Dollar General 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.forfeited and all vested but unpaid RSUs will be forfeited except for Mr. Perdue’ s vested but

unpaid restricted stock units which will settle in due course.

Involuntary Termination without Cause. In the event the NEO is involuntarily terminated

without cause, the NEO’ s equity grants will be treated as described under “Voluntary

Termination with Good Reason or After Failure to Renew the Employment Agreement” above.

In addition, each NEO will receive the applicable payments and benefits listed under “Voluntary

Termination with Good Reason or After Failure to Renew the Employment Agreement” above.

Payments Upon Termination After a Change-in-Control

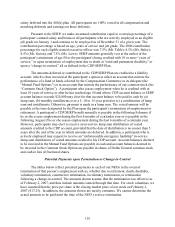

All unvested equity grants accelerate automatically upon a change-in-control (as defined

in our 1998 Stock Incentive Plan) regardless of whether the NEO’ s employment terminates, and

all CDP/SERP Plan benefits become fully vested upon a change-in-control (as defined in our

CDP/SERP Plan). In addition, under our 1998 Stock Incentive Plan, the Compensation

Committee may accelerate the vesting of all unvested equity grants in the event of a potential

change-in-control (as defined in our 1998 Stock Incentive Plan).

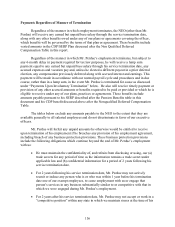

In the event the NEO is involuntarily terminated without cause or resigns for good reason

within 2 years of a change-in-control, in addition to the items identified under “Payments

Regardless of Manner of Termination” above, the NEO will receive the following upon

execution of a release of certain claims against us and our affiliates in the form attached to the

NEO’ s employment agreement:

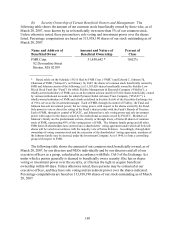

• Each NEO other than Mr. Perdue will receive a lump sum payment equal to 2 times

the NEO’ s annual base salary plus 2 times the NEO’ s target incentive bonus, each as

in effect immediately prior to the change-in-control, plus 2 times our annual

contribution for the NEO’ s participation in our medical, dental and vision benefits

program. The NEO also will receive outplacement services, at our expense, for 1 year

or, if earlier, until other employment is secured.

• Mr. Perdue will receive a lump sum payment equal to 3 times the sum of his annual

base salary in effect on his service termination date and the greater of his actual

annual incentive bonus earned in the last fiscal year prior to his termination date or

his target annual incentive bonus for the fiscal year in which the termination occurs.

In addition, for 36 months after his termination date, we will pay the premium for his

participation in our retiree medical plan, if any, in accordance with his elected

coverage in place on his termination date (no retiree medical plan is currently in place

so this benefit is not reflected in the table below regarding Mr. Perdue). We will also

gross-up our payment of those premiums to the extent they are taxable to Mr. Perdue.

• We also will credit Mr. Perdue with 5 additional years of continuous service under his

SERP. In determining his base salary and bonus for these additional years for

purposes of calculating final average compensation, we use his base salary on his

termination date (or, if higher, at the time immediately prior to the change-in-control)

and the greater of his actual annual incentive bonus earned in the last fiscal year prior

143