Singapore Airlines 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 01/02

Annual Report 01/02

Table of contents

-

Page 1

Annual Report 01/02 Annual Report 01/02 -

Page 2

Registered Address Airline House, 25 Airline Road, Singapore 819829 Company Secretaries Mr Mathew Samuel Tel: 6541 4010 Fax: 6545 4231 Email: [email protected] Mr Foo Kim Boon Tel: 6541 4030 Fax: 6542 6832 Email: [email protected] Investor Relations Tel: 6541 4885 ... -

Page 3

... Time in the Airline's History Product and Service Development Fleet Network Promoting Tourism and Air Travel Subsidiaries and Associated Companies Community Relations Our People The Environment Corporate Governance Financials 114 Notice of Annual General Meeting and Closure of Books SIA Annual... -

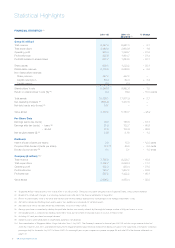

Page 4

... Singapore Airlines Cargo (revenue received from leasing out space in the cargo holds of the parent company's passenger fleet) for the period July 2001 to March 2002. For meaningful year-on-year comparisons, please see page 35 and note 35 to the financial statements on page 100. 2 SIA Annual Report... -

Page 5

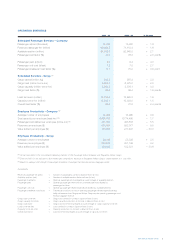

OPERATING STATISTICS 2001 - 02 2000 - 01 % Change Scheduled Passenger Services - Company Passenger carried (thousand) Revenue passenger-km (million) Available seat-km (million) Passenger load factor (%) Passenger yield (¢/pkm) Passenger unit cost (¢/ask) Passenger breakeven load factor (%) ... -

Page 6

... Board for nine years until 2001, has been actively involved in the private and public sectors as a director for SNP Corporation, Clipsal Industries (Holdings), The Esplanade Company, Singapore Art Museum, and Urban Redevelopment Authority. He was also a past president of the Real Estate Developers... -

Page 7

... Group, which owns both listed and private companies engaged in the development, ownership and operation of hotels, resorts, spas, residential homes, retail galleries and other lifestyle activities in the region. He is also Chairman of the family-owned Wah Chang Group and of the Singapore Management... -

Page 8

... the end of the year, the recovery of loads across our network, and to a lesser extent cost reductions, helped SIA remain loss-free. Our results were certainly helped by finally being able to recognize the profit of SIA Engineering Company's 1998 sale of 51 per cent equity interest in Eagle Services... -

Page 9

...ready by 2003 and 2004. Last year, SIAEC also started a new joint venture for engine overhaul, Singapore Aero Engine Services Limited (SAESL). It continues to look for expansion opportunities overseas, particularly in the fast-growing China market. Another member of the SIA Group, Singapore Airport... -

Page 10

... 138 Robinson Road #17-00 The Corporate Office Singapore 068906 Auditors Ernst & Young Certified Public Accountants 10 Collyer Quay #21-01 Ocean Building Singapore 049315 Audit Partner Fang Ai Lian (From 1 April 2002) Bey Soo Khiang Executive Vice-President (Marketing and the Regions) Fock Siew... -

Page 11

... Officer SIA Engineering Company Ltd Despatch of summary financial statement to shareholders 20 June 2002 Loh Meng See Senior Vice-President (Information Technology) William Tan Seng Koon Chief Executive SilkAir (Singapore) Pte Ltd Despatch of annual report to shareholders 13 July 2002 Annual... -

Page 12

...phones. SIA opens a $1.5 million one-stop service centre at Singapore's Paragon Shopping Centre for its Priority Passenger Service (PPS) Club members. SIA announces plans to invest over $6 million in advanced scheduling technology and sophisticated forecasting techniques. This new Network Management... -

Page 13

... in Fortune's list of Global Most Admired Companies. SIA achieves an overall score of 6.38, making it the industry leader among all airlines included in the poll. · SIA launches a new Internet check-in service that allows customers to choose their seats up to two days before departure. Users can... -

Page 14

... flight alert service via the Short Message System (SMS). This service sends flight departure and arrival times on request to customer-specified mobile phones and pagers. Customers can also check flight schedules and status using this service. Two months later, the Airline's first non-English mobile... -

Page 15

...flights with partner airlines, as well as related services such as hotels, car and tour packages. They will lay the foundation for the development of direct relationships with customers. Smart Systems KrisMax II is a new revenue management system which will help overcome the complexities of matching... -

Page 16

...'s development process underscored SIA's commitment to offering its customers the world's best travel experience. SpaceBeds will eventually be installed on 45 B747-400 and B777-200ER aircraft serving Europe, North America and Australia. SIA customers are now assured of arriving at their destinations... -

Page 17

... 2002, KrisFlyer had established business relationships with 39 partners, including 18 airlines, 13 hotel chains and other service providers, such as rental car, telecommunications and credit card companies. The programme had 1.26 million members. KrisFlyer SIA's frequent flyer programme, KrisFlyer... -

Page 18

... world, together with awards from the Indonesian and the Philippine governments for its promotion of tourism in those countries. SIA also made it to Fortune's list of Global Most Admired Companies. Outside of Japan, Singapore Airlines is the top-ranked Asian company in the list. SIA Annual Report... -

Page 19

... Service Business Class Service Short-Haul Flights (Under 4 hours) Long-Haul Flights (Over 4 hours) June 2001 Aviation Week and Space Technology (US) Best Managed Companies Awards Best Managed Global Carrier Investor Relations Magazine (Hong Kong) Asia Awards Best Investor Relations Best Corporate... -

Page 20

... August 2002 and September 2002, are now planned for August 2003 and November 2002 respectively. The new delivery dates for the three on option are between June 2006 and June 2008. The B747-400 freighter aircraft, originally scheduled for delivery to Singapore Airlines Cargo in September 2002, will... -

Page 21

... Singapore and London. Benefits for SIA and Virgin customers include an expanded network, better connections, access to more lounges and a seamless travel experience. Frequent flyer miles on both airlines count towards elite status. As at 31 March 2002, SIA's passenger network served 64 cities... -

Page 22

... strengthen Singapore's position as the region's premier destination. These included attractively-priced holiday packages like the US$1 Singapore Stopover Splendour and SIA Getaway Specials, media and trade familiarisation visits, and support of sales missions and trade shows. 22 SIA Annual Report... -

Page 23

.... The three-month campaign began in January 2002 and involved television and print advertising in six languages across 10 Asian countries. SIA played a leading role in positioning Singapore as a world class sporting and cultural event city during the year in review. SIA Annual Report 01/02 23 -

Page 24

..., Dallas-Fort Worth and Munich were added to its freighter network. In March 2002, Singapore Airlines Cargo launched new services to Amsterdam, Dublin, London, Munich, New York and Shanghai. At the end of the year in review, Singapore Airlines Cargo operated more than 600 scheduled flights a week... -

Page 25

... Rolls-Royce (30 per cent) and Hong Kong Aero Services (20 per cent). During the year in review, SIAEC began The new 18,500 square metre facility is designed to repair and overhaul up to 200 Trent engines a year. These engines have become increasingly popular with Asian long-haul jet operators. work... -

Page 26

... company offering air cargo delivery services in Singapore. Aerolog is a 70:30 joint venture between SATS and the YCH Group, and began with a paid-up capital of $1.8 million. It uses specialized software to ensure seamless and timely cargo delivery within the Singapore Changi Airport Free Trade... -

Page 27

... of a new PPS Service Centre in Singapore and the As at 31 March 2002, the SIA Group owned 20 commercial and 25 residential properties, and leased 472 properties located in 127 cities in 50 countries. An SIA town and ticket office was developed in Hiroshima in October 2001. Offices in Bangkok, Kuala... -

Page 28

... of the SIA Group. During the financial year, Auspice was liquidated and the funds recalled back to the parent company. It was becoming increasingly difficult to run the Advanced Training operations at Singapore's busy Changi Airport, and the clear airspace and logistical support services available... -

Page 29

... to reduce costs from SIA's heavy investment in staff development generated 3.1 training places for every employee during the year, translating to 15.9 training days per employee. It is this kind of sustained Company-wide As part of the Airline's effort to manage the business downturn, recruitment... -

Page 30

... and the SIA Group of companies. 3.2 The members of the ExCo are: Chairman Koh Boon Hwee Deputy Chairman and Chief Executive Officer 2. Board of Directors of the Company. It meets regularly and focuses on strategies and policies, with particular attention paid to major investments and financial... -

Page 31

... working relationship and management exchanges in the subsidiaries and associated companies in the Group. 8. Securities Transactions trading of its shares by Board Directors and employees which are in conformity with the guidelines of the SGX. 8.1 The Company has clear policies on Members 5. Board... -

Page 32

...the Financial Statements Additional Information Half-Yearly Results of the Group Five-Year Financial Summary of the Group Ten-Year Statistical Record of the Company Ten-Year Charts / SIA's Fleet Share Price and Turnover Group Corporate Structure Information on Shareholdings 32 SIA Annual Report 01... -

Page 33

... diminution in value of investment in Air New Zealand following the release of its results for the financial year ended 30 June 2001, and further losses arising from the closure of its wholly owned subsidiary, Ansett Australia; and (iv) the profit of $440 million from sale of 13.0% vendor shares in... -

Page 34

...net tangible assets per share dropped 1.3% (-$0.11) from $8.19 (restated) a year ago to $8.08 at 31 March 2002, after accounting for share buyback costing $25 million and capital distribution of $609 million. The Group profitability ratios are as follows: 2001 - 02 % 2000 - 01 % Change % pts Return... -

Page 35

... for financial year 2001-02 includes cargo revenue for the first 3 months of April to June 2001, and bellyhold revenue from Singapore Airlines Cargo (revenue received from leasing out space in the cargo holds of the parent company's passenger fleet) for the period July 2001 to March 2002. Financial... -

Page 36

...02 2000 - 01 Change Yield (¢/pkm)-gross Unit cost (¢/ask) Breakeven load factor (%) R1 R2 R2 9.0 7.3 71.1 9.4 7.5 70.2 R1 R1 - 4.3 % - 2.7 % + 0.9 point Restated as if Singapore Airlines Cargo corporatization took place in the previous year to allow meaningful year-on-year comparisons. With... -

Page 37

... financial years are actuals. For July 2001 to March 2002, bellyhold revenue is based on agreed rates with Singapore Airlines Cargo while the amount for July 2000 to March 2001 is notional to allow meaningful year-on-year comparisons. 2001 - 02 $M 2000 - 01 $M (Restated) Change % Passenger revenue... -

Page 38

... allowances, larger staff strength, and increase in employer's Central Provident Fund contribution rate. Sales costs decreased $120 million (-16.1%) mainly because commission, incentives and frequent flyer costs (FFP) were lower as a result of a decline in passenger and cargo revenue. Expenditure on... -

Page 39

... Inflight meal and other passenger costs Landing, parking and overflying charges Communication and information technology costs Other costs R5 R4 166.3 306.4 7,282.7 2.3 4.2 100.0 105.7 294.9 7,357.3 1.5 4.0 100.0 + 57.3 + - 3.9 1.0 R1 Restated as if Singapore Airlines Cargo corporatization... -

Page 40

...Group no longer equity accounts for Air NZ's financial results. The net carrying value of the investment in Air NZ was reclassified as long-term investment from January 2002. Disposal of the remaining shareholding in Equant N.V. and the entire holding in Cargo Community Network to Singapore Airlines... -

Page 41

... remain outstanding under the Employee Share Option Plan. Issue of Debentures On 19 December 2001, the Company issued $900 million Fixed Rate Notes due 2011. The net proceeds from the issue of the Notes were used to finance capital expenditure and working capital requirements. SIA Annual Report 01... -

Page 42

... share ($) Shareholders' Fund ($ Million) Total Assets ($ Million) Net Liquid Assets Net Debt Financial Position Shareholders' funds of the Group stood at $9,847 million on 31 March 2002, down 1.5% (-$146 million) from a year ago after accounting for share buyback costing $25 million and capital... -

Page 43

..., Philippines, Singapore, Thailand, Taiwan and Vietnam. Americas comprises mainly Canada, Latin America and USA. Europe consists mainly of Baltic States, Continental Europe, Russia, Scandinavia and United Kingdom. South West Pacific includes largely Australia and New Zealand. West Asia and Africa... -

Page 44

Financial Review Company Route Performance (continued) By area of original sale, countries in East Asia contributed most to systemwide passenger revenue (51.2%), followed by countries in Europe (19.6%), South West Pacific (11.9.%), Americas (9.7%) and West Asia and Africa (7.6%). Revenue from East ... -

Page 45

... courier centre, and information technology systems. SIA Engineering Group Notwithstanding the events of September 11 and a downturn in the global airline industry, the Company's operating profit for the financial year 2001-02 was $208.9 million, up $86.5 million (+70.6%) from FY 2000-01. Revenue... -

Page 46

... year under review, Singapore Airlines Cargo took delivery of 2 B747-400 freighters, which increased the fleet size to 11 B747-400 freighters. Shareholders' funds as at 31 March 2002 stood at $1,360.8 million. R1 Figures for July 2000 - March 2001 are based on SIA's Cargo Division's profit-centre... -

Page 47

...Less: Purchase of goods and services Value added by the Group Add: Surplus on disposal of aircraft, spares and spare engines Share of profits of joint venture companies Share of (losses)/profits of associated companies Provision for diminution in value of Air New Zealand Recognition of deferred gain... -

Page 48

... Group Value Added Productivity 3.0 2.4 Dollar 1.8 1.2 0.6 0 1997/98 1998/99 1999/00 2000/01 2001/02 Government Suppliers of Capital Employees Retained in the Business Value Added per $ Employment Costs Value Added per $ Revenue Value Added per $ Investment in Fixed Assets Group Staff Strength... -

Page 49

...Change SIA Passenger Airline Company Singapore Airlines Cargo SATS Group SIA Engineering Group SilkAir Others 14,205 632 9,227 4,293 516 443 29,316 13,676 578 9,147 4,037 476 422 28,336 3.9 9.3 0.9 6.3 8.4 5.0 3.5 Group revenue per employee was $322,275, down 8.2%, while value added dropped... -

Page 50

... gallon (AG). This was mainly attributable to the ageing B744 and A313 fleet with average age of 7.9 years and 9.7 years respectively. A change in fuel productivity (passenger aircraft) of 1.0 percent would impact the Company's annual fuel costs by $13 million. A change in price of one US cent per... -

Page 51

...Airport Terminal Services (SATS) Group. (b) Following the corporatization of the Company's cargo operations on 1 July 2001, the Company's result for the year excludes third party cargo revenues from that date, but includes revenue from the sale of aircraft bellyhold space to Singapore Airlines Cargo... -

Page 52

... the subsidiary companies of the Company's holding company:Direct interest Name of Director 1.4.2001 31.3.2002 21.4.2002 1.4.2001 Deemed interest 31.3.2002 21.4.2002 Interest in Singapore Airlines Limited Ordinary shares of $0.50 each Cheong Choong Kong Edmund Cheng Wai Wing Charles B Goode Options... -

Page 53

... directors might acquire benefits by means of the acquisition of shares and share options in, or debentures of, the Company or any other body corporate, other than pursuant to the Singapore Airlines Limited Employee Share Option Plan. (c) Since the end of the previous financial year no director has... -

Page 54

.... Two subsidiary companies, Auspice Limited and SH Tours Ltd, were liquidated during the financial year. In addition, another subsidiary company, Star Kingdom Investment Limited is undergoing members' voluntary liquidation. 9 Other Significant Changes in Group Structure On 18 January 2002, Air New... -

Page 55

... outstanding at end of financial year year under review Cheong Choong Kong 228,000 708,000 - - 708,000 12 Options on Shares in Subsidiary Companies The particulars of options on shares in subsidiary companies are as follows:(a) Singapore Airport Terminal Services Limited (SATS) The Singapore... -

Page 56

...Board of Directors 12 Options on Shares in Subsidiary Companies (continued) At the end of the financial year, options to take up 47,310,700 unissued shares of $0.10 each in SATS were outstanding:Number of unissued ordinary shares of $0.10 each Balance at 1.4.2001/ Date of grant Balance at 31.3.2002... -

Page 57

... of the operations of the Group or of the Company for the financial year in which this report is made. 14 Subsequent Events (a) On 3 April 2002, one A310-300 passenger aircraft was traded-in to Rolls Royce Aircraft Management. (b) On 2 May 2002, it was announced that Singapore Airlines (SIA) and... -

Page 58

... the state of affairs of the Group and of the Company as at 31 March 2002, the results of the business, the changes in equity and the cash flows of the Group and of the Company for the financial year ended on that date; (ii) at the date of this statement there are reasonable grounds to believe that... -

Page 59

... have audited the financial statements of Singapore Airlines Limited and its subsidiary companies set out on pages 60 to 100. These financial statements comprise the balance sheets of the Company and the Group as at 31 March 2002, and the profit and loss accounts, the statements of changes in equity... -

Page 60

Profit and Loss Accounts For the financial year ended 31 March 2002 (in $ million) The Group Notes 2001 - 02 2000 - 01 The Company 2001 - 02 2000 - 01 REVENUE Other income TOTAL REVENUE EXPENDITURE Staff costs Fuel costs Depreciation Provision for impairment of fixed assets Rentals on lease of ... -

Page 61

...,413.0 - 2,986.4 592.1 13,991.5 SHARE CAPITAL AND RESERVES MINORITY INTERESTS DEFERRED ACCOUNTS LONG-TERM LIABILITIES 14 & 15 16 Represented by:FIXED ASSETS Aircraft, spares and spare engines Land and buildings Others 17 SUBSIDIARY COMPANIES Investment in subsidiary companies Amount owing (to)/by... -

Page 62

Statements of Changes in Equity for the financial year ended 31 March 2002 (in $ million) The Group Share capital Share premium Capital redemption reserve Special nonCapital distributable reserve reserve Foreign currency translation reserve General reserve Notes Total Balance at 31 March 2000 ... -

Page 63

... (25.3) (609.0) 0.3 10 As restated Share buyback Capital reduction Dividends received from share buyback Net gains and losses not recognized in the profit and loss account Profit attributable to shareholders for the financial year Dividends Balance at 31 March 2002 12 12 (611.1) - 2.1 - (25... -

Page 64

...Flow Statements For the financial year ended 31 March 2002 (in $ million) The Group Notes 2001 - 02 2000 - 01 The Company 2001 - 02 2000 - 01 NET CASH PROVIDED BY OPERATING ACTIVITIES CASH FLOW FROM INVESTING ACTIVITIES Capital expenditure Proceeds from disposal of aircraft and other fixed assets... -

Page 65

...owned subsidiary, Singapore Airlines Cargo Private Limited. The consolidated financial statements of Singapore Airlines Limited ("the Company") for the year ended 31 March 2002 were authorized for issue in accordance with a resolution of the directors on 17 May 2002. 2 Accounting Policies The main... -

Page 66

...in whose financial and operating policy decisions the Group exercises significant influence. The Group's share of the results of associated companies is included in the consolidated profit and loss account and the Group's share of the post-acquisition reserves is added to the value of investments in... -

Page 67

Notes to the Financial Statements 31 March 2002 2 Accounting Policies (continued) (f) Fixed assets Fixed assets are stated at cost less accumulated depreciation. The cost of an asset comprises its purchase price and any directly attributable costs of bringing the asset to working condition for its... -

Page 68

Notes to the Financial Statements 31 March 2002 2 Accounting Policies (continued) (h) Leased assets As lessee Finance leases, which effectively transfer to the Group substantially all the risks and benefits incidental to ownership of the leased asset, are capitalized at the present value of the ... -

Page 69

...Engineering Company Limited Employee Share Option Plan for granting of share options to senior executives and all other employees. There are no charges to the profit and loss account upon the grant or exercise of the options. The exercise price approximates the market value of the shares at the date... -

Page 70

...of frequent flyer benefits is estimated and deferred until they are utilized. Such unutilized benefits are written-back upon expiry. (v) Training and development costs Training and development costs, including start-up programme costs, are charged to the profit and loss account in the financial year... -

Page 71

... the airline operations by area of original sale. The following tables present revenue and profit information regarding business segments for the financial years ended 31 March 2002 and 2001 and certain assets and liabilities information of the business segments as at those dates. SIA Annual Report... -

Page 72

...RESULT Segment result Surplus on disposal of aircraft, spares and spare engines Dividends from subsidiary and associated companies Share of profits of joint venture companies Share of (losses)/profits of associated companies Exceptional items Taxation Profit after taxation 442.2 934.9 265.0 193... -

Page 73

Notes to the Financial Statements 31 March 2002 Others 2001 - 02 2000 - 01 Total of segments 2001 - 02 2000 - 01 ...- 01 2001 - 02 2000 - 01 3.4 0.1 (1.5) 3.5 - 5.6 970.1 1.8 115.5 1,146.3 9.0 (182.1) (0.7) - - (1.2) - (9.4) 969.4 1.8 115.5 1,145.1 9.0 (191.5) SIA Annual Report 01/02 73 -

Page 74

... table presents revenue information regarding geographical segments for the financial years ended 31 March 2002 and 2001. By area of original sale 2001 - 02 2000 - 01 East Asia Europe South West Pacific Americas West Asia and Africa Systemwide Non-scheduled services and incidental revenue 4,589... -

Page 75

... for impairment in value of investment in Air New Zealand Recognition of deferred gain on divestment of Eagle Services Asia Profit on disposal of investments in Equant N.V. Profit on disposal of investment in Cargo Community Network Gain on liquidation of Auspice Loss on liquidation of Star Kingdom... -

Page 76

....6 211.8 136.9 323.2 The directors propose that a final tax exempt dividend of 4.0 cents per share ($48.7 million) and a dividend of 8.0 cents per share less tax at 22.0% ($76.0 million) amounting to a total of $124.7 million, be paid for the year ended 31 March 2002. 76 SIA Annual Report 01/02 -

Page 77

Notes to the Financial Statements 31 March 2002 11 Earnings Per Share The Group 2001 - 02 2000 - 01 The Company 2001 - 02 2000 - 01 Profit attributable to shareholders (in $ million) Weighted average number of ordinary shares in issue used for computing basic earnings per share (in million) ... -

Page 78

...: 30,334,600) ordinary shares during the financial year at an average price of $12.48 (2000-01: $15.70), amounting to a total cost, including brokerage, of $25.3 million (2000-01: $476.0 million). The Company's ability to operate its existing route network and flight frequency is derived solely from... -

Page 79

Notes to the Financial Statements 31 March 2002 12 Share Capital (in $ million) (continued) As at 31 March 2002, the unissued ordinary shares under The Singapore Airlines Limited Employee Share Option Plan were as follows: (i) 13,310,630 ordinary shares at $15.96 per share exercisable between 28 ... -

Page 80

... Statements 31 March 2002 15 Deferred Taxation (in $ million) The Group 31 March 2002 2001 2002 The Company 31 March 2001 Balance at April 1 As previously reported Change in accounting policies (see note 2) As restated Provided during the financial year Transfer to Singapore Airlines Cargo... -

Page 81

... During the year, SIA sub-leased both aircraft to Singapore Airlines Cargo under identical terms and conditions as part of Cargo Division's corporatization. Singapore Airlines Cargo paid the entire outstanding lease liabilities by issuing ordinary shares at par for cash to SIA. Interest rates on the... -

Page 82

... Property and equipment The Group 31 March 2002 2001 2002 The Company 31 March 2001 Within one year After one year but not more than five years More than five years Total future lease payments 10.0 21.3 41.6 72.9 11.5 22.2 44.0 77.7 7.2 10.5 - 17.7 8.0 10.0 - 18.0 82 SIA Annual Report 01/02 -

Page 83

...the Financial Statements 31 March 2002 17 Fixed Assets (in $ million) The Group 1 April 01 Additions Disposals/ Transfer Provision for impairment 31 March 02 Cost Aircraft Aircraft spares Aircraft spare engines Freehold land and buildings Leasehold land and buildings Plant and equipment Office and... -

Page 84

... The Group 31 March 2002 2001 2002 2001 Net book value of fixed assets acquired under finance leases - aircraft 410.8 410.8 517.0 517.0 - - 517.0 517.0 Advances and progress payments comprise mainly purchases of aircraft, related equipment and building projects. 84 SIA Annual Report 01... -

Page 85

... (2000-01: 4.92% to 6.80%) per annum for USD funds. Interest on loans to subsidiary companies is computed using variously LIBOR, SIBOR and SGD Swap-Offer Rates, and applying agreed margins. Amounts owing to/by subsidiary companies are trade-related and are interest-free. SIA Annual Report 01/02 85 -

Page 86

...Travel Systems Pte Ltd Cargo Community Network Pte Ltd Auspice Limited Star Kingdom Investment Limited* SH Tours Ltd** Singapore Airlines (Mauritius) Ltd* SIA Mauritius Ltd** Aviation Software Development Consultancy India Ltd Investment holding company Airport cargo, apron and passenger services... -

Page 87

... and reclassified the net carrying amount of the Air NZ investment under long-term investments (refer note 21 to the financial statements). The share of Virgin Atlantic's 2001-02 results in the Group profit and loss account included the share of exceptional one-off costs relating to the 11 September... -

Page 88

... Frequent Flyer Pte Ltd Ritz-Carlton, Millenia Singapore Properties Private Limited Servair-SATS Holding Company Pte Ltd Combustor Airmotive Services Pte Ltd Fuel Accessory Service Technologies Pte Ltd Quality service training Voluntary liquidation Hotel ownership and management Investment holding... -

Page 89

... recapitalization package in January 2002. The Company's equity interest in Evergreen Air Cargo Services Corporation was sold to Singapore Airport Terminal Services Limited in May 2001. 20 Joint Venture Companies (in $ million) The Group 31 March 2002 2001 2002 The Company 31 March 2001 Investment... -

Page 90

...the financial year, SIA Engineering Company Limited (SIAEC) made additional capital contribution of $13.6 million in Singapore Aero Engine Services Private Limited in accordance with the joint venture agreement. 21 Long-Term Investments (in $ million) The Group 31 March 2002 2001 2002 The Company 31... -

Page 91

... investments Non-equity investments 2.4 21.9 13.1 37.4 25 Cash and Bank Balances (in $ million) The Group 31 March 2002 2001 2002 The Company 31 March 2001 Fixed deposits Cash on hand and in banks 531.5 560.1 1,091.6 1,136.1 136.2 1,272.3 438.0 416.9 854.9 760.4 106.6 867.0 SIA Annual Report... -

Page 92

... companies Exchange differences Provision for impairment of fixed assets Amortization of deferred gain on sale and leaseback of aircraft and spare engines Operating profit before working capital changes (Decrease)/Increase in trade creditors and deferred accounts Decrease in investments Increase... -

Page 93

... route from Jakarta to Singapore on 19 December 1997, which resulted in the tragic loss of the aircraft and all its 104 passengers and crew, the directors have considered its likely impact on the financial position of the Company and the Group. Taking into account the remaining 6 outstanding claims... -

Page 94

Notes to the Financial Statements 31 March 2002 31 Employee Benefits The Group 31 March 2002 2001 2002 The Company 31 March 2001 Number of employees at 31 March Staff costs (including Executive Directors) (in $ million) Salary, bonuses and other costs CPF and other defined contributions 29,515 ... -

Page 95

... to the Financial Statements 31 March 2002 31 Employee Benefits (continued) Terms of share options outstanding as at 31 March 2002:SIA ESOP Exercise period Exercise price Number outstanding Number exercisable 28.3.2001 - 27.3.2010 28.3.2002 - 27.3.2010 28.3.2003 - 27.3.2010 28.3.2004 - 27.3.2010... -

Page 96

...in various currencies. The Group's airline operations carry certain financial and commodity risks, including the effects of changes in jet fuel prices, foreign currency exchange rates, interest rates and the market value of its investments. The Group's overall risk management approach is to minimize... -

Page 97

.... The Group has a number of foreign exchange contracts outstanding as of 31 March 2002 that have been entered into as a hedge of forecast sales denominated in GBP, Japanese Yen, Euros, Swiss Francs, Australian Dollars, New Zealand Dollars, Indian Rupees, Hong Kong Dollars, Taiwan Dollars, Chinese... -

Page 98

... as at year end. The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid prices at the close of the business on the balance sheet date. For investments where there is no quoted market price, fair value is based on either acquisition cost or the... -

Page 99

... a joint venture company 296.4 (1.1) 12.7 (1.7) 440.9 - 12.6 (5.9) 34 Subsequent Events (a) On 3 April 2002, one A310-300 passenger aircraft was traded-in to Rolls Royce Aircraft Management. (b) On 2 May 2002, it was announced that Singapore Airlines (SIA) and Virgin Investments SA have agreed... -

Page 100

...2001, and bellyhold revenue from Singapore Airlines Cargo for the period July 2001 to March 2002. Financial results for July 2000 to March 2001 have been restated to exclude cargo operations and to include notional bellyhold revenue to allow meaningful year-on-year comparisons: The Company 2001 - 02... -

Page 101

...' emoluments for the financial year ended 31 March 2002 include directors' fees of $560,000 ($630,000 in FY2000-01) which are derived using the following rates:The Company 2000 - 01 2001 - 02 $ $ Type of appointment Type of appointment (i) Board of Directors (i) Board of fee Directors - Basic... -

Page 102

Additional Information required by The Singapore Exchange Securities Trading Limited 2 Interested Persons Transactions (in $ million) Interested persons transactions under the shareholders' mandate for the financial year are as follows:The Company 2001 - 02 2000 - 01 Property-based transactions: ... -

Page 103

...Yearly Results of the Group First half Second half Total TOTAL REVENUE...464.4 100.0 8,604.6 100.0 OPERATING PROFIT 2001-02 ($ million) (%) ...EARNINGS (AFTER TAX) PER SHARE 2001-02 (cents) (%) 2000-01 (cents) (%) 11.1 21.4 93.1 70.2 40.8 78.6 39.6 29.8 51.9 100.0 132.7 100.0 SIA Annual Report... -

Page 104

... Operating profit Finance charges Surplus on disposal of aircraft, spares and spare engines Share of profits of joint venture companies Share of (losses)/profits of associated companies Profit on sale of investments Provision for diminution in value of investment in Air New Zealand Recognition... -

Page 105

... (cents per share) Dividend cover (times) PROFITABILITY RATIOS (%) Return on shareholders' funds Return on total assets Return on turnover PRODUCTIVITY AND EMPLOYEE DATA Value added ($ million) Value added per employee ($) Revenue per employee ($) Average employee strength US$/S$ exchange rate as at... -

Page 106

... generated from operations, dividends from subsidiaries and associated companies, and proceeds from sale of aircraft and other fixed assets. Seat capacity per employee is available seat capacity divided by average staff strength of passenger operations. Passenger load carried per employee is defined... -

Page 107

...,481.3 69.4 550.5 3,389.4 71.0 72.7 7,789.3 11,167.3 69.8 483.4 2,973.4 70.3 64.3 7,058.8 10,155.6 69.5 399.1 2,411.5 66.4 55.2 6,086.3 8,982.3 67.8 SIA Annual Report 01/02 107 -

Page 108

... Information Systems, Rugby, England Average age of SIA passenger fleet : 5 years 9 months (as at 31 March 2002). R2 Excludes 2 aircraft assigned to Singapore Aircraft Leasing Enterprise. R3 Excludes 10 aircraft assigned to Singapore Aircraft Leasing Enterprise. Singapore Airlines Cargo's fleet... -

Page 109

... Market Value Ratios Price/Earnings Price/Book value Price/Cash earnings R2 R1 14.90 7.00 14.40 19.20 12.90 13.60 27.75 1.78 10.99 10.25 1.66 6.02 R1 Based on closing price on 31 March. R2 Cash earnings is defined as profit after tax and minority interests plus depreciation. SIA Annual Report... -

Page 110

Group Corporate Structure at 31 March 2002 Singapore Airlines Limited 87% Singapore Airport Terminal Services Limited 87% SIA Engineering Company Limited 100% Singapore Airlines Cargo Private Limited 100% SIA Properties (Pte) Ltd 100% Singapore Flying College Pte Ltd 100% Sing-Bi Funds Private ... -

Page 111

... Inflight Catering Private Limited Tan Son Nhat Cargo Services Ltd Taj-Madras Flight Kitchen Private Limited Asia Airfreight Terminal Company Ltd Singapore Airport Duty-Free Emporium (Private) Limited MacroAsia-Eurest Catering Services Evergreen Air Cargo Services Corporation Evergreen Airline... -

Page 112

Information on Shareholdings as at 10 May 2002 Authorized share capital Issued and fully paid capital Class of shares $3,000,000,000.50 $609,071,811.50 a) 3,000,000,000 ordinary shares of $0.50 each b) One special share of par value $0.50 each c) 3,000,000,000 Air Services Agreements (ASA) shares ... -

Page 113

Information on Shareholdings as at 10 May 2002 Major shareholders Number of shares % 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Temasek Holdings (Private) Ltd Raffles Nominees Pte Ltd DBS Nominees Pte Ltd HSBC (Singapore) Nominees Pte Ltd Citibank Nominees Singapore Pte Ltd DB Nominees ... -

Page 114

..., Singapore 039594 on Saturday, 13 July 2002 at 10.00 a.m. to transact the following business: Ordinary Business 1. To receive and adopt the Directors' Report and Audited Financial Statements for the year ended 31 March 2002 and the Auditors' Report thereon. 2. To declare a final tax-exempt dividend... -

Page 115

...terms of the equal access scheme for effecting the off-market purchase; "Maximum Percentage" means that number of Ordinary Shares representing 10 per cent. of the issued ordinary share capital of the Company as at the date of the passing of this Resolution; "Maximum Price" in relation to an Ordinary... -

Page 116

... and vote in his stead. A proxy need not be a member of the Company. 2. The instrument appointing a proxy must be deposited at the Company's registered office at Airline House, 25 Airline Road, Singapore 819829 not less than 48 hours before the time appointed for the Meeting. 116 SIA Annual Report...