Entergy 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-19 -

Entergy Corporation and Subsidiaries 2004

internet-based work management

system that permits team members to

work on the same license renewal

project at the same time from multiple

locations. Entergy Nuclear, partnering

with Framatome, is the nation’s largest

contract provider of license renewal

services to the U.S. nuclear power

industry.

Intrinsic Growth

We pursue uprates when economically

attractive to increase the capacity and

output of our nuclear plants. As a

general rule of thumb, a 100 MW uprate

in our Nuclear Northeast fleet with an

$800 per KW capital investment and a

market price for power of $40 per MWh

yields approximately six cents in earnings

per share.

In 2004, we implemented plant

uprates at FitzPatrickand Indian

Point 2, bringing the total capacity of

our Northeast fleet to 4,058 MW. In

2005, we expect to complete uprates at

Waterford 3 and Indian Point 3, and we

willwork to resolve regulatory hurdles to

place in service the 50 MW uprate we

completed at Vermont Yankee in 2004.

We proactively engage in selling

power generated by the Northeast fleet

through forward contracts. At the end

of 2004, 95 percent of the planned

generation for 2005 was under contract,

89 percent for 2006, and 69 percent for

2007 at average prices per MWh of $39,

$40, and $42 respectively. That’s up

significantly from year-end 2003 when

average contract prices per MWh were

$37, $36, and $36 for 2005, 2006, and

2007 respectively. Going forward, we will

use insights from our ongoing relationship

with Merrill Lynch to keep our point of

view unbiased and current, enabling us

to determine the optimal portion of our

output to sell forward.

Opportunities Follow Capability

In 2003, we signed a first-of-its-kind

service contract with the Nebraska

Public Power District to operate its

Cooper Nuclear Station. Since then,

the NRChas noted improved

performance and recently closed

aCooper confirmatory action letter.

A$100 million capital improvement

program is onschedule. The NPPD

Board of Directors approved proceeding

with the NRC’s operating license

renewal process. And in 2004, Cooper

had its longest run in plant history.

Clearly, in one year Cooper has

undergone a remarkable turnaround. We

are proud of what we have been able to

accomplish and believe our capabilities

as a nuclear operator willprovide similar

opportunities in the very near future.

Allnuclear owners are facing

heightened regulatory scrutiny and we

believe that will motivate many small-

scale plant owners to exit the business.

Today, there are more than 30 small-

scale plants operating in the U.S. that

have either production costs greater

than $20 per MWh, low capacity

factors, event issues, low regulatory

scores, or all of the above. We believe

this segment of the market has good

potential for future plant sales or

management services contracts. In the

meantime, we will further develop the

already strong operational expertise that

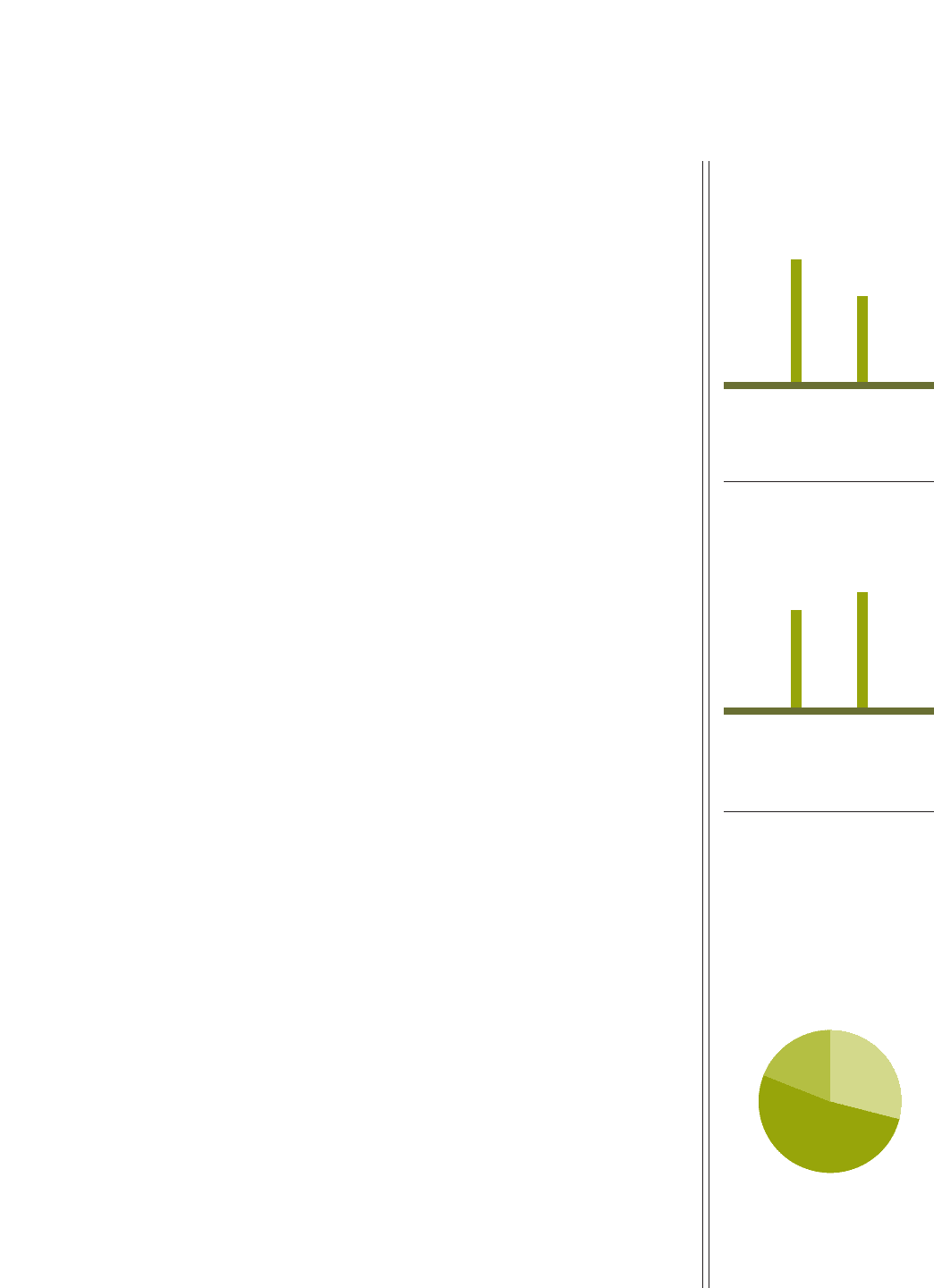

got us here. Entergy’s utility generating fleet is one of the

cleanest in the nation. Almost 80 percent of

Entergy’s power comes from clean nuclear

fuel and natural gas generation.

SOURCES OF GENERATION

Coal

19% Gas/Oil

29%

Nuclear

52%

NUCLEAR NORTHEAST

PRODUCTION COSTS

$/MWh

Down 31%

Before

ETR

Ownership

2004

2004 Regulated Fleet = $15 per MWh

20

29

In the past five years, we have driven

significant performance improvement in our

Northeast non-regulated nuclear fleet. We

continue to target the performance levels

achieved by our regulated nuclear fleet.

NUCLEAR NORTHEAST

CAPACITY FACTORS

%

Up 19%

Before

ETR

Ownership

2004

92

77

2004 Regulated Fleet = 95%