate fluctuations because of its foreign currency denominated operating

revenues and expenses. These generally account for about 79.3% of total revenue and 53.5% of total operating expenses. The

Group’s largest exposures are from USD, UK Sterling Pound (“GBP”), Japanese Yen, Euro, Swiss Franc, Australian Dollar, New

Zealand Dollar, Indian Rupee, Hong Kong Dollar, Taiwan Dollar, Chinese Renminbi, Korean Won, Thai Baht and Malaysian Ringgit.

The Group generates a surplus in all of these currencies, except for USD. The deficits in USD are attributable to capital expenditure,

leasing costs and fuel costs – all conventionally denominated and payable in USD.

The Group manages its foreign exchange exposure by a policy of matching, as far as possible, receipts and payments in each

individual currency. Surpluses of convertible currencies are sold, as soon as practicable, for USD and SGD. The Group also uses

forward foreign currency contracts to hedge a portion of its future foreign exchange exposure.

(d) Interest rate risk

The Group’s earnings are also affected by changes in interest rates due to the impact such changes have on interest income and

expense from cash, short-term deposits and interest-bearing financial assets and liabilities. The Group’s interest-bearing financial

liabilities with maturities above two years have predominantly fixed rates of interest or are hedged by matching interest-bearing

financial assets.

The Group’s cash, short-term deposits and interest-bearing financial assets and liabilities are predominantly denominated in SGD

and USD.

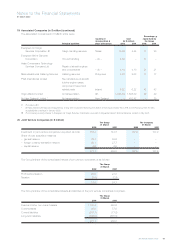

(e) Market price risk

The Group owned $480.7 million (2001: $369.6 million) in quoted equity and non-equity investments as of 31 March 2002. The

estimated market value of these investments was $467.7 million (2001: $376.4 million) as of 31 March 2002.

The market risk associated with these investments is the potential loss resulting from a decrease in market prices.

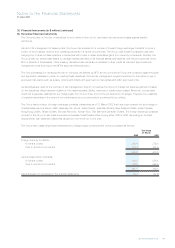

(f) Counter-party risk

Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments. Counter-party risks

are managed by limiting aggregated exposure on all outstanding financial instruments to any individual counter-party, taking into

account its credit rating. Such counter-party exposures are regularly reviewed, and adjusted as necessary. This mitigates the risk of

material loss arising in the event of non-performance by counter-parties.

(g) Liquidity risk

As at 31 March 2002, the Group had at its disposal cash and short-term deposits amounting to $1,091.6 million (2001 : $1,272.3

million). In addition, the Group has available short-term credit facilities of about $1,700.0 million.

The Group’s holdings of cash and short-term deposits, together with committed funding facilities and net cash flow from operations,

are expected to be sufficient to cover the cost of all firm aircraft deliveries due in the next financial year. Any shortfall can be met by

aircraft financing via structured leases, bank borrowings or public market funding. Because of the necessity to plan aircraft orders well

in advance of delivery, it is not economical for the Group to have committed funding in place at present for all outstanding orders,

many of which relate to aircraft which will not be delivered for several years. The Group’s policies in this regard are in line with the

funding policies of other major airlines.