Entergy 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-24 -

Entergy Corporation and Subsidiaries 2004

U.S. Utility

The increase in earnings for the U.S. Utility for 2004 from

$469 million to $643 million was primarily due to the following:

•the $107.7 million ($65.6 million net-of-tax) accrual in 2003 of

the loss that would be associated with a final, non-appealable

decision disallowing abeyed River Bend plant costs. Refer to

Note 2 to the consolidated financial statements for more details

regarding the River Bend abeyed plant costs;

•lower other operation and maintenance expenses primarily due

to $99.8 million ($70.1 million net-of-tax) of charges recorded

in 2003 in connection with the voluntary severance program;

•the $21.3 million net-of-tax cumulative effect of a change in

accounting principle that reduced earnings at Entergy Gulf

States in the first quarter of 2003 upon implementation of

SFAS 143. See “Critical Accounting Estimates - SFAS 143”

below for discussion of the implementation of SFAS 143;

•miscellaneous other income of $27.7 million (pre-tax) in 2004

resulting from a revision of the decommissioning liability for

River Bend, as discussed in Note 8 to the consolidated

financial statements;

•higher net revenue; and

•lower interest charges.

The decrease in earnings for the U.S. Utility for 2003 from

$583 million to $469 million was primarily due to:

•the $107.7 million($65.6 million net-of-tax) accrual in 2003 of

the loss that would be associated with a final, non-appealable

decisiondisallowing abeyed River Bend plant costs;

•$99.8 million($70.1 million net-of-tax) of charges recorded in

2003 in connection with the voluntary severance program; and

•the $21.3 millionnet-of-tax cumulativeeffect of a change in

accounting principle that reduced earnings at Entergy Gulf

States in the first quarter of 2003 upon implementation of

SFAS 143. See “Critical Accounting Estimates - SFAS 143”

below for discussion of the implementation of SFAS 143.

Partially offsetting the decrease in earnings in 2003 were higher net

revenue and lower interest charges.

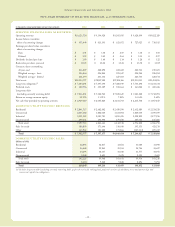

Net Revenue

2004 Compared to 2003

Net revenue, which is Entergy’s measure of gross margin, consists of

operating revenues net of: 1) fuel, fuel-related, and purchased power

expenses and 2) other regulatorycredits. Following is an analysis of

the change in net revenue comparing 2004 to 2003 (in millions):

2003 net revenue $4,214.5

Volume/weather 68.3

Summer capacity charges 17.4

Base rates 10.6

Deferred fuel cost revisions (46.3)

Price applied to unbilled sales (19.3)

Other (1.2)

2004 net revenue $4,244.0

The volume/weather variance resulted primarily from increased

usage, partially offset by the effect of milder weather on sales

during 2004 compared to 2003. Billed usage increased a total of

2,261 GWh in the industrial and commercial sectors.

The summer capacity charges variance was due to the

amortization in 2003 at Entergy Gulf States and Entergy Louisiana

of deferred capacity charges for the summer of 2001. Entergy Gulf

States’ amortization began in June 2002 and ended in May 2003.

Entergy Louisiana’s amortization began in August 2002 and ended

in July 2003.

Base rates increased net revenue due to a base rate increase at

Entergy New Orleans that became effective in June 2003.

The deferred fuel cost revisions variance resulted primarily from

arevision in 2003 to an unbilled sales pricing estimate to more

closely align the fuel component of that pricing with expected

recoverable fuel costs at Entergy Louisiana. Deferred fuel cost

revisions also decreased net revenue due to a revision in 2004 to the

estimate of fuel costs filed for recovery at Entergy Arkansas in the

March 2004 energy cost recovery rider.

The price applied to unbilled sales variance resulted from a

decrease in fuel price in 2004 caused primarily by the effect of

nuclear plant outages in 2003 on average fuel costs.

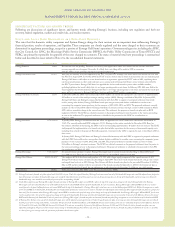

Gross Operating Revenues and Regulatory Credits – Gross operating

revenues include an increase in fuel cost recovery revenues of

$475 millionand $18 millionin electric and gas sales, respectively,

primarily due to higher fuel rates in 2004 resulting from increases in

the market prices of purchased power and natural gas. As such, this

revenue increase is offset by increased fuel and purchased

power expenses.

Other regulatorycredits increased primarily due to the following:

•cessationof the Grand Gulf Accelerated Recovery Tariff that

was suspended in July2003;

•the amortization in 2003 of deferred capacity charges for

summer 2001 power purchases at Entergy Gulf States and

Entergy Louisiana;

•the deferral in 2004 of $14.3 million of capacity charges related

to generation resource planning as allowed by the Louisiana

Public Service Commission (LPSC);

•the deferral in 2004 by Entergy Louisiana of $11.4 million

related to the voluntaryseverance program, in accordance with

aproposed stipulation entered into with the LPSC staff; and

•the deferral in August 2004 of $7.5 million of fossil plant

maintenance and voluntaryseverance program costs at Entergy

New Orleans as a result of a stipulation approved by the

Council of the Cityof New Orleans (City Council or Council).

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued