Entergy 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-78 -

Entergy Corporation and Subsidiaries 2004

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

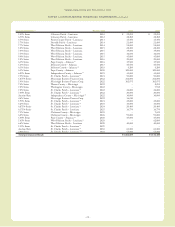

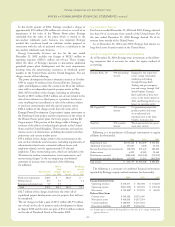

their undivided interest in Grand Gulf. Both refinancings are at

lower interest rates, and Entergy Louisiana’s and System Energy’s

lease payments have been reduced to reflect the lower interest costs.

As of December 31, 2004, Entergy Louisiana and System Energy

had future minimum lease payments, recorded as long-term debt

(reflecting an overall implicit rate of 7.45% and 5.01%, respectively)

as follows (in thousands): Entergy System

Year Louisiana Energy

2005 $ 14,554 $ 45,423

2006 18,261 46,019

2007 18,754 46,552

2008 22,606 47,128

2009 32,452 47,760

Years thereafter 334,062 302,402

Minimum lease payments $440,689 $535,284

Less: Amount representing interest 192,964 138,165

Present value of net

minimum lease payments $ 247,725 $397,119

NOTE 10. RETIREMENT, OTHER POSTRETIREMENT

BENEFITS, AND DEFINED CONTRIBUTION PLANS

Pension Plans

Entergyhas seven pensionplans covering substantially all of

its employees: “Entergy Corporation Retirement Plan for

Non-Bargaining Employees,” “Entergy Corporation Retirement

Plan for Bargaining Employees,” “Entergy Corporation Retirement

Plan II for Non-Bargaining Employees,” “Entergy Corporation

Retirement Plan II for Bargaining Employees,” “Entergy

CorporationRetirement Plan III,” “Entergy Corporation

Retirement Plan IV for Non-Bargaining Employees,” and “Entergy

CorporationRetirement Plan IV for Bargaining Employees.”

Except for the EntergyCorporation Retirement Plan III, the

pension plans are noncontributory and provide pension

benefits that arebased on employees’ credited service and

compensation during the final years before retirement.The Entergy

Corporation Retirement Plan III includes a mandatory employee

contribution of 3% of earnings during the first 10 years of plan

participation, and allows voluntary contributions from 1% to 10% of

earnings for a limited group of employees. Entergy Corporation and

its subsidiaries fund pension costs in accordance with contribution

guidelines established by the Employee Retirement Income

Security Act of 1974, as amended, and the Internal Revenue Code

of 1986, as amended. The assets of the plans include common and

preferred stocks, fixed-income securities, interest in a money

market fund, and insurance contracts. As of December 31, 2004 and

2003, Entergy recognized an additional minimum pension liability

for the excess of the accumulated benefit obligation over the fair

market value of plan assets. In accordance with SFAS 87, an

offsetting intangible asset, up to the amount of any unrecognized

prior service cost, was also recorded, with the remaining offset to

the liability recorded as a regulatory asset reflective of the recovery

mechanism for pension costs in Entergy’s jurisdictions or to other

comprehensive income for Entergy’s non-regulated business.

Entergy’s domestic utility companies’ and System Energy’s pension

costs are recovered from customers as a component of cost of

service in eachof its jurisdictions. Entergyuses a December 31

measurement date for its pensionplans.

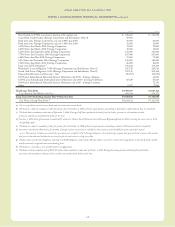

Components of Net Pension Cost

Total 2004, 2003, and 2002 pension costs of Entergy Corporation

and its subsidiaries, including amounts capitalized, included the

following components (in thousands):

2004 2003 2002

Service cost - benefits

earned during the period $ 76,946 $ 70,337 $ 56,947

Interest cost on projected

benefit obligation 148,092 134,403 128,387

Expected return on assets (153,584) (155,460) (158,202)

Amortization of transition asset (763) (763) (763)

Amortization of prior service cost 5,143 5,886 5,993

Recognized net loss 21,687 6,399 5,504

Curtailment loss – 14,864 –

Special termination benefits – 32,006 –

Net pension costs $ 97,521 $ 107,672 $ 37,866

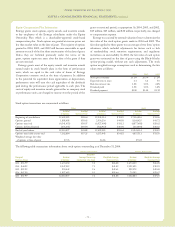

Pension Obligations, Plan Assets, Funded

Status, Amounts Not Yet Recognized and

Recognized in the Balance Sheet as of

December 31, 2004and 2003 (in thousands):

2004 2003

Change in Projected Benefit

Obligation (PBO)

Balance at beginning of year $2,349,565 $1,992,207

Service cost 76,946 70,337

Interest cost 148,092 134,403

Amendments 3,709 227

Actuarial loss 171,146 205,949

Benefits paid (117,234) (97,574)

Employee contributions 1,212 1,059

Curtailment loss – 10,951

Special terminationbenefits – 32,006

Balance at end of year $2,633,436 $2,349,565

Change in Plan Assets

Fair value of assets at

beginning of year $1,744,975 $1,451,802

Actual return on plan assets 170,964 355,043

Employer contributions 72,825 34,645

Employee contributions 1,212 1,059

Benefits paid (117,234) (97,574)

Fair value of assets

at end of year $1,872,742 $1,744,975

Funded status $ (760,694) $ (604,590)

Amounts not yet recognized

in the balance sheet

Unrecognized transition asset (662) (1,426)

Unrecognized prior service cost 29,053 30,467

Unrecognized net loss 542,391 410,321

Accrued pension cost recognized

in the balance sheet $ (189,912) $ (165,228)

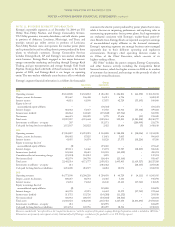

Amounts recognized in

the balance sheet

Accrued pensioncost $ (189,912) $ (165,228)

Additional minimum

pension liability (244,280) (180,212)

Intangible asset 26,167 30,832

Accumulated other

comprehensive income 10,781 15,359

Regulatory asset 207,332 134,021

Net amount recognized $ (189,912) $ (165,228)