Entergy 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

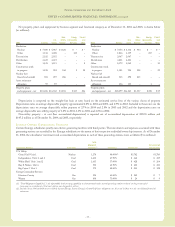

the market-related value of assets recognizes investment gains or

losses over a twenty-quarter period, the future value of assets will be

impacted as previously deferred gains or losses are recognized. As a

result, the losses that the pension plan assets experienced in 2002

may have an adverse impact on pension cost in future years

depending on whether the actuarial losses at each measurement date

exceed the 10% corridor in accordance with SFAS 87.

Costs and Funding

In 2004, Entergy’s total pension cost was $98 million. Entergy

anticipates 2005 pension cost to increase to $117 million due to

decreases in the discount rate (from 6.25% to 6.00%) and the

expected rate of return (from 8.75% to 8.5%) used to calculate

benefit obligations. Pension funding was $73 million for 2004 and

in 2005 is projected to be $186 million. The rise in pension

funding requirements is due to declining interest rates and the

phased-in effect of asset underperformance from 2000 to 2002,

offset by the Pension Funding Equity Act relief passed in

April 2004.

Entergy’s accumulated benefit obligation at December 31, 2004,

2003, and 2002 exceeded plan assets. As a result, Entergy was

required to recognizean additional minimum pension liability

as prescribed by SFAS 87. At December 31, 2004, Entergy

increased its additional minimum pension liability to

$244 million ($218 million net of related pension assets)

from $180 million ($149 million net of related pension assets) at

December 31, 2003. Other comprehensive income decreased to

$6.6 million at December 31, 2004 from $9.3 million at December

31, 2003, after reductions for the unrecognized prior service cost,

amounts recoverable in rates, and taxes. Net income for 2004, 2003,

and 2002 was not affected.

Total postretirement health care and life insurance benefit costs

for Entergy in 2004 were $86 million, including $23 million in

savings due to the estimated effect of future Medicare Part D

subsidies. Entergy expects 2005 postretirement health care and life

insurance benefit costs to approximate $96 million, including a

projected $27 million in savings due to the estimated effect of future

Medicare Part D subsidies. The increase in postretirement health

careand lifeinsurance benefit costs is due to the decrease in the

discount rate (from 6.25% to 6.00%) and an increase in the health

care cost trend rate used to calculate benefit obligations.

Other Contingencies

Entergy, as a company with multi-state domestic utility operations,

and which also had investments in international projects, is subject

to a number of federal, state, and international laws and regulations

and other factors and conditions in the areas in which it operates,

whichpotentiallysubject it to environmental, litigation, and other

risks. Entergy periodically evaluates its exposure for such risks

and records a reserve for those matters which are considered

probable and estimable in accordance with generally accepted

accounting principles.

Environmental

Entergy must comply with environmental laws and regulations

applicable to the handling and disposal of hazardous waste. Under

these various laws and regulations, Entergy could incur substantial

costs to restore properties consistent with the various standards.

Entergy conducts studies to determine the extent of any required

remediation and has recorded reserves based upon its evaluation of

the likelihood of loss and expected dollar amount for each issue.

Additional sites could be identified which require environmental

remediation for which Entergy could be liable. The amounts of

environmental reserves recorded can be significantly affected by the

following external events or conditions:

•Changes to existing state or federal regulation by governmental

authorities having jurisdiction over air quality, water quality,

control of toxic substances and hazardous and solid wastes, and

other environmental matters.

•The identification of additional sites or the filing of other

complaints in which Entergy may be asserted to be a potentially

responsible party.

•The resolutionor progressionof existing matters through the

courtsystem or resolutionby the United States Environmental

Protection Agency (EPA).

Litigation

Entergy has been named as defendant in a number of lawsuits

involving employment, ratepayer, and injuries and damages issues,

among other matters. Entergyperiodically reviews the cases in

which it has been named as defendant and assesses the likelihood of

loss in each case as probable, reasonably estimable, or remote and

records reserves for cases which have a probable likelihood of loss

and can be estimated. Notes 2 and 8 to the consolidated financial

statements include moredetail on ratepayer and other lawsuits and

management’s assessment of the adequacy of reserves recorded for

these matters. Given the environment in which Entergy operates,

and the unpredictable nature of many of the cases in which Entergy

is named as a defendant, however, the ultimate outcome of the

litigation Entergy is exposed to has the potential to materially

affect the results of operations of Entergy, or its operating

company subsidiaries.

Sales Warranty and Tax Reserves

Entergy’s operations, including acquisitions and divestitures, require

Entergy to evaluate risks such as the potential tax effects of a trans-

action, or warranties made in connection with such a transaction.

Entergy believes that it has adequately assessed and provided for

these types of risks, where applicable. Any reserves recorded for

these types of issues, however, could be significantly affected by

events such as claims made by third parties under warranties,

additional transactions contemplated by Entergy, or completion of

reviews of the tax treatment of certain transactions or issues by

taxing authorities. Tax reserves not expected to reverse within the

next year are reflected as non-current taxes accrued in the

consolidated financial statements. Entergydoes not expect a

material adverse effect on earnings from these matters.

-45 -

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS concluded