Entergy 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-65 -

improperly and imprudently included in the fuel adjustment filings.

Testimony was filed on behalf of the plaintiffs in this proceeding

asserting, among other things, that Entergy New Orleans and other

defendants have engaged in fuel procurement and power

purchasing practices and included costs in Entergy New Orleans’

fuel adjustment that could have resulted in New Orleans customers

being overcharged by more than $100 million over a period of years.

Hearings were held in February and March 2002. In February 2004,

the City Council approved a resolution that resulted in a refund to

customers of $11.3 million, including interest, during the

months of June through September 2004. The resolution

concludes, among other things, that the record does not support an

allegation that Entergy New Orleans’ actions or inactions, either

alone or in concert with Entergy or any of its affiliates, constituted

amisrepresentation or a suppression of the truth made in order to

obtain an unjust advantage of Entergy New Orleans, or to cause

loss, inconvenience, or harm to its ratepayers. Management believes

that it has adequately provided for the liability associated with this

proceeding. The plaintiffs have appealed the City Council

resolution to the state court in Orleans Parish. Oral argument on

the plaintiffs’ appeal was conducted in February 2005.

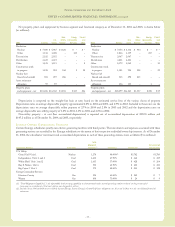

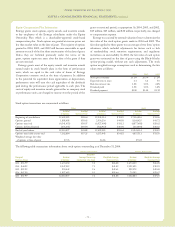

NOTE 3. INCOME TAXES

Income tax expenses for 2004, 2003, and 2002 consist of

the following (in thousands):

2004 2003 2002

Current:

Federal(a) (b) $ 54,380 $ (731,129) $ 510,109

Foreign (2,231) 8,284 (3,295)

State (a) (b) 38,301 23,396 43,788

Total(a) (b) 90,450 (699,449) 550,602

Deferred - net 296,445 1,307,092 (233,532)

Investment tax credit

adjustments - net (20,987) (27,644) (23,132)

Recorded income tax expense $ 365,908 $ 579,999 $ 293,938

(a) The actual cash taxes paid were $28,241 in 2004, $188,709 in 2003, and

$57,856 in 2002. Entergy Louisiana’smark-to-market tax accounting

election significantly reduced taxes paid in 2002. In 2001, Entergy

Louisiana changed its method of accounting for tax purposes related to its

wholesale electric power contracts. The most significant of these is the

contract to purchase power from the Vidalia project (the contract is discussed

in Note 8 to the consolidated financial statements). The new tax accounting

method has provided a cumulative cash flow benefit of approximately $790

million through 2004, which is expected to reverse in the years 2005 through

2031. The election did not reduce book income tax expense. The timing of the

reversal of this benefit depends on several variables, including the price of

power. Approximately half of the consolidated cash flow benefit of the

election occurred in 2001 and the remainder occurred in 2002.

(b) In 2003, the domestic utility companies and System Energy filed, with the IRS, a

change in tax accounting method notification for their respective calculations of

cost of goods sold. The adjustment implemented a simplified method of allocation

of overhead to the production of electricity, which is provided under the IRS

capitalization regulations. The cumulative adjustment placing these companies on

the new methodology resulted in a $2.95 billion deduction on Entergy’s 2003

income tax return. There was no cash benefit from the method change in 2003.

On a consolidated basis, a $74 million cash tax benefit was realized in 2004.

This tax accounting method change is an issue across the utility industry and will

likely be challenged by the IRS on audit.

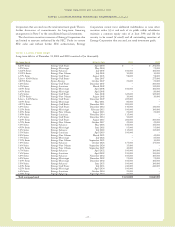

Total income taxes differ from the amounts computed by

applying the statutory income tax rate to income before taxes. The

reasons for the differences for the years 2004, 2003, and 2002 are:

(in thousands):

2004 2003 2002

Computed at statutory rate (35%) $454,635 $535,663 $320,954

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 36,185 54,024 44,835

Regulatory differences-

utility plant items 41,240 52,638 29,774

Amortization of investment

tax credits (20,596) (24,364) (22,294)

EAM Capital Loss (86,426) – –

Flow-through/permanent

differences (42,902) (30,221) (38,197)

U.S. tax on foreign income 2,014 7,888 (28,416)

Other – net (18,242) (15,629) (12,718)

Total income taxes $365,908 $579,999 $293,938

Effective income tax rate 28.2% 37.9% 32.1%

The EAM capital loss is a tax benefit resulting from the sale of

preferred stock and less than 1% of the common stock of Entergy

Asset Management, an Entergy subsidiary. In December 2004, an

Entergysubsidiarysold the stockto a thirdpartyfor $29.75 million.

The sale resulted in a capital loss for tax purposes

of $370 million, producing a federal and state net tax benefit of

$97 millionthat Entergyrecorded in the fourth quarter of 2004.

Entergyhas established a contingency provision in its financial

statements that management believes will sufficiently cover the risk

associated with this issue.

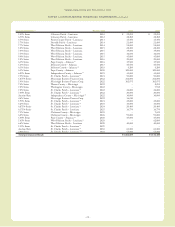

Significant components of net deferred and noncurrent accrued

tax liabilities as of December 31, 2004 and 2003 are as follows

(in thousands):

2004 2003

Deferred and Noncurrent

Accrued Tax Liabilities:

Net regulatoryliabilities $(978,815) $(1,072,898)

Plant-related basis differences (4,699,803) (3,574,593)

Power purchase agreements (972,348) (945,495)

Nuclear decommissioning (545,109) (519,028)

Other (346,993) (379,875)

Total (7,543,068) (6,491,889)

Deferred Tax Assets:

Accumulated deferred investment

tax credit 133,979 141,723

Capital losses 134,688 92,423

Net operating loss carryforwards 1,201,006 129,122

Sale and leaseback 227,155 223,134

Unbilled/deferred revenues 28,741 18,983

Pension-related items 247,662 204,083

Reserve for regulatory adjustments 131,112 138,933

Customer deposits 107,652 108,591

Nuclear decommissioning 158,796 272,551

Other 225,659 399,080

Valuation allowance (43,864) (39,210)

Total 2,552,586 1,689,413

Net deferred and noncurrent

accrued tax liability $(4,990,482) $(4,802,476)

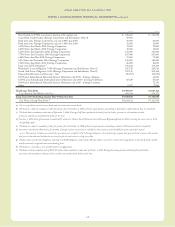

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued