Entergy 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-79 -

Other Postretirement Benefits

Entergy also currently provides health care and life insurance bene-

fits for retired employees. Substantially all domestic employees may

become eligible for these benefits if they reach retirement age

while still working for Entergy. Entergy uses a December 31

measurement date for its postretirement benefit plans.

Effective January 1, 1993, Entergy adopted SFAS 106, which

required a change from a cash method to an accrual method

of accounting for postretirement benefits other than pensions.

AtJanuary 1, 1993, the actuarially determined accumulated

postretirement benefit obligation (APBO) earned by retirees and

active employees was estimated to be approximately $241.4 million

for Entergy (other than Entergy Gulf States) and $128 million for

Entergy Gulf States. Such obligations are being amortized over a

20-year period that began in 1993. For the most part, the domestic

utilities and System Energy recover SFAS 106 costs from customers

and are required to fund postretirement benefits collected in rates to

an external trust.

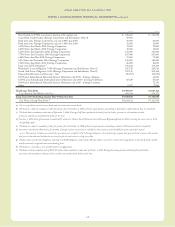

Components ofNet Postretirement

Benefit Cost

Total 2004, 2003, and 2002 other postretirement benefit costs of

EntergyCorporationand its subsidiaries, including amounts

capitalized and deferred, included the following components

(in thousands):

2004 2003 2002

Service cost - benefits earned

during the period $30,947 $ 37,799 $ 29,199

Interest cost onAPBO 53,801 52,746 44,819

Expected return on assets (18,825) (15,810) (14,066)

Amortizationof

transitionobligation 9,429 15,193 17,874

Amortization of

prior service cost (5,222) (925) 992

Recognized net (gain)/loss 15,546 12,369 1,874

Curtailment loss – 57,958 –

Special terminationbenefits – 5,444 –

Net other postretirement

benefit cost $85,676 $164,774 $ 80,692

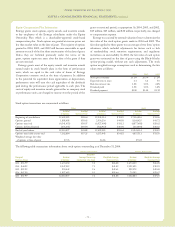

Other Postretirement Benefit Obligations,

Plan Assets, Funded Status, and Amounts Not

Yet Recognized and Recognized in the Balance

Sheet as of December 31, 2004 and 2003

(in thousands):

2004 2003

Change in APBO

Balance at beginning of year $ 941,803 $ 799,506

Service cost 30,947 37,799

Interest cost 53,801 52,746

Actuarial loss 73,890 115,966

Benefits paid (66,456) (48,379)

Plan amendments (a) (60,231) (84,722)

Plan participant contributions 9,312 7,074

Curtailment – 56,369

Special termination benefits – 5,444

Balance at end of year $ 983,066 $ 941,803

Change in Plan Assets

Fair value of assets at

beginning of year $ 227,446 $ 182,692

Actual return on plan assets 15,550 22,794

Employer contributions 63,399 63,265

Plan participant contributions 9,312 7,074

Benefits paid (66,455) (48,379)

Fair value of assets

at end of year $ 249,252 $ 227,446

Funded status $(733,814) $ (714,357)

Amounts not yet recognized

in the balance sheet

Unrecognized transition obligation 5,594 44,815

Unrecognized prior service cost (39,560) (20,746)

Unrecognized net loss 391,940 336,005

Accrued other postretirement benefit

cost recognized in the balance sheet $ (375,840) $ (354,283)

(a) Reflects plan design changes, including a change in the participation

assumption for the majority of non-bargaining employees effective August 1,

2003 and certain bargaining employees and additional non-bargaining

employees effective January 1, 2004.

Pension and Other Postretirement

Plans’Assets

Entergy’s pension and postretirement plans weighted-average asset

allocations by asset category at December 31, 2004 and 2003 are

as follows:

Pension Postretirement

2004 2003 2004 2003

Domestic Equity Securities 46% 56% 38% 37%

International Equity Securities 21% 14% 14% 0%

Fixed–Income Securities 31% 28% 47% 60%

Other 2% 2% 1% 3%

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued