Entergy 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

of operations. Following are Entergy’s payment obligations as of

December 31, 2004 on non-cancelable operating leases with a term

over one year (in millions):

2008- After

2005 2006 2007 2009 2009

Operating lease payments $99 $86 $69 $100 $210

The operating leases are discussed more thoroughly in Note 9 to the

consolidated financial statements.

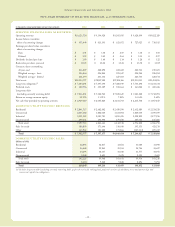

Summary of Contractual Obligations

of Consolidated Entities (in millions)

2006- 2008- After

Contractual Obligations 2005 2007 2009 2009 Total

Long-term debt(1) $496 $ 331 $1,328 $5,354 $7,509

Capital lease payments(2) $136 $ 146 $ 2 $ 3 $ 287

Operating leases(2) $ 99 $ 155 $ 100 $ 210 $ 564

Purchase obligations(3) $1,160 $1,402 $ 962 $1,156 $4,680

(1) Long-term debt is discussed in Note 5 to the consolidated financial

statements.

(2) Capital lease payments include nuclear fuel leases. Lease obligations are

discussed in Note 9 to the consolidated financial statements.

(3) Purchase obligations represent the minimum purchase obligation or cancellation

charge for contractual obligations to purchase goods or services. Approximately

99% of the total pertains to fueland purchased power obligations that are

recovered in the normal course of business through various fuel cost recovery

mechanisms in the U.S. Utilitybusiness.

In additionto these contractual obligations, Entergyexpects to con-

tribute $185.9 millionto its pension plans and $63.3 million

to other postretirement plans in 2005.

Capital Funds Agreement

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with sufficient

capital to:

•maintain System Energy’s equity capital at a minimum of 35%

of its total capitalization (excluding short-term debt);

•permit the continued commercial operation of Grand Gulf;

•pay in full all System Energy indebtedness for borrowed money

when due; and

•enable System Energy to make payments on specific System

Energydebt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

Capital Expenditure Plans and Other Uses of Capital

Following are the amounts of Entergy’s planned construction

and other capital investments by operating segment for 2005

through 2007 (in millions):

Planned construction

and capital investments 2005 2006 2007

Maintenance Capital:

U.S. Utility $ 734 $ 699 $ 763

Non-Utility Nuclear 72 72 60

Energy Commodity Services 3 4 6

Parent and Other 11 19 11

820 794 840

Capital Commitments:

U.S. Utility 571 349 201

Non-Utility Nuclear 90 67 43

Energy Commodity Services – – –

Parent and Other – – –

661 416 244

Total $1,481 $1,210 $1,084

Maintenance Capital refers to amounts Entergy plans to spend

on routine capital projects that are necessary to support reliability

of its service, equipment, or systems and to support normal

customer growth.

Capital Commitments refers to non-routine capital investments

for which Entergy is either contractually obligated, has

Board-approval, or is otherwise required to make pursuant to a

regulatoryagreement or existing rule or law. Amounts reflected in

this category include the following:

•Replacement of the Arkansas Nuclear One Unit 1 (ANO 1)

steam generators and reactor vessel closure head. Management

estimates the cost of the ANO 1 project to be approximately

$235 million, of whichapproximately $96 million has been

incurred through 2004. $115 million is expected to be incurred

in 2005, with the remainder expected to be spent in 2006.

Entergy expects the replacement to occur during a planned

refueling outage in 2005. Entergy Arkansas filed with the

APSC in January2003 a request for a declaratory order that the

investment in the replacement is in the public interest. The

APSC issued the requested order in May 2003. This order is

analogous to the order received in 1998 prior to the

replacement of the Arkansas Nuclear One Unit 2 (ANO 2)

steam generators.

•Purchase of the Perryville power plant in Louisiana. In January

2004, Entergy Louisiana signed a definitive agreement to

acquire the 718 MW Perryville power plant for $170

million.The agreement has subsequently been amended to allow

the current plant owner to retain the interconnection facilities

associated with the plant, resulting in a decrease in the

acquisition price to $162 million. As a result of the amended

terms, the Federal Energy Regulatory Commission (FERC)

issued an order in October 2004 disclaiming jurisdiction over

the acquisition. This order currently is subject to rehearing by

FERC. The plant is owned by a subsidiary of Cleco

Corporation, which subsidiary submitted a bid in response to

Entergy’s Fall 2002 request for proposals for supply-side

-29 -

“Assuming regulatoryapproval by the

LPSC, Entergy Louisiana expects to

close its acquisition of the 718 MW

Perryville power plant in mid-2005.”

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued