Entergy 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-69 -

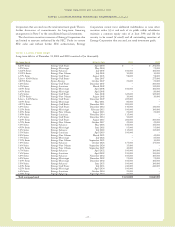

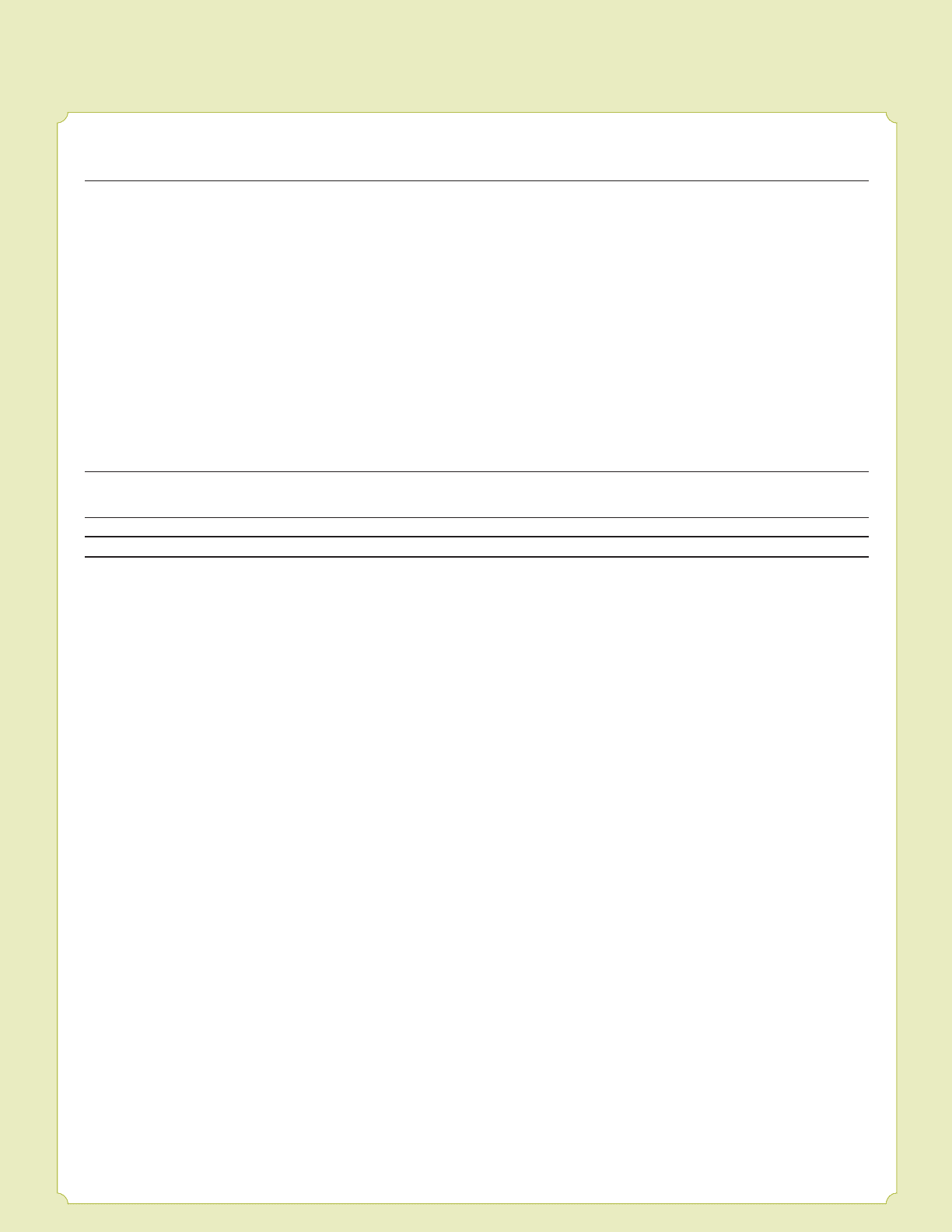

Other Long-Term Debt: 2004 2003

Note Payable to NYPA, non-interest bearing, 4.8% implicit rate $ 445,605 $ 514,708

3year Bank Credit Facility (Entergy Corporation and Subsidiaries, Note 4) 50,000 –

Bank term loan, Entergy Corporation, avg rate 2.98%, due 2005 60,000 60,000

Bank term loan, Entergy Corporation, avg rate 3.08%, due 2008 35,000 35,000

6.17% Notes due March 2008, Entergy Corporation 72,000 72,000

6.23% Notes due March 2008, Entergy Corporation 15,000 15,000

6.13% Notes due September 2008, Entergy Corporation 150,000 150,000

7.75% Notes due December 2009, Entergy Corporation 267,000 267,000

6.58% Notes due May 2010, Entergy Corporation 75,000 75,000

6.9% Notes due November 2010, Entergy Corporation 140,000 140,000

7.06% Notes due March 2011, Entergy Corporation 86,000 86,000

Long-term DOE Obligation (f ) 156,332 154,409

Waterford 3 Lease Obligation 7.45% (Entergy Corporation and Subsidiaries, Note 9) 247,725 262,534

Grand Gulf Lease Obligation 5.01% (Entergy Corporation and Subsidiaries, Note 9) 397,119 403,468

Unamortized Premium and Discount – Net (10,277) (11,853)

8.5% Junior Subordinated Deferrable Interest Debentures due 2045 – Entergy Arkansas – 61,856

8.75% Junior Subordinated Deferrable Interest Debentures due 2046 – Entergy Gulf States 87,629 87,629

9.0% Junior Subordinated Deferrable Interest Debentures due 2045 – Entergy Louisiana – 72,165

Other 9,457 9,966

Total Long-Term Debt $7,509,395 $7,847,312

Less Amount Due Within One Year 492,564 524,372

Long-TermDebt Excluding Amount Due Within One Year $7,016,831 $7,322,940

Fair Value of Long-Term Debt (g) $6,614,211 $7,123,706

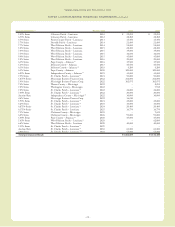

(a) Consists of pollution control revenue bonds and environmental revenue bonds.

(b) The bonds aresubject to mandatorytender for purchase from the holders at 100% of the principal amount outstanding on September 1, 2005 and can then be remarketed.

(c) The bonds had a mandatory tender date of September 1, 2004. Entergy Gulf States purchased the bonds from the holders, pursuant to the mandatory tender

provision, and has not remarketed the bonds at this time.

(d) On June 1, 2002, Entergy Louisiana remarketed $55 million St. Charles Parish Pollution Control Revenue Refunding Bonds due 2030, resetting the interest rate to 4.9%

through May 2005.

(e) The bonds are subject to mandatory tender for purchase from the holders at 100% of the principal amount outstanding on June 1, 2005 and can then be remarketed.

(f ) Pursuant to the Nuclear Waste Policy Act of 1982, Entergy’snuclear owner/licensee subsidiaries havecontracts with the DOE for spent nuclear fuel disposal

service. The contracts include a one-time fee for generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric power with nuclear

fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term debt.

(g) The fair value excludes lease obligations and long-term DOE obligations, and includes debt due within one year. It is determined using bid prices reported by dealer markets

and by nationally recognized investment banking firms.

(h) The bonds are secured by a series of collateral first mortgage bonds.

(i) The bonds in the principal amount of $110.95 million had a mandatory tender date of October 1, 2003. Entergy Louisiana purchased the bonds from the holders,

pursuant to the mandatorytender provision, and has not remarketed the bonds at this time.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued