Entergy 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-44 -

Entergy Corporation and Subsidiaries 2004

Due to the oversupply of power that existed throughout the U.S.

and the UK in 2002, and the resulting decreases in spark spreads,

consistent with Entergy’s point of view, Entergy’s impairment tests

indicated that a number of impairments were required to be

recognized in 2002 in the Energy Commodity Services segment.

These impairments, which were also accompanied by other charges

related to the restructuring of Entergy’s independent power

business, are further detailed in Note 11 to the consolidated

financial statements.

In 2004, Entergy recorded a charge of approximately $55 million

($36 million net-of-tax) as a result of an impairment of the value of

the Warren Power plant. Entergy concluded that the value of the

plant, which is owned in the non-nuclear wholesale assets business,

was impaired. Entergy reached this conclusion based on valuation

studies prepared in connection with the Entergy Asset

Management stock sale discussed above in “Results of Operations.”

Pension and Other Postretirement Benefits

Entergysponsors defined benefit pensionplans which cover

substantially all employees. Additionally, Entergy currently provides

postretirement health care and life insurance benefits for

substantially all employees who reach retirement age while still

working for Entergy. Entergy’s reported costs of providing these

benefits, as described in Note 10 to the consolidated financial

statements, are impacted by numerous factors including the

provisions of the plans, changing employee demographics, and

various actuarial calculations, assumptions, and accounting

mechanisms. Because of the complexity of these calculations, the

long-term nature of these obligations, and the importance of

the assumptions utilized, Entergy’s estimate of these costs is a

critical accounting estimate for the U.S. Utility and Non-Utility

Nuclear segments.

Assumptions

Keyactuarial assumptions utilized in determining these

costs include:

•Discount rates used in determining the future benefit

obligations;

•Projected health care cost trend rates;

•Expected long-term rate of return on plan assets; and

•Rate of increase in future compensation levels.

Entergy reviews these assumptions on an annual basis and adjusts

them as necessary. The falling interest rate environment and worse-

than-expected performance of the financial equity markets over the

past several years have impacted Entergy’s funding and reported

costs for these benefits. In addition, these trends have caused

Entergy to make a number of adjustments to its assumptions.

In selecting an assumed discount rate to calculate benefit

obligations, Entergy reviews market yields on high-quality

corporate debt and matches these rates with Entergy’s projected

stream of benefit payments. Based on recent market trends,

Entergy reduced its discount rate used to calculate benefit

obligations from 6.75% in 2002 to 6.25% in 2003 and to 6% in

2004. Entergy reviews actual recent cost trends and projected future

trends in establishing health care cost trend rates. Based on this

review, Entergy increased its health care cost trend rate

assumption used in calculating the December 31, 2004

accumulated postretirement benefit obligation to a 10% increase in

health care costs in 2005 gradually decreasing each successive year,

until it reaches a 4.5% annual increase in health care costs in 2011

and beyond.

In determining its expected long-term rate of return on plan

assets, Entergy reviews past long-term performance, asset

allocations, and long-term inflation assumptions. Entergy targets an

asset allocation for its pension plan assets of roughly 65% equity

securities, 31% fixed-income securities, and 4% other investments.

The target allocation for Entergy’s other postretirement benefit

assets is 51% equity securities and 49% fixed income securities.

Based on recent market trends, Entergy reduced its expected

long-term rate of return on plan assets used to calculate benefit

obligations from 8.75% for 2002 and 2003 to 8.5% in 2004. The

assumed rate of increase in future compensation levels used to

calculate benefit obligations was 3.25% in 2002, 2003, and 2004.

Cost Sensitivity

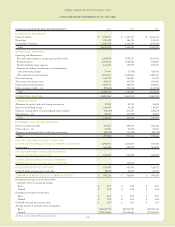

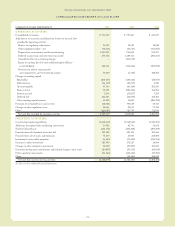

The following chart reflects the sensitivity of pension cost to

changes in certain actuarial assumptions (in thousands):

Actuarial Change in Impact on 2004 Impact on Projected

Assumption Assumption Pension Cost Benefit Obligation

Increase/(Decrease)

Discount rate (0.25%) $10,268 $94,903

Rate of return

onplan assets (0.25%) $ 4,388 –

Rate of increase

in compensation 0.25% $ 4,928 $29,134

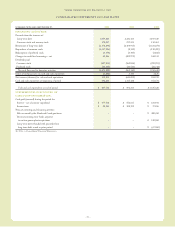

The following chart reflects the sensitivity of postretirement

benefit cost to changes in certain actuarial assumptions

(in thousands):

Impact on

Impact on 2004 Accumulated

Actuarial Change in Postretirement Postretirement

Assumption Assumption Benefit Cost Benefit Obligation

Increase/(Decrease)

Health care

cost trend 0.25% $4,150 $23,892

Discount rate (0.25%) $2,715 $28,719

Eachfluctuationabove assumes that the other components of the

calculation are held constant.

Accounting Mechanisms

In accordance with SFAS No. 87, “Employers’ Accounting for

Pensions,” Entergy utilizes a number of accounting mechanisms

that reduce the volatilityof reported pension costs. Differences

between actuarial assumptions and actual plan results are deferred

and are amortized into cost only when the accumulated differences

exceed 10% of the greater of the projected benefit obligationor the

market-related value of plan assets. If necessary, the excess is

amortized over the average remaining service period of

active employees.

Additionally, Entergy accounts for the effect of asset

performance on pension expense over a twenty-quarter phase-in

period through a “market-related” value of assets calculation. Since

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued