Entergy 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-86 -

Entergy Corporation and Subsidiaries 2004

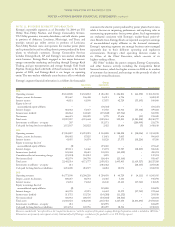

Entergy evaluates these unrealized gains and losses at the end of

each period to determine whether an other-than-temporary

impairment has occurred. This analysis considers the length of time

that a security has been in a loss position, the current performance

of that security, and whether decommissioning costs are recovered

in rates. Due to the regulatory treatment of decommissioning

collections and trust fund earnings, Entergy Arkansas, Entergy

Gulf States, Entergy Louisiana, and System Energy record

regulatory assets or liabilities for unrealized gains and losses on trust

investments. For the unregulated portion of River Bend, Entergy

Gulf States has recorded an offsetting amount of unrealized gains

or losses in other deferred credits. No significant impairments were

recorded in 2004 and 2003 as a result of these evaluations.

The fair value of debt securities, summarized by contractual

maturities, at December 31, 2004 is as follows (in millions):

Fair Value

Less than 1 year $ 134

1 year - 5 years 592

5 years - 10 years 425

10 years - 15 years 158

15 years - 20 years 60

20 years + 88

Total $1,457

During the year ended December 31, 2004, the proceeds from

the dispositions of securities amounted to $37 million with gross

gains of $0.7 million and gross losses of $0.7 million, which were

reclassified out of other comprehensiveincome into earnings during

the period.

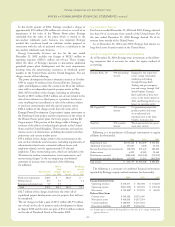

NOTE 16. QUARTERLY FINANCIAL DATA

(UNAUDITED)

Operating results for the four quarters of 2004 and 2003 were

(in thousands): Net

Operating Operating Income

Revenues Income (Loss)

2004

First Quarter $2,251,549 $378,834 $213,016

Second Quarter $2,485,097 $494,312 $271,011

Third Quarter $2,963,581 $571,472 $288,047

Fourth Quarter $2,423,497 $208,946 $160,975

2003

First Quarter $2,037,723 $363,403 $400,923(a)

Second Quarter $2,353,909 $461,576 $211,517

Third Quarter $2,700,125 $619,005 $371,650

Fourth Quarter $2,103,163 $ 40,571 $ (33,623)

(a) Net income before the cumulative effect of accounting changes for the first

quarter of 2003 was $258,001.

Earnings per Average CommonShare

2004 2003

Basic Diluted Basic Diluted

First Quarter $0.90 $0.88 $ 1.77(b) $ 1.73(b)

Second Quarter $1.16 $1.14 $ 0.91 $ 0.89

Third Quarter $1.24 $1.22 $ 1.60 $ 1.57

Fourth Quarter $0.71 $0.69 $(0.19) $(0.18)

(b) Basic and diluted earnings per average common share before the cumulative

effect of accounting changes for the first quarter of 2003 were $1.13 and

$1.10, respectively.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS concluded