Entergy 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-36 -

Entergy Corporation and Subsidiaries 2004

future production costs if FERC adopts the ALJ’s Initial Decision,

the following potential annual production cost reallocations among

the domestic utility companies could result assuming annual

average gas prices range from $6.39/mmBtu in 2005 declining to

$4.97/mmBtu by 2009 (in millions):

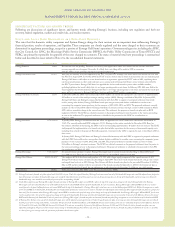

Average Annual

Range of Annual Payments Payments or (Receipts)

or (Receipts) for 2005-2009 Period

Entergy Arkansas $ 154 to $281 $ 215

Entergy Gulf States $(130) to $ (15) $ (63)

Entergy Louisiana $(199) to $(98) $(141)

Entergy Mississippi $(16) to $ 8 $ 1

Entergy New Orleans $(17) to $ (5) $ (12)

Management believes that any changes in the allocation of

production costs resulting from a FERC decision and related retail

proceedings should result in similar rate changes for retail

customers. The timing of recovery of these costs in rates could be

the subject of additional proceedings at the APSC and elsewhere,

however, and a delay in full recovery of any increased allocation of

productioncosts could result in additional financing requirements.

Although the outcome and timing of FERC, APSC, and other

proceedings cannot be predicted at this time, Entergy does not

believethat the ultimate resolutionof these proceedings willhave a

material effect onits financial condition or results of operation.

In February 2004, the APSC issued an “Order of Investigation,”

in whichit discusses the negativeeffect that implementationof the

FERCALJ’s Initial Decision would have on Entergy Arkansas’

customers. The APSC order establishes an investigation into

whether EntergyArkansas’ continued participationin the System

Agreement is in the best interest of its customers, and whether there

aresteps that EntergyArkansas or the APSC can take “to protect

[EntergyArkansas’ customers] from future attempts by Louisiana,

or anyother Entergy retail regulator, to shift its high costs to

Arkansas.” Entergy Arkansas filed testimony in response to the

APSC’s Order of Investigation. The testimony emphasizes that the

ALJ’s Initial Decision is not a final order by FERC; briefly

discusses some of the aspects of the Initial Decision that are

included in Entergy’s exceptions filed with FERC; emphasizes that

Entergy will seek to reverse the production cost-related portions of

the Initial Decision; and states that Entergy Arkansas believes that

it is premature, before FERC makes a decision, for Entergy

Arkansas to determine whether its continued participation in the

System Agreement is appropriate.

In April 2004, the APSC commenced the investigation into

Entergy Louisiana’s Vidalia purchased power contract and

requested historical documents, records, and information from

Entergy Arkansas, which Entergy Arkansas has provided to the

APSC. Also in April 2004, the APSC issued an order directing

Entergy Arkansas to show cause why Entergy Arkansas should not

have to indemnify and hold its customers harmless from any adverse

financial effects related to Entergy Louisiana’s pending acquisition

of the Perryville power plant, or show that the Perryville unit will

produce economic benefits for Entergy Arkansas’ customers.

EntergyArkansas filed a response in May 2004 stating that Entergy

will seek to reverse the production cost-related portions of the ALJ’s

Initial Decision in the System Agreement proceeding at FERC,

that the Perryville acquisition is part of Entergy’s request for

proposal generation planning process, that Entergy Arkansas is not

in a position to indemnify its retail customers from actions taken by

FERC, and that the Perryville acquisition is expected to reduce the

domestic utility companies’ overall production costs. Procedural

schedules have not been established in these APSC investigations.

In April 2004, the City Council issued a resolution directing

Entergy New Orleans and Entergy Louisiana to notify the City

Council and obtain prior approval for any action that would

materially modify, amend, or terminate the System Agreement for

one or more of the domestic utility companies. Entergy New

Orleans and Entergy Louisiana appealed to state court the City

Council’s resolution on the basis that the imposition of this

requirement with respect to the System Agreement, a FERC-

approved tariff, exceeds the City Council’s jurisdiction and

authority. In July 2004, the City Council answered the appeal and

filed a third party demand and counterclaim against Entergy, the

domestic utilitycompanies, Entergy Services, and System Energy,

seeking a declaratoryjudgment that Entergyand its subsidiaries

cannot terminate the System Agreement until obligations owed

under a March2003 rate case settlement aresatisfied. In August

2004, Entergy New Orleans and Entergy Louisiana, as well as the

named third party defendants, filed pleadings objecting to the City

Council’sthirdpartydemand and counterclaim on various grounds,

including federal preemption. In February 2005, the state court

issued an oral decision dismissing the City Council’s claims for lack

of subject matter jurisdictionand prematurity.

Transmission

In 2000, FERCissued an order encouraging utilities to voluntarily

place their transmission facilities under the control of independent

RTOs (regional transmission organizations) by December 15, 2001.

Delays in implementing the FERC order have occurred due to a

variety of reasons, including the fact that utility companies, other

stakeholders, and federal and state regulators continue to work to

resolve various issues related to the establishment of such RTOs.

In April 2004, Entergy filed a proposal with FERC to commit

voluntarily to retain an independent entity (Independent

Coordinator of Transmission or ICT) to oversee the granting of

transmission or interconnection service on Entergy’s transmission

system, to implement a transmission pricing structure that ensures

that Entergy’s retail native load customers are required to pay for

only those upgrades necessary to reliably serve their needs, and to

have the ICT serve as the security coordinator for the Entergy

region. Assuming applicable regulatory support and approvals can

be obtained, Entergy proposed to contract with the ICT to oversee

the granting of transmission service on the Entergy system as well

as the implementation of the proposed weekly procurement process

(WPP). The proposal was structured to not transfer control of

Entergy’s transmission system to the ICT, but rather to vest with

the ICT broad oversight authorityover transmission planning

and operations.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued