Entergy 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-57 -

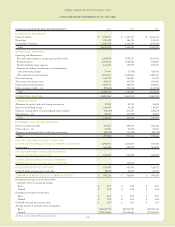

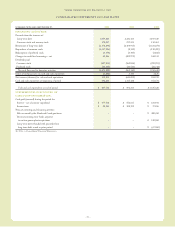

the determination of net income for 2004 and 2003 is less than that

which would have been recognized if the fair value based method

had been applied to all awards since the original effective date of

SFAS 123. The following table illustrates the effect on net income

and earnings per share if Entergy would have historically applied

the fair value based method of accounting to stock-based employee

compensation (in thousands, except per share data):

For the years ended December 31, 2004 2003 2002

Earnings applicable

to common stock $909,524 $926,943 $599,360

Add back: Stock-based compensation

expense included in earnings

applicable to common stock, net

of related tax effects 5,141 2,818 –

Deduct: Total stock-based employee

compensation expense determined

under fair value method for all

awards, net of related tax effects 16,668 24,518 28,110

Pro forma earnings applicable

to common stock $897,997 $905,243 $571,250

Earnings per average common share:

Basic $4.01 $4.09 $2.69

Basic - pro forma $3.96 $3.99 $2.56

Diluted $3.93 $4.01 $2.64

Diluted - pro forma $3.88 $3.92 $2.51

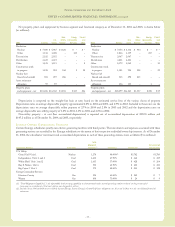

Application of SFAS 71

The domestic utility companies and System Energy currently

account for the effects of regulation pursuant to SFAS 71,

“Accounting for the Effects of Certain Types of Regulation.” This

statement applies to the financial statements of a rate-regulated

enterprise that meets three criteria. The enterprise must have rates

that (i) areapproved by a body empowered to set rates that bind

customers (its regulator); (ii) are cost-based; and (iii) can be charged

to and collected from customers. These criteria may also be applied

to separable portions of a utility’s business, such as the generation or

transmission functions, or to specific classes of customers. If an

enterprise meets these criteria, it capitalizes costs that would

otherwise be charged to expense if the rate actions of its regulator

make it probable that those costs will be recovered in future revenue.

Such capitalized costs are reflected as regulatory assets in the

accompanying financial statements. Asignificant majority of

Entergy’s regulatory assets, net of related regulatory and deferred

tax liabilities, earn a return on investment during their recovery

periods. SFAS 71 requires that rate-regulated enterprises assess the

probability of recovering their regulatory assets at each balance

sheet date. When an enterprise concludes that recovery of a

regulatoryasset is no longer probable, the regulatory asset must be

removed from the entity’s balance sheet.

SFAS 101, “Accounting for the Discontinuation of Application

of Financial Accounting Standards Board (FASB) Statement No.

71,” specifies how an enterprise that ceases to meet the criteria for

application of SFAS 71 for all or part of its operations should report

that event in its financial statements. In general, SFAS 101 requires

that the enterprise report the discontinuation of the application of

SFAS 71 by eliminating from its balance sheet all regulatory assets

and liabilities related to the applicable segment. Additionally, if

it is determined that a regulated enterprise is no longer recovering

all of its costs and therefore no longer qualifies for SFAS 71

accounting, it is possible that an impairment may exist that could

require further write-offs of plant assets.

Emerging Issues Task Force (EITF) 97-4: “Deregulation of the

Pricing of Electricity - Issues Related to the Application of FASB

Statements No. 71 and 101” specifies that SFAS 71 should be

discontinued at a date no later than when the effects of a transition

to competition plan for all or a portion of the entity subject to such

plan arereasonably determinable. Additionally, EITF 97-4

promulgates that regulatory assets to be recovered through cash

flows derived from another portion of the entity that continues to

apply SFAS 71 should not be written off; rather, they should be

considered regulatory assets of the segment that will continue to

apply SFAS 71.

See Note 2 to the consolidated financial statements for discussion

of transition to competition activity in the retail regulatory

jurisdictions served by the domestic utility companies. Only Texas

has a currentlyenacted retail open access law, but Entergybelieves

that significant issues remain to be addressed by regulators, and the

enacted law does not provide sufficient detail to reasonably

determine the impact onEntergy Gulf States’ regulated operations.

Cash and Cash Equivalents

Entergy considers all unrestricted highly liquid debt instruments

with an original or remaining maturityof three months or less at

date of purchase to be cash equivalents. Investments with original

maturities of more than three months are classified as other

temporary investments on the balance sheet.

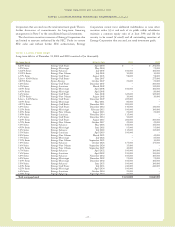

Investments

Entergy applies the provisions of SFAS 115, “Accounting for

Investments for Certain Debt and Equity Securities,” in accounting

for investments in decommissioning trust funds. As a result,

Entergy records the decommissioning trust funds at their fair value

onthe consolidated balance sheet. Because of the ability of the

domestic utility companies and System Energy to recover

decommissioning costs in rates and in accordance with the

regulatory treatment for decommissioning trust funds, the domestic

utilitycompanies and System Energyhaverecorded an offsetting

amount of unrealized gains/(losses) oninvestment securities in

other regulatoryliabilities/assets. For the nonregulated portion of

River Bend, Entergy Gulf States has recorded an offsetting

amount of unrealized gains/(losses) in other deferred credits.

Decommissioning trust funds for Pilgrim, Indian Point 2, and

Vermont Yankee do not receive regulatory treatment. Accordingly,

unrealized gains and losses recorded on the assets in these trust

funds are recognized in the accumulated other comprehensive

income component of shareholders’ equity because these assets are

classified as available for sale. See Note 15 to the consolidated

financial statements for details onthe decommissioning trust funds.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued