Entergy 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•In January 2004, Entergy Louisiana

filed a $167 million rate case that

included resources from our

Generation Supply Plan and

reliability investments. The potential

rate increase to customers would be

largely offset by estimated fuel savings

that would result from securing

capacity under our Generation Supply

Plan. Discussions include a formula

rate plan and are ongoing with a

potential decision expected around

the end of first quarter 2005.

•Entergy Gulf States – Louisiana

requested a $22 million rate increase

in May 2002. In January 2005, a

procedural schedule for a global

settlement proposal was advanced.

The settlement proposal resolves 12

open dockets and includes a formula

rate plan. The current timeline calls

for the Commissionto consider the

global settlement proposal in

March 2005.

•EntergyGulf States – Texas filed for

a$68 million rate increase in August

2004 after the move to Retail Open

Access was delayed. The Public

Utility Commission of Texas

dismissed our case in October and

failed to act onour request for

rehearing, effectively dismissing our

case by operation of law. That’s

something we have to change and we

will work aggressively and relentlessly

to resolve this situation. We are

currently pursuing an appeal in a

Texas district courtas well as

legislativeaction to get our case

back on track to create financial

stability and certainty for Entergy

Gulf States – Texas.

In addition to state regulatory actions,

we are also actively pursuing positive

regulatory outcomes with FERC.

While the majority of these actions are

not expected to have an impact on our

future earnings, we are still fighting for

the best possible outcomes for our

customers. Why? Because we know that

in order to build lasting value for our

shareholders, we must operate in a

regulatory environment that enables us

to deliver the best possible value to

our customers.

Long term, we believe the incentive

rate structures in place at Entergy

Mississippi and Entergy New Orleans

are excellent models. They include

financial incentives to the utilityupon

meeting performance hurdles in areas

such as reliability, customer service, and

the customers’ overall cost of power.

By aligning shareholder interests with

customer interests, these structures drive

the right behaviors and the right results.

AComprehensive Supply Plan

The gap between our utility-owned

capacity and our demand load profile is

close to four gigawatts. To close that

gap, we have developed a comprehensive

Generation Supply Plan that prescribes

both the contract purchase of power as

well as acquisition of generation assets.

The merchant generation capacity

within our service territory is

approximately 19 GW – ample capacity

to both meet our four GW-capacity

shortfalland displace some of our less

efficient, older units. We believe

contracting for or purchasing a portion

of our generation requirements from

merchant generators creates opportunities

to lower our customers’ rates.

-14 -

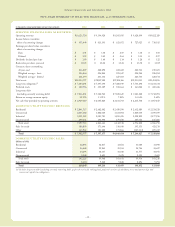

Entergy Corporation and Subsidiaries 2004

Weaspire to industry-leading customer

satisfaction in our utilities and we steadily

invest in our operations to improve reliability.

Since 1998, our investments have delivered an

improvement in both the average frequency and

the average duration of outages, and in the

number of regulatory outage complaints.

OUTAGE FREQUENCY

average number per customer per year

Down 48%

98 04

1.85

OUTAGE DURATION

average minutes per customer per year

Down 39%

98 04

169

278

REGULATORY OUTAGE COMPLAINTS

Down 85%

98 04

81

535

3.54