Entergy 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-61 -

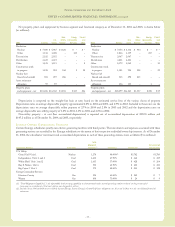

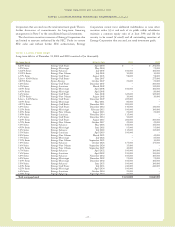

fuel mechanisms of the domestic utility companies, subject to

subsequent regulatory review (in millions):

2004 2003

Entergy Arkansas $ 7.4 $ 10.6

Entergy Gulf States $ 90.1 $118.4

Entergy Louisiana $ 8.7 $ 30.6

Entergy Mississippi $(22.8) $ 89.1

Entergy New Orleans $ 2.6 $ (2.7)

Entergy Arkansas

Entergy Arkansas’ rate schedules include an energy cost recovery

rider to recover fuel and purchased energy costs in monthly bills.

The rider utilizes prior calendar year energy costs and projected

energy sales for the twelve-month period commencing on April 1

of each year to develop an annual energy cost rate. The energy cost

rate includes a true-up adjustment reflecting the over-recovery or

under-recovery, including carrying charges, of the energy cost for

the prior calendar year.

In March 2004, Entergy Arkansas filed with the Arkansas Public

Service Commission (APSC) its energy cost recovery rider for the

period April 2004 through March 2005. The filed energy cost rate,

whichaccounts for 12 percent of a typical residential customer’s bill

using 1,000 kWh per month, increased 16 percent due primarily

to the elimination of a credit contained in the prior year’s rate to

refund previously over-recovered fuel costs. Also included in the

current year’senergycost calculationis a decrease in rates of

$3.9 million as a result of the operation of a revised energy

allocationmethod between the retail and wholesale sectors resulting

fromthe APSC's approval of a life-of-resources power purchase

agreement with Entergy New Orleans.

Entergy Gulf States (Texas)

In the Texas jurisdiction, Entergy Gulf States’ rate schedules include

afixed fuel factor to recover fuel and purchased power costs,

including carrying charges, not recovered in base rates. Under the

current methodology, semi-annual revisions of the fixed fuel factor

maybe made in March and September based on the market price of

natural gas. Entergy Gulf States will likely continue to use this

methodology until the start of retail open access, which has been

delayed. The amounts collected under Entergy Gulf States’ fixed

fuel factor and any interim surcharge implemented until the date

retail open access commences are subject to fuel reconciliation

proceedings before the PUCT. In the Texas jurisdiction, Entergy

Gulf States’ deferred electric fuel costs are $78.6 million as of

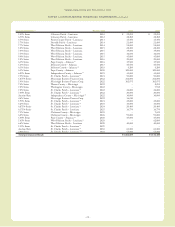

December 31, 2004, whichinclude the following (in millions):

Under-recovered fuel costs for the period 9/03 - 7/04

to be recovered through an interim fuel surcharge over a

six-month period beginning in January 2005 $27.8

Items to be addressed as partof unbundling $29.0

Imputed capacity charges $ 9.3

Other $12.5

The PUCT has ordered that the imputed capacity charges be

excluded from fuel rates and therefore recovered through base rates.

Entergy Gulf States filed a retail electric rate case and fuel

proceeding with the PUCT in August 2004. As discussed below,

the PUCT dismissed the rate case and fuel reconciliation

proceeding in October 2004 indicating that Entergy Gulf States is

still subject to a rate freeze based on the current PUCT-approved

settlement agreement stipulating that a rate freeze would remain in

effect until retail open access commenced in Entergy Gulf States’

service territory, unless the rate freeze is lifted by the PUCT prior

thereto. Without a Texas base rate proceeding, it is possible that

Entergy Gulf States will not be allowed to recover imputed

capacity charges in Texas retail rates in the future. Entergy Gulf

States believes the PUCT has misinterpreted the settlement and has

appealed the PUCT order to the Travis County District Court and

also intends to pursue other available remedies as discussed above in

“Electric Industry Restructuring and the Continued Application of

SFAS 71.” The dismissal of the rate case does not preclude Entergy

Gulf States from seeking the reconciliation of fuel and purchased

power costs of $288 million incurred from September 2003 through

March 2004 when, at the appropriate time, similar costs are

reconciled in the future.

In January 2001, Entergy Gulf States filed with the PUCT a fuel

reconciliation case covering the period from March 1999 through

August 2000. Entergy Gulf States was reconciling approximately

$583 millionof fuel and purchased power costs. As partof this

filing, Entergy Gulf States requested authority to collect

$28 million, plus interest, of under-recovered fuel and purchased

power costs. In August 2002, the PUCT reduced Entergy Gulf

States’ request to approximately $6.3 million, including interest

through July 31, 2002. Approximately $4.7 million of the total

reduction to the requested surcharge relates to nuclear fuel costs

that the PUCT deferred ruling on at this time. In October 2002,

Entergy Gulf States appealed the PUCT’s final order in Texas

District Court. In its appeal, Entergy Gulf States is challenging the

PUCT’s disallowance of approximately $4.2 million related to

imputed capacitycosts and its disallowance related to costs for ener-

gydelivered from the 30% non-regulated share of River Bend. The

case was argued before the Travis County Texas District Court in

August 2003 and the Travis CountyDistrict Court judge affirmed

the PUCT’s order. In October 2003, Entergy Gulf States appealed

this decisionto the Court of Appeals. Oral argument before the

appellate court occurred in September 2004 and the matter

is stillpending.

In September 2003, Entergy Gulf States filed an application with

the PUCT to implement an $87.3 million interim fuel surcharge,

including interest, to collect under-recovered fuel and purchased

power expenses incurred from September 2002 through August

2003. Hearings were held in October 2003 and the PUCT issued

an order in December 2003 allowing for the recovery of

$87 million. The surcharge was collected over a twelve-month

period that began in January 2004.

In March 2004, Entergy Gulf States filed with the PUCT a fuel

reconciliationcase covering the period September 2000 through

August 2003. Entergy Gulf States is reconciling $1.43 billion of

fuel and purchased power costs on a Texas retail basis. This amount

includes $8.6 million of under-recovered costs that Entergy Gulf

States is asking to reconcile and roll into its fuel over/under-

recoverybalance to be addressed in the next appropriate fuel

proceeding. This case involves imputed capacity and River Bend

payment issues similar to those decided adversely in the January

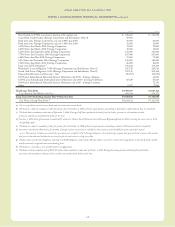

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued