Entergy 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-67 -

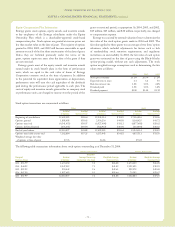

Corporation that are rated must be rated investment grade. There is

further discussion of commitments for long-term financing

arrangements in Note 5 to the consolidated financial statements.

The short-term securities issuances of Entergy Corporation also

are limited to amounts authorized by the SEC. Under its current

SEC order and without further SEC authorization, Entergy

Corporation cannot incur additional indebtedness or issue other

securities unless (a) it and each of its public utility subsidiaries

maintain a common equity ratio of at least 30% and (b) the

security to be issued (if rated) and all outstanding securities of

Entergy Corporation that are rated, are rated investment grade.

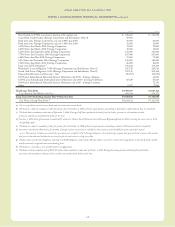

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

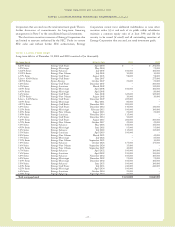

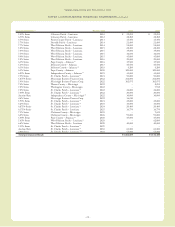

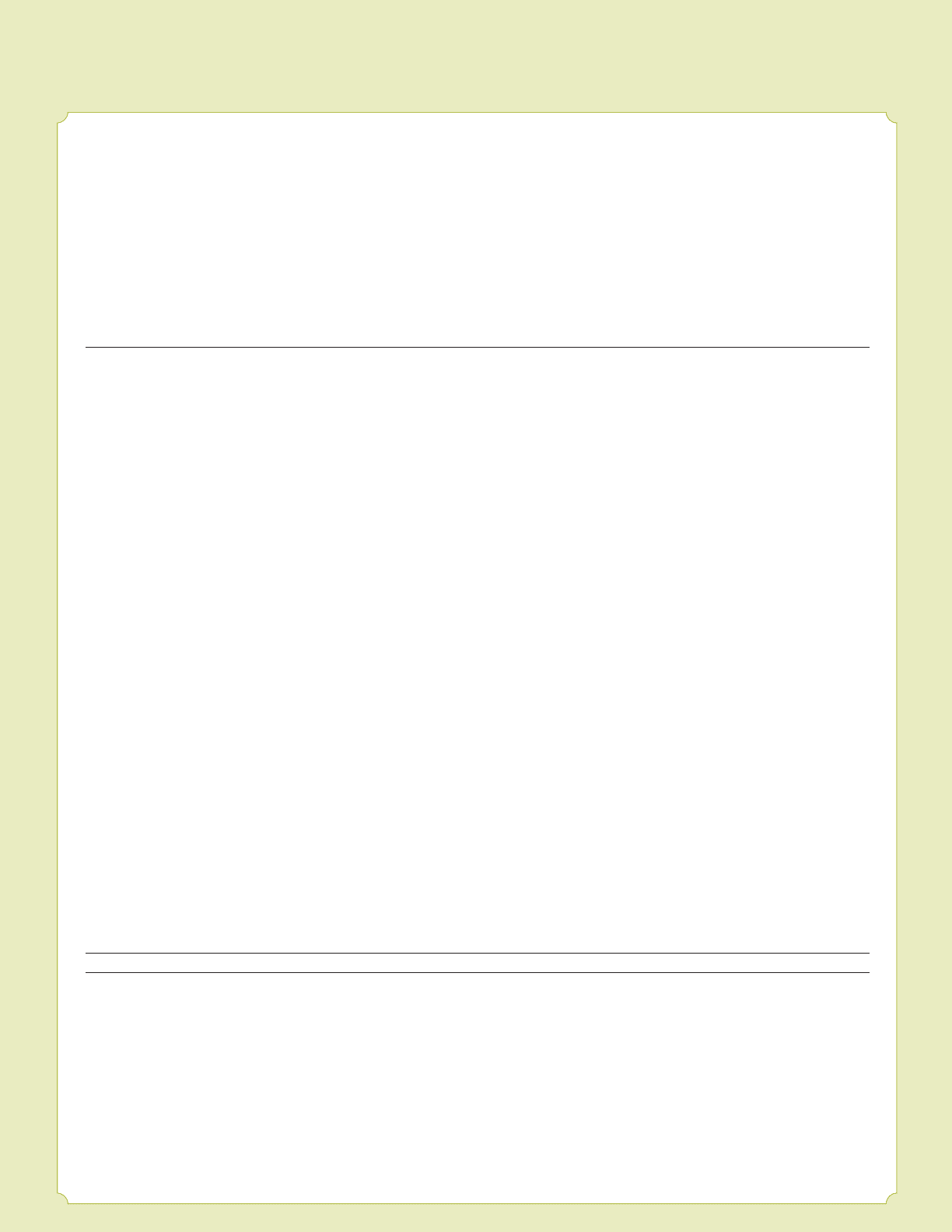

NOTE 5. LONG-TERM DEBT

Long-term debt as of December 31, 2004 and 2003 consisted of (in thousands):

Mortgage Bonds: Maturity Date 2004 2003

8.25% Series Entergy Gulf States April 2004 $ – $ 292,000

6.2% Series Entergy Mississippi May 2004 – 75,000

6.125% Series Entergy Arkansas July 2005 100,000 100,000

8.125% Series Entergy New Orleans July 2005 30,000 30,000

6.77% Series Entergy Gulf States August 2005 98,000 98,000

Libor + 0.90% Series Entergy Gulf States June 2007 – 275,000

4.875% Series System Energy October 2007 70,000 70,000

5.2% Series Entergy Gulf States December 2007 – 200,000

6.5% Series Entergy Louisiana March 2008 – 115,000

4.35% Series Entergy Mississippi April 2008 100,000 100,000

6.45% Series Entergy Mississippi April 2008 – 80,000

3.6% Series Entergy Gulf States June 2008 325,000 325,000

3.875% Series Entergy New Orleans August 2008 30,000 30,000

Libor + 0.40% Series Entergy Gulf States December 2009 225,000 –

4.65% Series EntergyMississippi May2011 80,000 –

4.875% Series Entergy Gulf States November 2011 200,000 –

6.0% Series Entergy Gulf States December 2012 140,000 140,000

5.15% Series EntergyMississippi February2013 100,000 100,000

5.25% Series Entergy NewOrleans August 2013 70,000 70,000

5.09% Series Entergy Louisiana November 2014 115,000 –

5.6% Series Entergy Gulf States December 2014 50,000 –

5.25% Series Entergy Gulf States August 2015 200,000 200,000

6.75% Series Entergy NewOrleans October 2017 25,000 25,000

5.4% Series EntergyArkansas May2018 150,000 150,000

4.95% Series EntergyMississippi June 2018 95,000 95,000

5.0% Series EntergyArkansas July2018 115,000 115,000

5.5% Series Entergy Louisiana April 2019 100,000 –

8.0% Series Entergy New Orleans March 2023 – 45,000

7.7% Series Entergy Mississippi July 2023 – 60,000

7.55% Series Entergy New Orleans September 2023 – 30,000

7.0% Series Entergy Arkansas October 2023 175,000 175,000

5.6% Series Entergy New Orleans September 2024 35,000 –

5.65% Series Entergy New Orleans September 2029 40,000 –

6.7% Series Entergy Arkansas April 2032 100,000 100,000

7.6% Series Entergy Louisiana April 2032 150,000 150,000

6.0% Series Entergy Arkansas November 2032 100,000 100,000

6.0% Series Entergy Mississippi November 2032 75,000 75,000

7.25% Series Entergy Mississippi December 2032 100,000 100,000

5.9% Series Entergy Arkansas June 2033 100,000 100,000

6.20% Series Entergy Gulf States July 2033 240,000 240,000

6.25% Series Entergy Mississippi April 2034 100,000 –

6.4% Series Entergy Louisiana October 2034 70,000 –

6.38% Series Entergy Arkansas November 2034 60,000 –

Total mortgage bonds $3,763,000 $3,860,000