Entergy 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

To the extent the Entergy companies are ordered to provide such

refunds, these costs will qualify for inclusion in the Entergy

companies’ rates. The recovery of these costs is not automatic,

however, especially at the retail level, where the majority of the cost

recovery would occur. Entergy intends to pursue all regulatory and

legal avenues available to it in order to have these orders reversed

and have the affected interconnection agreements reinstated as

agreed to by the generators.

Available Flowgate Capacity Proceeding

On December 17, 2004, FERC issued an order initiating a hearing

and investigation concerning the justness and reasonableness

of the Available Flowgate Capacity (AFC) methodology,

the methodology used to evaluate short-term transmission service

requests under the domestic utility companies’ open access

transmission tariff, and establishing a refund effective date. In its

order, FERC indicated that although it “appreciates that Entergy is

attempting to explore ways to improve transmission access on its

system,” it believed that an investigation was warranted to gather

more evidence in light of the concerns raised by certain

transmission customers and certain issues raised in a FERC audit

reportfinding errors and problems with the predecessor

methodology used by Entergy for evaluating short-term

transmission requests, the Generator Operating Limits

methodology. The FERC order indicates that the investigation will

include an examination of (i) Entergy’s implementation of the AFC

program, (ii) whether Entergy’s implementation has complied with

prior FERC orders and open access transmission tariff provisions

addressing the AFC program, and (iii) whether Entergy’s provision

of access to short-term transmission on its transmission system was

just, reasonable, and not undulydiscriminatory.

Entergy has submitted an Emergency Interim Request for

Rehearing requesting FERC to defer the hearing process and

instead proceed initially with an independent audit of the AFC

program and the expansion of the current process involving other

market participants to address a broader range of issues. Entergy

believes that this type of approach is a more efficient and effective

mechanism for evaluating the AFC program. Following the

completion of the independent audit and process involving other

market participants, FERC could determine whether other

procedural steps arenecessary. FERC has not yet ruled on the

Emergency Interim Request for Rehearing submitted by Entergy.

Entergy believes that it has complied with the provisions of its

open access transmission tariff, including the provisions addressing

the implementationof the AFC methodology; however, the

ultimate scope of this proceeding cannot be predicted at this time.

Ahearing in the AFC proceeding is currently scheduled to

commence in August 2005.

Federal Legislation

Federal legislation intended to facilitate wholesale competition in

the electric power industry has been seriously considered by the

United States Congress for the past several years. In the last

Congress, both the House and Senate passed separate versions of

comprehensiveenergylegislation, negotiated a conference package,

and fell two votes short of bringing the conferenced bill up for a

vote in the Senate. The bill contained electricity provisions that

would, among other things, allow for participant funding of

transmission interconnections and upgrades, repeal PUHCA, repeal

or modify PURPA, enact a mechanism for establishing enforceable

reliability standards, provide FERC with new authority over utility

mergers, and acquisitions, and codify FERC’s authority over

market-based rates. It is expected that the United States House and

Senate will again craft and consider energy legislation in the

109th Congress.

Market and Credit Risks

Market risk is the risk of changes in the value of commodity and

financial instruments, or in future operating results or cash flows, in

response to changing market conditions. Entergy is exposed to the

following significant market risks:

•The commodity price risk associated with Entergy’s Non-Utility

Nuclear and Energy Commodity Services segments.

•The foreign currency exchange rate risk associated with certain

of Entergy’s contractual obligations.

•The interest rate and equity price risk associated with Entergy’s

investments in decommissioning trust funds.

Entergyis also exposed to credit risk. Credit risk is the risk

of loss from nonperformance by suppliers, customers, or

financial counterparties to a contract or agreement. Where it is

asignificant consideration, counterparty credit risk is addressed in

the discussions that follow.

Commodity Price Risk

Power Generation

The sale of electricity from the power generation plants owned by

Entergy’s Non-Utility Nuclear business and Energy Commodity

Services, unless otherwise contracted, is subject to the fluctuation of

market power prices. Entergy’s Non-Utility Nuclear business has

entered into purchased power agreements (PPA) and other

contracts to sell the power produced by its power plants at prices

established in the PPAs. Entergy continues to pursue opportunities

to extend the existing PPAs and to enter into new PPAs with other

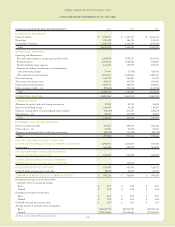

parties. Following is a summary of the amount of the Non-Utility

Nuclear business’ output that is currently sold forward under

physical or financial contracts at fixed prices:

2005 2006 2007 2008 2009

Percent of planned generation

sold forward:

Unit-contingent 36% 20% 17% 1% 0%

Unit-contingent with

availability guarantees 54% 52% 38% 25% 0%

Firmliquidated damages 4% 4% 2% 0% 0%

Total 94% 76% 57% 26% 0%

Planned generation (TWh) 34 35 34 34 35

Average contracted price per MWh $39 $41 $42 $44 N/A

The Vermont Yankee acquisition included a 10-year PPA under

whichthe former owners willbuy the power produced by the plant,

which is through the expiration in 2012 of the current operating

license for the plant. The PPA includes an adjustment clause under

-39 -

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued