Entergy 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-75 -

accounting change. In accordance with ratemaking treatment and as

required by SFAS 71, the depreciation provisions for the domestic

utility companies and System Energy include a component for

removal costs that are not asset retirement obligations under SFAS

143. In accordance with regulatory accounting principles, Entergy

has recorded a regulatory asset for certain of its domestic utility

companies and System Energy of $86.9 million as of December 31,

2004 and $72.4 million as of December 31, 2003 to reflect an

estimate of incurred but uncollected removal costs previously

recorded as a component of accumulated depreciation. The

decommissioning and retirement cost liability for certain of the

domestic utility companies and System Energy includes a

regulatory liability of $34.6 million as of December 31, 2004 and

$26.8 million as of December 31, 2003 representing an estimate of

collected but not yet incurred removal costs. For the Non-Utility

Nuclear business, the implementation of SFAS 143 resulted in a

decrease in liabilities of $595 million due to reductions in

decommissioning liabilities, a decrease in assets of $340 million,

including a decrease in electric plant in service of $315 million, and

an increase in earnings in 2003 of $155 millionnet-of-tax as a result

of a one-time cumulative effect of accounting change.

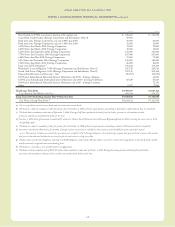

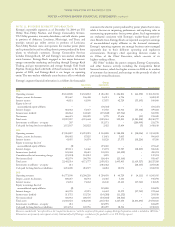

The cumulative decommissioning liabilities and expenses

recorded in 2004 by Entergywereas follows (in millions):

Liabilities Change in Liabilities

as of Cash Flow as of

Dec. 31, 2003 Accretion Estimate Spending Dec. 31, 2004

U. S. Utility $1,504.1 $98.0 $(274.1) – $1,328.0

Non-Utility Nuclear $ 710.4 $57.6 $ (20.3) $(9.4) $ 738.3

In addition, an insignificant amount of removal costs associated

with non-nuclear power plants are also included in the

decommissioning line item on the balance sheet. Entergy

periodically reviews and updates estimated decommissioning costs.

The actual decommissioning costs may vary from the estimates

because of regulatory requirements, changes in technology, and

increased costs of labor, materials, and equipment. During 2004,

Entergyupdated decommissioning cost studies for ANO 1 and 2

and River Bend.

In the first quarter of 2004, Entergy Arkansas recorded a revision

to its estimated decommissioning cost liability in accordance with a

newdecommissioning cost study for ANO 1 and 2 as a result of

revised decommissioning costs and changes in assumptions

regarding the timing of when the decommissioning of the plants

willbegin. The revised estimate resulted in a $107.7 million

reductionin its decommissioning liability, along with a

$19.5 million reductionin utilityplant and an $88.2 million

reduction in the related regulatory asset.

In the thirdquarter of 2004, EntergyGulf States recorded a

revisionto its estimated decommissioning cost liabilityin

accordance with a new decommissioning cost study for River Bend

that reflected an expected lifeextensionfor the plant. The revised

estimate resulted in a $166.4 million reductionin decommissioning

liability, along with a $31.3 million reduction in utility plant, a

$49.6 million reduction in non-utility property, a $40.1 million

reduction in the related regulatory asset, and a regulatory liability of

$17.7 million. For the portion of River Bend not subject to

cost-based ratemaking, the revised estimate resulted in the

elimination of the asset retirement cost that had been recorded

at the time of adoption of SFAS 143 with the remainder recorded

as miscellaneous income of $27.7 million.

In the third quarter of 2004, Entergy’s Non-Utility Nuclear

business recorded a reduction of $20.3 million in decommissioning

liability to reflect changes in assumptions regarding the timing of

when decommissioning of a plant will begin. Entergy considered

the assumptions as part of recent studies evaluating the economic

effect of the plant in its region. The revised estimate resulted in

miscellaneous income of $20.3 million, reflecting the excess of the

reduction in the liability over the amount of undepreciated asset

retirement cost recorded at the time of adoption of SFAS 143.

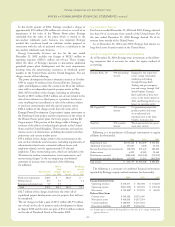

If Entergy had applied SFAS 143 during prior periods, the

following impacts would have resulted:

For the year ended December 31, 2002

Earnings applicable to common stock - as reported $599,360

Proforma effect of SFAS 143 $ 14,119

Earnings applicable to common stock - pro forma $613,479

Basic earnings per average common share - as reported $2.69

Pro forma effect of SFAS 143 $0.06

Basic earnings per average common share - pro forma $2.75

Diluted earnings per average common share - as reported $2.64

Pro forma effect of SFAS 143 $0.06

Diluted earnings per average common share - pro forma $2.70

For the Indian Point 3 and FitzPatrick plants purchased

in 2000, NYPA retained the decommissioning trusts and

the decommissioning liability. NYPA and Entergy executed

decommissioning agreements, which specify their decommissioning

obligations. NYPA has the right to require Entergy to assume

the decommissioning liability provided that it assigns the

corresponding decommissioning trust, up to a specified level,

to Entergy. If the decommissioning liability is retained by NYPA,

Entergywillperform the decommissioning of the plants at a price

equal to the lesser of a pre-specified level or the amount in the

decommissioning trusts. Entergy believes that the amounts

available to it under either scenario aresufficient to cover the

futuredecommissioning costs without any additional contributions

to the trusts.

Entergymaintains decommissioning trust funds that are

committed to meeting the costs of decommissioning the nuclear

power plants. The fair values of the decommissioning trust funds

and asset retirement obligation-related regulatoryassets of Entergy

as of December 31, 2004 are as follows (in millions):

Regulatory

Decommissioning Trust Asset

U. S. Utility $1,052.0 $380.1

Non-Utility Nuclear $1,401.6 $–

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued