Entergy 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-63 -

Filings with the PUCT and Texas Cities

(Entergy Gulf States)

Retail Rates

Entergy Gulf States is operating in Texas under the terms of a

December 2001 settlement agreement approved by the PUCT. The

settlement provided for base rates that have remained in effect

during the delay in the implementation of retail open access in

Entergy Gulf States’ Texas service territory. In view of the PUCT

order in July 2004 to further delay retail open access in the Texas

service territory, Entergy Gulf States filed a retail electric rate case

and fuel reconciliation proceeding with the PUCT in August 2004

seeking the following:

•approval of a base rate increase of $42.6 million annually for the

Texas retail jurisdiction;

•approval to implement a $14.1 million per year rider to recover,

over a 15-year period, $110.9 million of incurred costs related to

its efforts to transition to a competitive retail market in

accordance with the Texas restructuring law;

•approval to implement a proposed $11.3 million franchise fee

rider to recover payments to municipalities charging such

fees; and

•a requested return on equityof 11.5%.

In addition, Entergy Gulf States’ fuel reconciliation filing made

in conjunctionwith the base rate case sought to reconcile

approximately $288 million in fuel and purchased power costs

incurred during the period September 2003 through March 2004.

In October 2004, the PUCT issued a written order in which it

dismissed the rate case and fuel reconciliation proceeding indicating

that Entergy Gulf States is still subject to a rate freeze based on a

PUCT-approved agreement in 2001 stipulating that a rate freeze

would remain in effect until retail open access commenced

in Entergy Gulf States’ service territory, unless the rate freeze is

lifted by the PUCT prior thereto. Entergy Gulf States believes

the PUCT has misinterpreted the settlement and has appealed the

PUCT order to the Travis CountyDistrict Court and intends to

pursue other available remedies.

In February 2005, bills were submitted in the Texas Legislature

that would clarify that Entergy Gulf States is no longer subject to a

rate freeze and specify that retail open access will not commence in

Entergy Gulf States’ Texas service territory until the PUCT

certifies a power region.

Recovery of River Bend Costs

In March 1998, the PUCT disallowed recovery of $1.4 billion of

company-wide abeyed River Bend plant costs, which have been

held in abeyance since 1988. Entergy Gulf States appealed the

PUCT’s decision on this matter to the Travis County District Court

in Texas. In April 2002, the Travis County District Court issued an

order affirming the PUCT’s order on remand disallowing recovery

of the abeyed plant costs. Entergy Gulf States appealed this

ruling to the Third District Court of Appeals. In July 2003,

the Third District Court of Appeals unanimously affirmed the

judgment of the Travis County District Court. After considering

the progress of the proceeding in light of the decisionof the Court

of Appeals, Entergy Gulf States accrued for the loss that would be

associated with a final, non-appealable decision disallowing the

abeyed plant costs. The net carrying value of the abeyed plant costs

was $107.7 million at the time of the Court of Appeals decision.

Accrual of the $107.7 million loss was recorded in the second

quarter of 2003 as miscellaneous other income (deductions) and

reduced net income by $65.6 million after-tax. In September 2004,

the Texas Supreme Court denied Entergy Gulf States’ petition for

review, and Entergy Gulf States filed a motion for rehearing. In

February 2005, the Texas Supreme Court denied the motion for

rehearing, and the proceeding is now final.

Filings with the LPSC

Proposed Settlement

In September 2004, the LPSC consolidated various dockets that

were the subject of settlement discussions between the LPSC staff

and Entergy Gulf States and Entergy Louisiana. The LPSC

directed its staff to continue the settlement discussions and submit

any proposed settlement to the LPSC for its consideration. In

January 2005, Entergy Gulf States and Entergy Louisiana filed

testimony with the LPSC in support of a proposed settlement that

currently includes an offer to refund $76 million to Entergy Gulf

States’ Louisiana customers, with no immediate change in current

base rates and to refund $14 millionto Entergy Louisiana’s

customers. If the LPSC approves the proposed settlement, Entergy

Gulf States willbe regulated under a three-year formula rate plan

that, among other provisions, establishes an ROE mid-point of

10.65% and permits Entergy Gulf States to recover incremental

capacity costs without filing a traditional base rate proceeding. The

settlement resolves all issues in, and will result in the dismissal of,

Entergy Gulf States’ fourth, fifth, sixth, seventh, and eighth annual

earnings reviews, Entergy Gulf States’ ninth post-merger earnings

reviewand revenue requirement analysis, a fuel review for Entergy

Gulf States, dockets established to consider issues concerning

power purchases for both Entergy Gulf States and Entergy

Louisiana for the summers of 2001, 2002, 2003, and 2004, and a

docket concerning retail issues arising under the Entergy

System Agreement. The settlement does not include the System

Agreement case pending at FERC. The LPSC has solicited

comments on the proposed settlement from the parties to the

various proceedings at issue in the proposed settlement. The

proposed settlement is scheduled to be presented to the LPSC for

consideration onMarch 23, 2005.

Annual Earnings Reviews (Entergy Gulf States)

In May 2002, Entergy Gulf States filed its ninth and last required

post-merger analysis with the LPSC. The filing included an

earnings review filing for the 2001 test year that resulted in a rate

decrease of $11.5 million, which was implemented effective June

2002. In its latest testimony, in December 2003, the LPSC staff

recommended a rate refund of $30.6 million and a prospective rate

reductionof approximately $50 million. Hearings concluded in

May 2004. Should the LPSC approve the proposed settlement

discussed above, the ninth post-merger analysis would be resolved.

In December 2002, the LPSC approved a settlement between

Entergy Gulf States and the LPSC staff pursuant to which Entergy

Gulf States agreed to make a base rate refund of $16.3 million,

including interest, and to implement a $22.1 million prospective

base rate reduction effective January 2003. The settlement

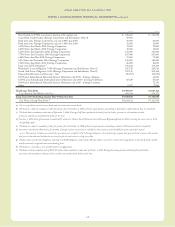

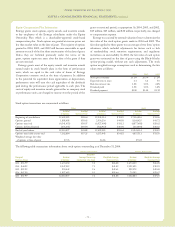

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued