Entergy 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-77 -

On April 19, 2004, CashPoint failed to pay funds due to

the domestic utility companies that had been collected through

payment agents. The domestic utility companies then obtained a

temporary restraining order from the Civil District Court for the

Parish of Orleans, State of Louisiana, enjoining CashPoint from

distributing funds belonging to Entergy, except by paying those

funds to Entergy. On April 22, 2004, a petition for involuntary

Chapter 7 bankruptcy was filed against CashPoint by other

creditors in the United States Bankruptcy Court for the Southern

District of New York. In response to these events, the domestic

utility companies expanded an existing contract with another

company to manage all of their payment agents. The domestic

utility companies filed proofs of claim in the CashPoint

bankruptcy proceeding in September 2004. Although Entergy

cannot precisely determine at this time the amount that CashPoint

owes to the domestic utility companies that may not be repaid, it

has accrued an estimate of loss based on current information. If no

cash is repaid to the domestic utility companies, an event Entergy

does not believe is likely, the current estimate of maximum exposure

to loss is approximately $25 million.

Employment Litigation

Entergy Corporation and certain subsidiaries are defendants in

numerous lawsuits filed by former employees asserting that they

were wrongfully terminated and/or discriminated against on the

basis of age, race, sex, and/or other protected characteristics.

Entergy Corporation and these subsidiaries are vigorously defend-

ing these suits and deny any liability to the plaintiffs. Nevertheless,

no assurance can be given as to the outcome of these cases.

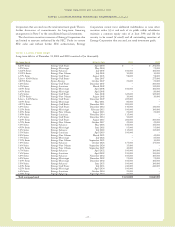

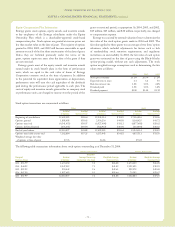

NOTE 9. LEASES

General

As of December 31, 2004, Entergy had capital leases and non-

cancelable operating leases for equipment, buildings, vehicles, and

fuel storage facilities (excluding nuclear fuel leases and the Grand

Gulf and Waterford 3 sale and leaseback transactions) with

minimum lease payments as follows (in thousands):

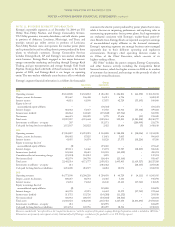

Operating Capital

Year Leases Leases

2005 $ 99,246 $ 9,660

2006 85,769 5,724

2007 68,557 3,438

2008 55,155 1,754

2009 45,240 237

Years thereafter 210,474 2,606

Minimum lease payments $564,441 $23,419

Less: Amount representing interest – 3,388

Present value of net

minimum lease payments $564,441 $20,031

Total rental expenses for all leases (excluding nuclear fuel leases

and the Grand Gulf and Waterford 3 sale and leaseback

transactions) amounted to $81.3 million in 2004, $84.3 million in

2003, and $92.2 million in 2002.

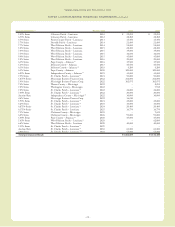

Nuclear Fuel Leases

As of December 31, 2004, arrangements to lease nuclear fuel

existed in an aggregate amount up to $150 million for Entergy

Arkansas, $105 million for Entergy Gulf States, $80 million for

Entergy Louisiana, and $110 million for System Energy. As of

December 31, 2004, the unrecovered cost base of nuclear fuel

leases amounted to approximately $93.9 million for Entergy

Arkansas, $71.2 million for Entergy Gulf States, $31.7 million for

Entergy Louisiana, and $65.6 million for System Energy. The

lessors finance the acquisition and ownership of nuclear fuel

through loans made under revolving credit agreements, the issuance

of commercial paper, and the issuance of intermediate-term notes.

The credit agreements for Entergy Arkansas, Entergy Gulf States,

Entergy Louisiana, and System Energy each have a termination

date of October 30, 2006. The termination dates may be extended

from time to time with the consent of the lenders.The intermediate-

term notes issued pursuant to these fuel lease arrangements have

varying maturities through February 15, 2009. It is expected that

additional financing under the leases will be arranged as needed to

acquire additional fuel, to pay interest, and to pay maturing debt.

However, if such additional financing cannot be arranged, the

lessee in each case must repurchase sufficient nuclear fuel to allow

the lessor to meet its obligations in accordance with the fuel lease.

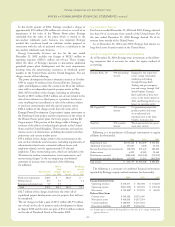

Lease payments are based on nuclear fuel use. The total

nuclear fuel lease payments (principal and interest) as well as

the separate interest component charged to operations by the

domestic utility companies and System Energy were $146.6

million(including interest of $12.8 million) in 2004, $142.0 million

(including interest of $11.8 million) in 2003, and $137.8

million (including interest of $11.3 million) in 2002.

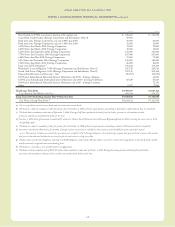

Sale and Leaseback Transactions

In 1988 and 1989, System Energy and Entergy Louisiana,

respectively, sold and leased back portions of their ownership

interests in Grand Gulf and Waterford 3 for 26½-year and 28-year

lease terms, respectively. Both companies have options to terminate

the leases, to repurchase the sold interests, or to renew the leases at

the end of their terms.

Under System Energy’s sale and leaseback arrangements, letters

of credit are required to be maintained to secure certain amounts

payable for the benefit of the equityinvestors by System Energy

under the leases. The current letters of credit are effective until

May2009.

Entergy Louisiana did not exercise its option to repurchase the

undivided interests in Waterford 3 in 1994. As a result, Entergy

Louisiana was required to provide collateral for the equity portion

of certain amounts payable by Entergy Louisiana under the leases.

Such collateral was in the form of a new series of non-interest

bearing first mortgage bonds in the aggregate principal amount of

$208.2 millionissued by Entergy Louisiana in September 1994.

In July 1997, Entergy Louisiana caused the Waterford 3 lessors

to issue $307.6 million aggregate principal amount of Waterford 3

Secured Lease ObligationBonds, 8.09% Series due 2017, to

refinance the outstanding bonds originally issued to finance the

purchase of the undivided interests by the lessors. In May 2004,

System Energy caused the Grand Gulf lessors to refinance the

outstanding bonds that they had issued to finance the purchase of

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued