Entergy 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

SOURCES OF CAPITAL

Entergy’s sources to meet its capital requirements and to fund

potential investments include:

•internally generated funds;

•cash on hand ($808 million as of December 31, 2004);

•securities issuances;

•bank financing under new or existing facilities; and

•sales of assets.

The majority of Entergy’s internally generated funds come from

the U.S. Utility. Circumstances such as weather patterns, price

fluctuations, and unanticipated expenses, including unscheduled

plant outages and storms, could affect the level of internally

generated funds in the future. In the following section, Entergy’s

cash flow activity for the previous three years is discussed.

Provisions within the Articles of Incorporation or pertinent

indentures and various other agreements relating to the long-term

debt and preferred stock of certain of Entergy Corporation’s

subsidiaries restrict the payment of cash dividends or other

distributions ontheir commonand preferred stock. As of

December 31, 2004, EntergyArkansas and Entergy Mississippi

had restricted retained earnings unavailable for distribution to

EntergyCorporationof $394.9 millionand $68.5 million, respec-

tively. Additionally, PUHCA prohibits Entergy Corporation’s sub-

sidiaries from making loans or advances to Entergy Corporation.

Alldebt and commonand preferred stockissuances by the domes-

tic utilitycompanies and System Energy require prior regulatory

approval and their preferred stock and debt issuances are also sub-

ject to issuance tests set forth in corporate charters, bond inden-

tures, and other agreements. The domestic utility companies and

System Energy have sufficient capacity under these tests to meet

foreseeable capital needs.

The short-term borrowings of Entergy’s subsidiaries are limited

to amounts authorized by the SEC. The current limits authorized

are effective through November 30, 2007. In addition to borrowing

from commercial banks, Entergy’s subsidiaries are authorized under

the SEC order to borrow from Entergy’s money pool. The money

pool is an inter-company borrowing arrangement designed to

reduce Entergy’s subsidiaries’ dependence on external short-term

borrowings. Borrowings from the money pool and external

borrowings combined may not exceed the SEC authorized limits.

As of December 31, 2004, Entergy’s subsidiaries’ aggregate

authorized limit was $1.6 billion and the aggregate outstanding

borrowing from the money pool was $151.6 million. There were no

borrowings outstanding from external sources. Under the SEC

order and without further SEC authorization, the domestic utility

companies and System Energy cannot issue new short-term

indebtedness unless (a) Entergy Corporation and the issuer each

maintain common equity of at least 30% of its capital and (b) with

the exception of money pool borrowings, the debt security to be

issued (if rated) and all outstanding securities of the issuer and

EntergyCorporationthat arerated must be rated investment grade.

See Note 4 to the consolidated financial statements for further

discussionof Entergy’s short-term borrowing limits.

The short- and long-term securities issuances of Entergy

Corporation also are limited to amounts authorized by the

SEC. Under its current SEC order, and without further SEC

authorization, Entergy Corporation cannot incur additional

indebtedness or issue other securities unless (a) Entergy

Corporation and each of its public utility subsidiaries maintain

common equity ratios of at least 30% and (b) the security to

be issued (if rated) and all outstanding securities of Entergy

Corporation that are rated, are rated investment grade.

The long-term securities issuances of Entergy Gulf States,

Entergy Louisiana, Entergy Mississippi, and System Energy also

are limited to amounts authorized by the SEC. Under the current

SEC orders of Entergy Gulf States, Entergy Louisiana, and

EntergyMississippi, and without further SEC authorization, the

issuer cannot incur additional indebtedness or issue other securities

unless (a) it and Entergy Corporation maintain a common equity

ratio of at least 30% and (b) the security to be issued (if rated) and

all outstanding securities of the issuer (other than preferred stock of

Entergy Gulf States), as well as all outstanding securities of Entergy

Corporation, that are rated, arerated investment grade.

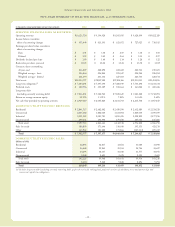

Cash Flow Activity

As shown in Entergy’s Statements of Cash Flows, cash flows for the

years ended December 31, 2004, 2003, and 2002 were as follows

(in millions):

2004 2003 2002

Cash and cash equivalents

at beginning of period $ 692 $ 1,335 $ 752

Cash flow provided by (used in):

Operating activities 2,929 2,006 2,181

Investing activities (1,140) (1,783) (1,388)

Financing activities (1,672) (869) (213)

Effect of exchange rates on

cash and cash equivalents (1) 3 3

Net increase (decrease) in

cash and cash equivalents 116 (643) 583

Cash and cash equivalents

at end of period $ 808 $ 692 $ 1,335

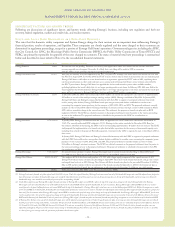

Operating Cash Flow Activity

2004 Compared to 2003

Entergy’s cash flow provided by operating activities increased in

2004 primarily due to the following:

•The U.S. Utility provided $2,208 million in cash from operating

activities compared to providing $1,675 million in 2003. The

increase resulted primarily from the receipt of intercompany

income tax refunds from the parent company, Entergy

Corporation. Income tax refunds/payments contributed

approximately $400 million of the increase in cash from

operating activities in 2004. Improved recovery of fuel costs and

areduction in interest paid also contributed to the

increase in 2004.

-31 -

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued