Entergy 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-66 -

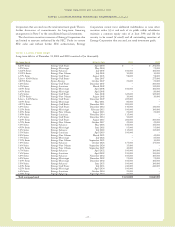

Entergy Corporation and Subsidiaries 2004

At December 31, 2004, Entergy had $342.4 million in net

realized federal capital loss carryforwards that will expire as follows:

$103.8 million in 2007, $10.6 million in 2008, and $228.0 million

in 2009.

At December 31, 2004, Entergy had federal net operating

loss carryforwards of $2.9 billion. If the federal net operating loss

carryforwards are not utilized, they will expire in the years 2023

through 2024.

At December 31, 2004, Entergy had state net operating loss

carryforwards of $3.5 billion, primarily resulting from Entergy

Louisiana’s mark-to-market tax election and the change in method

of accounting for tax purposes related to cost of goods sold, as

discussed above. If the state net operating loss carryforwards are not

utilized, they will expire in the years 2008 through 2019.

The 2004 and 2003 valuation allowances are provided against

UK capital loss and UK net operating loss carryforwards, and

certain state net operating loss carryforwards. The UK losses can be

utilized against future UK taxable income. For UK tax purposes,

these carryforwards do not expire.

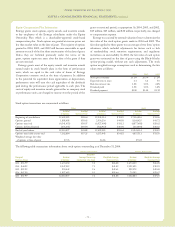

On October 22, 2004, the American Jobs Creation Act of 2004

(the Act) was enacted. The Act promotes domestic production

and investing activities by providing a number of tax incentives,

including a temporary incentive to repatriate accumulated

foreign earnings, subject to certain limitations, by providing an

85% dividends received deduction for certain repatriated earnings

and also providing a tax deduction of up to 9% of qualifying

production activities. In 2004, Entergy repatriated $64 million of

accumulated foreign earnings, which resulted in approximately

$16.1 million of tax benefit. At December 31, 2004, Entergy has

approximately $7.4 million of undistributed earnings from

subsidiary companies outside the United States that are being

considered for repatriation. If these earnings are repatriated in

accordance with the Act, the repatriation would result in

approximately $1.5 million of income tax expense. In accordance

with FSP 109-1, whichwas issued by the FASB to address the

accounting for the impacts of the Act, the allowable production tax

credit will be treated as a special deduction in the period in which it

is deducted rather than treated as a tax rate change during 2004

which is the period in which the Act was signed into law. The

adoption of FSP 109-1 and FSP 109-2, also issued by the FASB to

address the accounting for the repatriation provisions of the Act, did

not have a material effect on Entergy's financial statements.

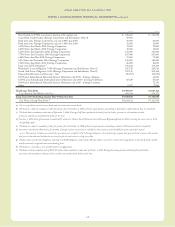

NOTE 4. LINES OF CREDIT AND

SHORT-TERM BORROWINGS

Entergy Corporation has in place two separate credit facilities, a

5-year credit facility and a 3-year credit facility. The 5-year credit

facility, which expires in December 2009, has a borrowing capacity

of $500 million, none of which was outstanding at December 31,

2004. The 3-year credit facility, which expires in May 2007, has a

borrowing capacity of $965 million, of which $50 million was

outstanding at December 31, 2004. Entergy also has the ability to

issue letters of credit against the total borrowing capacity of both

credit facilities, and $50 million had been issued against this 3-year

facility at December 31, 2004. The commitment fee for these

facilities is currently 0.13% of the line amount. Commitment fees

and interest rates on loans under the credit facility can fluctuate

depending on the senior debt ratings of the domestic

utility companies.

Entergy Corporation’s facilities require it to maintain a

consolidated debt ratio of 65% or less of its total capitalization, and

maintain an interest coverage ratio of 2 to 1. If Entergy fails to meet

these limits, or if Entergy or the domestic utility companies default

on other indebtedness or are in bankruptcy or insolvency

proceedings, an acceleration of the facility’s maturity date

mayoccur.

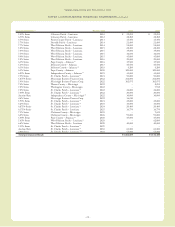

Entergy Arkansas, Entergy Louisiana, Entergy Mississippi, and

Entergy New Orleans each have 364-day credit facilities available

as follows (in millions):

Amount Drawn as

Company Expiration Date Amount of Facility of Dec. 31, 2004

EntergyArkansas April 2005 $85 –

EntergyLouisiana April 2005 $15(a) –

Entergy Mississippi May 2005 $25 –

Entergy NewOrleans April 2005 $14(a) –

(a) The combined amount borrowed by Entergy Louisiana and Entergy New Orleans

under these facilities at any one time cannot exceed $15 million.

The 364-day credit facilities have variable interest rates and the

average commitment fee is 0.13%. The Entergy Arkansas facility

requires it to maintain total shareholder’s equity of at least 25% of

its total assets.

The short-term borrowings of Entergy’s subsidiaries are limited

to amounts authorized by the SEC. The current limits authorized

are effective through November 30, 2007. In addition to borrowing

from commercial banks, Entergy’s subsidiaries are authorized under

the SEC order to borrow from Entergy’s money pool. The money

pool is an inter-companyborrowing arrangement designed to

reduce Entergy’s subsidiaries’ dependence on external short-term

borrowings. Borrowings from the money pool and external

borrowings combined may not exceed the SEC authorized limits.

As of December 31, 2004, Entergy’s subsidiaries’ aggregate

authorized limit was $1.6 billion and the aggregate outstanding

borrowing from the money pool was $151.6 million. There were no

borrowings outstanding from external sources. Under the SEC

order and without further SEC authorization, the domestic utility

companies and System Energy cannot issue new short-term

indebtedness unless (a) Entergy and the borrower each maintain

common equity of at least 30% of its capital and, (b) with the

exception of money pool borrowings, the debt security to be issued

(if rated) and alloutstanding securities of the issuer and Entergy

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued