Entergy 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-74 -

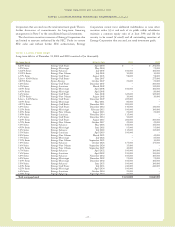

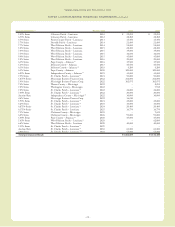

Entergy Corporation and Subsidiaries 2004

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

plants. These programs are underwritten by Nuclear Electric

Insurance Limited (NEIL). As of December 31, 2004, Entergy was

insured against such losses per the following structures:

U.S. Utility Plants (ANO 1 and 2, Grand Gulf 1, River Bend,

and Waterford 3)

•Primary Layer (per plant) - $500 million per occurrence

•Excess Layer (per plant) - $100 million per occurrence

•Blanket Layer (shared among all plants) - $1.0 billion

per occurrence

•Total limit - $1.6 billion per occurrence

•Deductibles:

•$5.0 million per occurrence – Turbine/generator damage

•$5.0 million per occurrence – Other than turbine/

generator damage

Note: ANO 1 and 2 share in the Primary Layer with one

policy in common.

Non-Utility Nuclear Plants (Indian Point 2 and 3, FitzPatrick,

Pilgrim, and Vermont Yankee)

•Primary Layer (per plant) - $500 million per occurrence

•Blanket Layer (shared among all plants) - $615 million

per occurrence

•Total limit - $1.115 billion per occurrence

•Deductibles:

•$1.0 million per occurrence – Turbine/generator damage

•$2.5 million per occurrence – Other than turbine/

generator damage

Note: Indian Point 2 and 3 share in the Primary Layer with one

policyin common.

In addition, the Non-Utility Nuclear plants are also covered

under NEIL’s Accidental Outage Coverage program. This

coverage provides certain fixed indemnities in the event of an

unplanned outage that results from a covered NEIL property

damage loss, subject to a deductible. The following summarizes this

coverage as of December 31, 2004:

Indian Point 2 and 3

•$4.5 million weekly indemnity

•$490 million maximum indemnity

•Deductible: 12 week waiting period

FitzPatrick and Pilgrim (each plant has an individual policy with the

noted parameters)

•$4.0 million weekly indemnity

•$490 million maximum indemnity

•Deductible: 12 week waiting period

Vermont Yankee

•$3.5 millionweekly indemnity

•$435 million maximum indemnity

•Deductible: 12 week waiting period

Entergy’s U.S. Utility nuclear plants have significantly less or no

accidental outage coverage. Under the property damage and

accidental outage insurance programs, Entergy nuclear plants could

be subject to assessments should losses exceed the accumulated

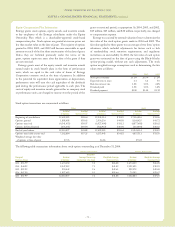

funds available from NEIL. As of December 31, 2004, the

maximum amounts of such possible assessments per occurrence

were $50.8 million for the U.S. Utility plants and $68.9 million for

the Non-Utility Nuclear plants.

Entergy maintains property insurance for its nuclear units in

excess of the Nuclear Regulatory Commission’s (NRC) minimum

requirement of $1.06 billion per site for nuclear power plant

licensees. NRC regulations provide that the proceeds of this

insurance must be used, first, to render the reactor safe and stable,

and second, to complete decontamination operations. Only after

proceeds are dedicated for such use and regulatory approval is

secured would any remaining proceeds be made available for the

benefit of plant owners or their creditors.

In the event that one or more acts of domestically-sponsored

terrorism causes property damage under one or more or all nuclear

insurance policies issued by NEIL (including, but not limited to,

those described above) within 12 months from the date the first

property damage occurs, the maximum recovery under all such

nuclear insurance policies shall be an aggregate of $3.24 billion plus

the additional amounts recovered for such losses from reinsurance,

indemnity, and any other sources applicable to such losses. There

is no aggregate limit involving one or more acts of foreign-

sponsored terrorism.

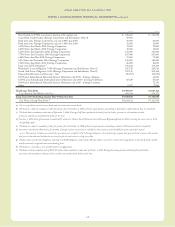

Nuclear Decommissioning and Other

Retirement Costs

SFAS 143, “Accounting for Asset Retirement Obligations,” which

was implemented effectiveJanuary1, 2003, requires the recording

of liabilities for alllegal obligations associated with the retirement

of long-lived assets that result from the normal operation of those

assets. For Entergy, these asset retirement obligations consist of its

liabilityfor decommissioning its nuclear power plants.

These liabilities are recorded at their fair values (which is the

present values of the estimated future cash outflows) in the period

in whichthey are incurred, with an accompanying addition to

the recorded cost of the long-lived asset. The asset retirement

obligation is accreted each year through a charge to expense, to

reflect the time value of money for this present value obligation.The

amounts added to the carrying amounts of the long-lived assets will

be depreciated over the useful lives of the assets. The net effect of

implementing SFAS 143 for the rate-regulated business of the

domestic utility companies and System Energy was recorded as a

regulatory asset, with no resulting impact on Entergy’s net income.

Entergy recorded these regulatory assets because existing rate

mechanisms in each jurisdiction are based on the principle

that Entergywillrecover all ultimate costs of decommissioning

from customers.

Upon implementation of SFAS 143 in 2003, assets and liabilities

increased $1.1 billion for the U.S. Utility segment as a result of

recording the asset retirement obligations at their fair values of

$1.1 billion as determined under SFAS 143, increasing utility

plant by $287 million, reducing accumulated depreciation by

$361 million, and recording the related regulatory assets of $422

million. The implementationof SFAS 143 for the portion of River

Bend not subject to cost-based ratemaking decreased earnings by

$21 million net-of-tax as a result of a one-time cumulative effect of