Entergy 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-26 -

Entergy Corporation and Subsidiaries 2004

Decommissioning expense increased from $30.5 million in 2002

to $92.5 million in 2003 primarily due to the implementation of

SFAS 143, “Accounting for Asset Retirement Obligations.” The

increase in decommissioning expense was offset by increases in

other regulatory credits and interest and dividend income and had

an insignificant effect on net income.

Depreciation and amortization expenses increased from $769.8

million in 2002 to $797.6 million in 2003 primarily due to an

increase in plant in service. The increase was also due to

the implementation of SFAS 143. The increase in depreciation and

amortization expense due to SFAS 143 implementation was offset

by increases in other regulatory credits and interest and dividend

income and has an insignificant effect on net income.

Other income (deductions) changed from $47.6 million in

2002 to ($36.0 million) in 2003 primarily due to a decrease

in “miscellaneous - net” as a result of a $107.7 million accrual in

the second quarter of 2003 for the loss that would be associated

with a final, non-appealable decision disallowing abeyed

River Bend plant costs. See Note 2 to the consolidated financial

statements for more details regarding the River Bend abeyed plant

costs. The decrease was partially offset by an increase in interest and

dividend income as a result of the implementationof SFAS 143.

Interest on long-term debt decreased from $462.0 million in

2002 to $433.5 millionin 2003 primarily due to the redemption and

refinancing of long-term debt.

Non-Utility Nuclear

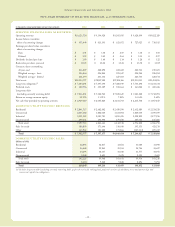

Following are key performance measures for Non-Utility Nuclear:

2004 2003 2002

Net MW in operation at December 31 4,058 4,001 3,955

Average realized price per MWh $41.26 $39.38 $40.07

Generation in GWh for the year 32,524 32,379 29,953

Capacityfactor for the year 92% 92% 93%

Results of Operations

2004 Compared to 2003

The decrease in earnings for Non-Utility Nuclear from

$300.8 million to $245.0 million was primarily due to

the $154.5 million net-of-tax cumulative effect of a change in

accounting principle that increased earnings in the first quarter

of 2003 upon implementation of SFAS 143. See “Critical

Accounting Estimates - SFAS 143” below for discussion of the

implementation of SFAS 143. Earnings before the cumulative effect

of accounting change increased by $98.7 million primarily due to

the following:

•lower operation and maintenance expenses, which decreased

from $681.8 million in 2003 to $595.7 million in 2004,

primarily resulting from charges recorded in 2003 in connection

with the voluntaryseverance program;

•higher revenues, which increased from $1.275 billion in 2003 to

$1.342 billion in 2004, primarily resulting from higher contract

pricing. The additionof a support services contract for the

Cooper Nuclear Station and increased generation in 2004 due

to power uprates completed in 2003 and fewer planned and

unplanned outages in 2004 also contributed to the higher

revenues; and

•miscellaneous income resulting from a reduction in the

decommissioning liability for a plant, as discussed in Note 8

to the consolidated financial statements.

Partially offsetting this increase were the following:

•higher income taxes, which increased from $88.6 million in

2003 to $142.6 million in 2004; and

•higher depreciation expense, which increased from $34.3

million in 2003 to $48.9 million in 2004, due to additions to

plant in service.

2003 Compared to 2002

The increase in earnings for Non-Utility Nuclear from $200.5

million to $300.8 million was primarily due to the $154.5 million

net-of-tax cumulative effect of a change in accounting principle

recognized in the first quarter of 2003 uponimplementationof

SFAS 143. See “Critical Accounting Estimates - SFAS 143” below

for discussion of the implementation of SFAS 143. Income before

the cumulativeeffect of accounting change decreased by $54.2

million. The decrease was primarily due to $83.0 million

($50.6 million net-of-tax) of charges recorded in connection with

the voluntaryseverance program. Except for the effect of the

voluntary severance program, operation and maintenance expenses

in 2003 per MWhof generationwerein line with 2002 operation

and maintenance expenses.

Energy Commodity Services

Sales of Entergy-KochBusinesses

In the fourth quarter of 2004, Entergy-Koch sold its energy trading

and pipeline businesses to third parties. The sales came after a

review of strategic alternatives for enhancing the value of Entergy-

Koch, LP. Entergy received $862 million of cash distributions in

2004 from Entergy-Koch after the business sales, and Entergy

ultimatelyexpects to receivetotal net cash distributions exceeding

$1 billion, comprised of the after-tax cash from the distributions of

the sales proceeds and the eventual liquidation of Entergy-Koch.

Entergycurrentlyexpects that it will receivethe remaining cash

distributions in 2006, and expects that the net cash distributions

will exceed its equity investment in Entergy-Koch. Entergy expects

to record a $60 million net-of-tax gain when the remainder of the

proceeds are received in 2006.

In the purchase agreements for the energy trading and the

pipeline business sales, Entergy-Kochhas agreed to indemnify the

respective purchasers for certain potential losses relating to any

breaches of the sellers’ representations, warranties, and obligations

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

“In the fourth quarter of 2004, Entergy-Koch sold its

energy trading and pipeline businesses to third parties.

The sales came after a review of strategic alternatives

for enhancing the value of Entergy-Koch, LP.”