Dollar General 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and basic clothing. Detailed information on our net sales by product class can be found in Note

13 to the consolidated financial statements contained in Item 8 of this report.

We maintain approximately 4,900 core stock-keeping units (“SKUs”) per store.

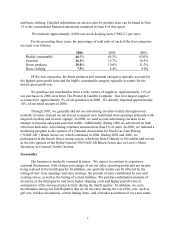

For the preceding three years, the percentage of total sales of each of the four categories

we track is as follows:

2006 2005 2004

Highly consumable 65.7% 65.3% 63.0%

Seasonal 16.4% 15.7% 16.5%

Home products 10.0% 10.6% 11.5%

Basic clothing 7.9% 8.4% 9.0%

Of the four categories, the home products and seasonal categories typically account for

the highest gross profit rates and the highly consumable category typically accounts for the

lowest gross profit rate.

We purchase our merchandise from a wide variety of suppliers. Approximately 11% of

our purchases in 2006 were from The Procter & Gamble Company. Our next largest supplier

accounted for approximately 5% of our purchases in 2006. We directly imported approximately

14% of our retail receipts in 2006.

Through 2005, we generally did not use advertising circulars widely throughout our

network of stores. Instead we advertised to support new traditional store openings primarily with

targeted circulars and in-store signage. In 2006, we used several advertising circulars in an

attempt to increase sales and customer traffic. Additionally, during 2006 we advertised on both

television and radio. Advertising expenses remained less than 1% of sales. In 2005, we initiated a

marketing program as the sponsor of a National Association for Stock Car Auto Racing

(“NASCAR”) Busch Series car, which continued in 2006. During 2005 and 2006, we

participated in the Busch Series racing season, which ran from February to November and served

as the title sponsor of the Dollar General 300 NASCAR Busch Series race at Lowe’ s Motor

Speedway in Concord, North Carolina.

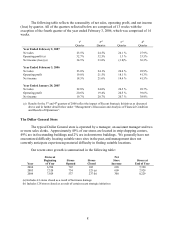

Seasonality

Our business is modestly seasonal in nature. We expect to continue to experience

seasonal fluctuations, with a larger percentage of our net sales, operating profit and net income

being realized in the fourth quarter. In addition, our quarterly results can be affected by the

timing of new store openings and store closings, the amount of sales contributed by new and

existing stores, as well as the timing of certain holidays. We purchase substantial amounts of

inventory in the third quarter and incur higher shipping costs and higher payroll costs in

anticipation of the increased sales activity during the fourth quarter. In addition, we carry

merchandise during our fourth quarter that we do not carry during the rest of the year, such as

gift sets, holiday decorations, certain baking items, and a broader assortment of toys and candy.

7