Entergy 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-76 -

Entergy Corporation and Subsidiaries 2004

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

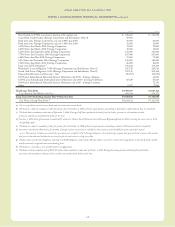

The Energy Policy Act of 1992 contains a provision that

assesses domestic nuclear utilities with fees for the decontamination

and decommissioning (D&D) of the DOE’s past uranium

enrichment operations. Annual assessments in 2004 were

$4.4 million for Entergy Arkansas, $1.1 million for Entergy Gulf

States, $1.6 million for Entergy Louisiana, and $1.8 million for

System Energy. The Energy Policy Act calls for cessation of

annual D&D assessments not later than October 24, 2007. At

December 31, 2004, two years of assessments were remaining.

D&D fees are included in other current liabilities and other

non-current liabilities and, as of December 31, 2004, recorded

liabilities were $8.8 million for Entergy Arkansas, $1.9 million for

Entergy Gulf States, $3.3 million for Entergy Louisiana, and

$3.3 million for System Energy. Regulatory assets in the financial

statements offset these liabilities, with the exception of Entergy

Gulf States’ 30% non-regulated portion. These assessments are

recovered through rates in the same manner as fuel costs.

Income Taxes

Entergy is currently under audit by the Internal Revenue Service

(IRS) with respect to tax returns for tax periods subsequent to 1995

and through 2001, and is subject to audit by the IRSand other

taxing authorities for subsequent tax periods. The amount and

timing of anytax assessments resulting fromthese audits are

uncertain, and could have a material effect on Entergy’s financial

position and results of operations. Entergy believes that the

contingency provisions established in its financial statements will

sufficiently cover the risk associated with tax matters. Certain

material audit matters as to which management believes there is a

reasonable possibility of a future tax assessment are discussed below.

See Note 3 to the consolidated financial statements for additional

discussion of income taxes.

Foreign Tax Credits

In July 1997, the UK government enacted the Windfall Tax, which

was a one-time tax imposed on formerlygovernment-owned

companies in regulated industries. The Windfall Tax applied to

companies that the government had previously privatized in the

telecommunication, airport operation, gas, water, electricity, and

railway industries. London Electricity, the UK public limited

companypurchased and subsequently sold by Entergy, was subject

to the UK Windfall Tax. Entergy fulfilled its obligation with respect

to the tax in 1997 and 1998. In subsequent tax years, Entergy

reported a foreign tax credit for the UK Windfall Tax that London

Electricity paid. Entergy has claimed a net tax benefit of $152 mil-

lion related to this foreign tax credit.

During 2004, the IRS proposed to disallow this foreign tax

credit. Entergy disagreed with the position of the IRS and

protested the disallowance of the credit to the Office of IRS

Appeals. Entergyexpects to receive a Notice of Deficiency in 2005

for this item, and plans to vigorously contest this matter. The

amount at issue including tax and interest as of December 31, 2004

is $195 million. Entergy believes that the contingency provision

established in its financial statements will sufficiently cover the risk

associated with this dispute.

Depreciable Property Lives

During the years 1997 through 2004, Entergy subsidiaries,

Entergy Services, Entergy Arkansas, Entergy Gulf States, Entergy

Louisiana, Entergy Mississippi, Entergy New Orleans, and System

Energy Resources reflected changes in tax depreciation methods

with respect to certain types of depreciable property (e.g. street

lighting, billing meters, and various generation plant equipment).

The cumulative effect of these changes results in additional

depreciation deductions generating a cash flow benefit of

approximately $152 million as of December 31, 2004. The related

IRS interest exposure if the deduction is ultimately disallowed is

$44 million at December 31, 2004. This benefit reverses over time

and will also fluctuate with each year’s addition to those types

of assets. Due to the temporary nature of the tax benefit, the

potential interest charge represents the total net earnings exposure

of Entergy.

For the years under audit, 1996-2001, the IRS challenged

Entergy’s classification of these assets and proposed adjustments to

the depreciation deductions taken. Entergy disagrees with the

position of the IRS and has protested the disallowance of these

deductions to the Office of IRS Appeals. Entergy expects to

receive a Notice of Deficiencyin 2005 for this item, and plans

to vigorously contest this matter. Entergy believes that the

contingency provisionestablished in its financial statements

sufficientlycovers the risk associated with this item.

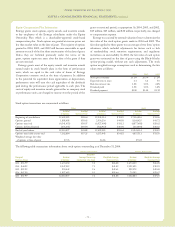

Mark to Market of Certain Power Contracts

In 2001, Entergy Louisiana changed its method of accounting for

tax purposes related to its wholesale electric power contracts. The

most significant of these is the contract to purchase power from the

Vidalia hydroelectric project. The new tax accounting method

has provided a cumulative cash flow benefit of approximately

$790 millionas of December 31, 2004. The related IRS interest

exposureis $93 million at December 31, 2004. This benefit

is expected to reverse in the years 2005 through 2031. The election

did not reduce bookincome tax expense. The timing of

the reversal of this benefit depends on several variables, including

the price of power. Due to the temporary nature of the tax

benefit, the potential interest charge represents Entergy’s net

earnings exposure. Entergy Louisiana’s 2001 tax return is currently

under examinationby the IRS, though no adjustments have yet

been proposed with respect to the mark to market election. Entergy

believes that the contingency provision established in its financial

statements will sufficiently cover the risk associated with this issue.

CashPoint Bankruptcy

In 2003, the domestic utility companies entered an agreement with

CashPoint Network Services (CashPoint) under which CashPoint

was to manage a network of payment agents through which

Entergy’sutility customers could pay their bills. The payment agent

system allows customers to pay their bills at various commercial

or governmental locations, rather than sending payments by

mail. Approximately one-third of Entergy’s utility customers use

payment agents.