Entergy 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-40 -

Entergy Corporation and Subsidiaries 2004

which the prices specified in the PPA will be adjusted downward

monthly, beginning in November 2005, if power market prices drop

below PPA prices. Accordingly, because the price is not fixed, the

table above does not report power from that plant as sold forward

after November 2005.

Asale of power on a unit contingent basis coupled with an

availability guarantee provides for the payment to the power

purchaser of contract damages, if incurred, in the event the

seller fails to deliver power as a result of the failure of the

specified generation unit to generate power at or above a specified

availability threshold. To date, Entergy has not incurred any

payment obligation to any power purchaser pursuant to an

availability guarantee. All of Entergy’s outstanding availability

guarantees provide for dollar limits on Entergy’s maximum liability

under such guarantees.

Some of the agreements to sell the power produced by Entergy’s

Non-Utility Nuclear power plants contain provisions that require an

Entergy subsidiary to provide collateral to secure its obligations

under the agreements. The Entergysubsidiary may be required to

provide collateral based upon the difference between the current

market and contracted power prices in the regions where the Non-

Utility Nuclear business sells its power. The primary form of the

collateral to satisfy these requirements would be an Entergy

Corporation guaranty. Cash and letters of credit are also acceptable

forms of collateral. At December 31, 2004, based on power prices at

that time,Entergyhad in place as collateral $545.5 million

of Entergy Corporation guarantees and $47.5 million of letters of

credit. In the event of a decrease in Entergy Corporation’s credit

rating to specified levels below investment grade, Entergy may be

required to replace Entergy Corporation guarantees with cash or

letters of credit under some of the agreements.

In additionto selling the power produced by its plants, the

Non-Utility Nuclear business sells installed capacity to load-serving

distribution companies in order for those companies to meet

requirements placed on them by the Independent System Operators

in their area. Following is a summary of the amount of the

Non-Utility Nuclear business’ installed capacity that is currently

sold forward, and the blended amount of the Non-Utility Nuclear

business’ planned generation output and installed capacity that is

currently sold forward:

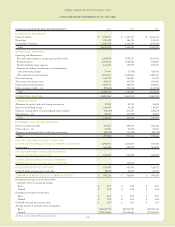

2005 2006 2007 2008 2009

Percent of capacity sold forward:

Bundled capacity and

energy contracts 13% 13% 13% 13% 13%

Capacity contracts 58% 67% 36% 22% 10%

Total 71% 80% 49% 35% 23%

Planned net MW in operation 4,155 4,200 4,200 4,200 4,200

Average capacity contract

price per kW per month $1.2 $1.1 $1.1 $1.0 $0.9

Blended Capacity and Energy

(based on revenues):

%of planned generation and

capacity sold forward 93% 87% 65% 36% 12%

Average contract

revenue per MWh $40 $42 $43 $44 $43

As of December 31, 2004, approximately 99% of Entergy’s

counterparties to Non-Utility Nuclear’s energy and capacity

contracts have investment grade credit ratings.

Following is a summary of the amount of Energy Commodity

Services’ output and installed capacity that is currently sold forward

under physical or financial contracts at fixed prices:

2005 2006 2007 2008 2009

Capacity:

Planned MW in operation 1,578 1,578 1,578 1,578 1,578

%of capacity sold forward 44% 33% 29% 29% 19%

Energy:

Planned generation (TWh) 3 3 3 3 4

%of planned generation

sold forward 69% 54% 45% 45% 35%

Blended Capacity and Energy

(based on revenues):

%of planned energy and

capacity sold forward 63% 44% 38% 39% 22%

Average contract

revenue per MWh $24 $24 $28 $28 $21

Entergycontinually monitors industry trends in order to

determine whether asset impairments or other losses could result

from a decline in value, or cancellation, of merchant power projects,

and records provisions for impairments and losses accordingly. As

discussed in “Results of Operations” above, in 2004 Entergy

determined that the value of the Warren power plant owned by the

non-nuclear wholesale assets business was impaired, and recorded

the appropriate provisionfor the loss.

Foreign Currency Exchange Rate Risk

Entergy Gulf States, System Fuels, and Entergy’s Non-Utility

Nuclear business enter into foreign currency forward contracts to

hedge the Euro-denominated payments due under certain purchase

contracts. The notional amounts of the foreign currency forward

contracts are 95.5 million Euro and the forward currency rates

range from .8641 to 1.33020. The maturities of these forward

contracts depend on the purchase contract payment dates and range

in time from January 2005 to January 2007. The mark-to-market

valuation of the forward contracts at December 31, 2004 was a net

asset of $28.1 million. The counterparty banks obligated on these

agreements are rated by Standard & Poor’s Rating Services at AA

ontheir senior debt obligations as of December 31, 2004.

Interest Rate and Equity Price Risk -

Decommissioning Trust Funds

Entergy’snuclear decommissioning trust funds are exposed to

fluctuations in equity prices and interest rates. The Nuclear

Regulatory Agency (NRC) requires Entergy to maintain trusts to

fund the costs of decommissioning ANO 1, ANO 2, River Bend,

Waterford 3, Grand Gulf, Pilgrim, Indian Point 1 and 2, and

Vermont Yankee (NYPA currently retains the decommissioning

trusts and liabilities for Indian Point 3 and FitzPatrick). The funds

areinvested primarily in equity securities; fixed-rate, fixed-income

securities; and cash and cash equivalents. Management believes that

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued