Entergy 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-83 -

In the fourth quarter of 2004, Entergy recorded a charge of

approximately $55 million ($36 million net-of-tax) as a result of an

impairment of the value of the Warren Power plant. Entergy

concluded that the value of the plant, which is owned in the

non-nuclear wholesale assets business, was impaired. Entergy

reached this conclusion based on valuation studies prepared in

connection with the sale of preferred stock in a subsidiary in the

non-nuclear wholesale assets business.

Energy Commodity Services’ net loss for the year ended

December 31, 2002 includes net charges of $428.5 million to

operating expenses ($238.3 million net-of-tax). These charges

reflect the effect of Entergy’s decision to discontinue additional

greenfield power plant development and the asset impairments

resulting from the deteriorating economics of wholesale power

markets in the United States and the United Kingdom. The net

charges consist of the following:

•The power development business obtained contracts in October

1999 to acquire 36 turbines from General Electric. Entergy’s

rights and obligations under the contracts for 22 of the turbines

were sold to an independent special-purpose entity in May

2001. $178.0 million of the charges, including an offsetting

benefit of $28.5 million($18.5 millionnet-of-tax) related to the

sale of four turbines to a third party, is a provision for the net

costs resulting from cancellation or sale of the turbines subject

to purchase commitments with the special-purpose entity.

•$204.4 million of the charges result from the write-off of

Entergy Power Development Corporation’s equity investment in

the Damhead Creek project and the impairment of the values of

the Warren Power power plant, the Crete project, and the RS

Cogen project. This portion of the charges reflects Entergy’s

estimate of the effects of reduced sparkspreads in the United

States and the United Kingdom. These estimates are based on

various sources of information, including discounted cash flow

projections and current market prices.

•$39.1 million of the charges relate to the restructuring of the

non-nuclear wholesale assets business, including impairments of

administrative fixed assets, estimated sublease losses, and

employee-related costs for approximately 135 affected

employees. These restructuring costs, which are included in the

“Provision for turbine commitments, asset impairments, and

restructuring charges” in the accompanying consolidated

statement of income, were comprised of the following

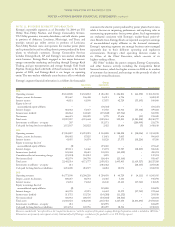

(in millions): Paid in Remaining

Cash Accrual

Restructuring through Non-Cash as of

Costs Dec. 2004 Portion Dec. 31, 2004

Fixed asset impairments $22.5 $ – $22.5 $ –

Sublease losses 10.7 5.6 – 5.1

Severance and related costs 5.9 5.9 – –

Total $39.1 $11.5 $22.5 $5.1

•$32.7 million of the charges result from the write-off of

capitalized project development costs for projects that will not

be completed.

•The net charges include a gain of $25.7 million ($15.9 million

net-of-tax) on the sale of projects under development in Spain

in August 2002 and the after-tax gain of $31.4 million realized

on the sale of Damhead Creek in December 2002.

Geographic Areas

For the years ended December 31, 2004 and 2003, Entergy derived

less than 1% of its revenue from outside of the United States. For

the year ended December 31, 2002 Entergy derived 3% of its

revenue from outside of the United States.

As of December 31, 2004 and 2003, Entergy had almost no

long-lived assets located outside of the United States.

NOTE 12. EQUITY METHOD INVESTMENTS

As of December 31, 2004, Entergy owns investments in the follow-

ing companies that it accounts for under the equity method of

accounting:

Company Ownership Description

Entergy-Koch, LP 50% partnership Engaged in two major busi-

interest nesses: energy commodity

marketing and trading

through Entergy-Koch

Trading, and gas transporta-

tionand storage through Gulf

South Pipeline. Entergy-

Kochsold both of these busi-

nesses in the fourth quarter of

2004, and Entergy-Koch is no

longer an operating entity.

RSCogen LLC 50% member Co-generation project that

interest produces power and steam

onan industrial and

merchant basis in the Lake

Charles, Louisiana area.

Top Deer 50% member Wind-powered electric gener-

interest ation joint venture.

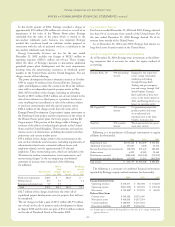

Following is a reconciliationof Entergy’sinvestments in equity

affiliates (in thousands):

2004 2003 2002

Beginning of year $1,053,328 $ 824,209 $ 766,103

Additional investments 157,020 4,668 36,372

Income (loss) from the investments (78,727) 271,647 183,878

Other income 6,232 45,583 21,462

Distributions received (888,260) (105,142) (73,902)

Dispositions and other adjustments (17,814) 12,363 (109,704)

End of year $ 231,779 $1,053,328 $ 824,209

The following is a summaryof combined financial information

reported by Entergy’s equity method investees (in thousands):

2004 2003 2002

Income Statement Items

Operating revenues $ 270,177 $ 585,404 $ 551,853

Operating income $(111,535) $ 207,301 $ 159,342

Net income $ 739,858(1) $ 172,595 $ 68,095

Balance Sheet Items

Current assets $ 540,386 $2,576,630

Noncurrent assets $ 418,038 $1,675,334

Current liabilities $ 180,009 $1,757,663

Noncurrent liabilities $ 463,899 $1,166,540

(1) Includes gains recorded by Entergy-Koch on the sales of its energy trading and

pipeline businesses.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued