Entergy 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2004

-59 -

FSP 109-1, “Application of FASB Statement No. 109, ‘Accounting

for Income Taxes’, to the Tax Deduction on Qualified Production

Activities Provided by the American Jobs Creation Act of 2004”

and FSP 109-2, “Accounting and Disclosure Guidance for the

Foreign Earnings Repatriation Provision within the American Jobs

Creation Act of 2004” which are further discussed in Note 3 to the

consolidated financial statements.

SFAS 123R, “Share-Based Payment” was issued in December of

2004 and is effective for Entergy at the beginning of the third

quarter in 2005. SFAS 123R requires all employers to account for

share-based payments at fair value and also provides guidance on

determining the assumptions to estimate fair value. SFAS 123R also

provides guidance on how to account for differences in the amounts

of deferred taxes initially recorded when the options are

recorded as expense and the amount of expense deducted on a

company’s tax return when the options are actually exercised.

Entergy began voluntarily expensing its stock options effective

January 1, 2003 in accordance with SFAS 148, “Stock-Based

Compensation - Transition and Disclosure.” Entergy is in the

process of evaluating the reporting and disclosure issues resulting

from the adoption of SFAS 123R but does not expect the effect of

the adoption of this standard to be material to Entergy’s financial

positionor results of operations.

SFAS 151, “Inventory Costs – an amendment of ARB No. 43,

Chapter 4” and SFAS 153, “Exchanges of Nonmonetary Assets,”

werealso issued during the fourth quarter of 2004 and are effective

for Entergy in 2006 and 2005, respectively. Entergy does not expect

the impact of the adoption of these standards to be material.

During 2003, Entergy adopted the provisions of the following

accounting standards: SFAS 143, “Accounting for Asset

Retirement Obligations,” which is discussed further in Note 8 to

the consolidated financial statements; FASB Interpretation No.

(FIN) 46, “Consolidation of Variable Interest Entities,” which is

discussed further in Note 5 to the consolidated financial statements;

and SFAS 150, “Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity.” SFAS 150, which

became effective July 1, 2003, requires mandatorily redeemable

financial instruments to be classified and treated as liabilities in the

presentation of financial position and results of operations.The only

effect of implementing SFAS 150 for Entergyis the inclusion of

long-term debt and preferred stock with sinking fund under the

liabilities caption in Entergy’s balance sheet. Entergy’s results of

operations and cash flows were not affected by SFAS 150.

During 2003, Entergy also adopted the provisions of the

following accounting standards: EITF 02-3, “Issues Involved in

Accounting for Derivative Contracts Held for Trading Purposes

and Contracts Involved in Energy Trading and Risk Management

Activities;” SFAS 149, “Amendment of Statement 133 on

DerivativeInstruments and Hedging Activities” and related inter-

pretations by the Derivatives Implementation Group, and FIN 45,

“Guarantor’s Accounting and Disclosure Requirements for

Guarantees Including Indirect Guarantees of Indebtedness of

Others.” The adoption of these standards did not have a material

effect onEntergy’sfinancial statements.

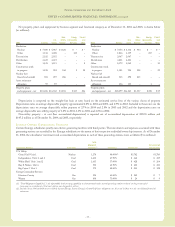

NOTE 2. RATE AND REGULATORY MATTERS

Electric Industry Restructuring and the

Continued Application of SFAS 71

Although Arkansas and Texas enacted retail open access laws, the

retail open access law in Arkansas has now been repealed. Retail

open access in Entergy Gulf States’ service territory in Texas has

been delayed. Entergy believes that significant issues remain to be

addressed by regulators, and the enacted law in Texas does not

provide sufficient detail to allow Entergy Gulf States to reasonably

determine the impact on Entergy Gulf States’ regulated operations.

Entergy therefore continues to apply regulatory accounting

principles to the retail operations of all of the domestic utility

companies. Following is a summary of the status of retail open

access in the domestic utility companies’ retail service territories.

%of Entergy’s

2004 Revenues Derived

Status of Retail from Retail Electric Utility

Jurisdiction Open Access Operations in the Jurisdiction

Arkansas Retail open access was repealed in

February 2003. 11.6%

Texas In July 2004, the Public Utility Commission

of Texas (PUCT)effectively rejected Entergy Gulf

States’ proposal to implement retail open access in its

service territory. In February 2005, bills were submitted

in the Texas Legislature that would specify that retail open

access will not commence in Entergy Gulf States’ territory

until the PUCT certifies a power region. 11.8%

Louisiana The LPSC has deferred pursuing retail open access,

pending developments at the federal level and

in other states. In response to a study submitted

to the LPSC that was funded by a group of large

industrial customers, the LPSC recently has solicited

comments regarding a limited retail access program.

It is uncertain what action, if any, the LPSC might

take in response to the information it received. 34.1%

Mississippi The Mississippi Public Service Commission

(MPSC) has recommended not pursuing

open access at this time. 10.9%

New Orleans The Council of the City of New Orleans,

Louisiana (Council or CityCouncil) has

taken no action onEntergy NewOrleans’

proposal filed in 1997. 4.5%

Texas

As ordered by the PUCT, in January 2003 Entergy Gulf States filed

its proposal for an interim solution (retail open access without a

FERC-approved RTO), which among other elements, included:

•the recommendation that retail open access in Entergy Gulf

States’ Texas service territory, including corporate unbundling,

occur by January 1, 2004, or else be delayed until at least

January1, 2007. If retail open access is delayed past January 1,

2004, Entergy Gulf States seeks authorization to separate into

two bundled utilities, one subject to the retail jurisdiction of the

PUCT and one subject to the retail jurisdiction of the LPSC.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued