Entergy 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-81 -

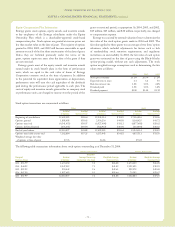

The significant actuarial assumptions used in determining the net

periodic pension and other postretirement benefit costs for 2004,

2003, and 2002 were as follows:

2004 2003 2002

Weighted-average discount rate

Pension 6.25% 6.75% 7.50%

Other postretirement 6.71% 6.75% 7.50%

Weighted-average rate of increase

in future compensation levels 3.25% 3.25% 4.60%

Expected long-term rate of

return on plan assets:

Taxable assets 5.50% 5.50% 5.50%

Non-taxable assets 8.75% 8.75% 9.00%

Entergy’s remaining pension transition assets are being

amortized over the greater of the remaining service period of active

participants or 15 years ending in 2005, and its SFAS 106 transition

obligations arebeing amortized over 20 years ending in 2012.

Voluntary Severance Program

As partof an initiativeto achieveproductivity improvements with a

goal of reducing costs, primarily in the Non-Utility Nuclear and

U.S. Utility businesses, in the second half of 2003 Entergy offered a

voluntary severance program to employees in various departments.

Approximately 1,100 employees, including 650 employees in

nuclear operations from the Non-Utility Nuclear and U.S. Utility

businesses, accepted the offers. As a result of this program, in the

fourth quarter of 2003 Entergy recorded additional pension

and postretirement costs (including amounts capitalized) of

$110.3 millionfor special termination benefits and plan curtailment

charges.These amounts are included in the net pension cost and net

postretirement benefit cost for the year ended December 31, 2003.

Medicare Prescription Drug, Improvement

and Modernization Act of 2003

In December 2003, the President signed the Medicare Prescription

Drug, Improvement and Modernization Act of 2003 into law. The

Act introduces a prescription drug benefit cost under Medicare

(PartD), starting in 2006, as well as federal subsidy to employers

who provide a retiree prescription drug benefit that is at least

actuarially equivalent to Medicare Part D.

AtDecember 2003, specific authoritative guidance on the

accounting for the federal subsidy was pending. As allowed by

Financial Accounting Standards Board Staff Position No. FAS

106-1, Entergyelected to recordan estimate of the effects of the

Act in accounting for its postretirement benefit plans at December

31, 2003, under SFAS 106 and in providing disclosures required by

SFAS No. 132 (revised 2003), Employers’ Disclosures about

Pensions and Other Postretirement Benefits. At December 31,

2003, based on actuarial analysis of prescription drug benefits,

estimated future Medicare subsidies were expected to reduce the

December 31, 2003 Accumulated Postretirement Benefit

Obligation by $56 million. For the year ended December 31, 2003,

the impact of the Act onnet postretirement benefit cost was

immaterial, as it reflected only one month’s impact of the Act.

In 2004, Entergy continued to record an estimate of the effects

of the Act in accounting for its postretirement benefit plans. In

mid-2004, the Financial Accounting Standards Board issued Staff

Position No. FAS 106-2, Accounting and Disclosure Requirements

Related to the Medicare Prescription Drug, Improvement and

Modernization Act of 2003, which was effective for Entergy’s June

30, 2004 interim reporting.

In August 2004, the Centers for Medicare and Medicaid Services

issued proposed regulations to implement the new Medicare law.

Aruling from the Centers for Medicare and Medicaid Services

was issued in late January 2005 with final guidance expected later

this year.

The actuarially estimated effect of future Medicare subsidies

reduced the December 31, 2003 and 2004 Accumulated

Postretirement Benefit Obligation by $128 million and $161

million, respectively, and reduced the 2004 other postretirement

benefit cost by $23.3 million.

Defined Contribution Plans

Entergy sponsors the Savings Plan of Entergy Corporation and

Subsidiaries (System Savings Plan). The System Savings Plan is a

defined contribution plan covering eligible employees of Entergy

and its subsidiaries. Through January31, 2004, the System Savings

Plan provided that the employing Entergy subsidiary:

•make matching contributions to the System Savings Plan in an

amount equal to 75% of the participants’ basic contributions, up

to 6% of their eligible earnings, in shares of Entergy

Corporation common stock if the employees direct their

company-matching contributionto the purchase of Entergy

Corporation’s common stock; or

•make matching contributions in the amount of 50% of the

participants’ basic contributions, up to 6% of their eligible

earnings, if the employees direct their company-matching

contribution to other investment funds.

Effective February 1, 2004, the employing Entergy subsidiary began

making matching contributions for non-bargaining employees to

the System Savings Plan in an amount equal to 70% of the

participants’ basic contributions, up to 6% of their eligible

earnings. The 70% match is allocated to investments as directed

by the employee.

Entergy also sponsors the Savings Plan of Entergy Corporation

and Subsidiaries II (established in 2001), the Savings Plan of

EntergyCorporationand Subsidiaries III (established in 2002), and

the Savings Plan of Entergy Corporation and Subsidiaries V

(established in 2002). The plans are defined contribution plans that

cover eligible employees, as defined by eachplan, of Entergyand its

subsidiaries. The employing Entergy subsidiary makes matching

contributions equal to 50% of the participants’ participating

contributions for each of these plans. Effective September 30, 2004,

employees participating in the Savings Plan of Entergy

Corporation and Subsidiaries III (Savings Plan III) were

transferred into the System Savings Plan and Savings Plan III

was terminated.

Entergy’s subsidiaries’ contributions to defined contribution

plans collectivelywere$32.9 millionin 2004, $31.5 million in 2003,

and $29.6 million in 2002. The majority of the contributions were

to the System Savings Plan.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued