Dollar General 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company believes that stock-based awards assist in retaining employees and better align the

interests of its employees with those of its shareholders.

Stock options granted under the plan are non-qualified stock options issued at an exercise

price equal to the market price of the Company’ s common stock on the grant date, vest ratably

over a four-year period (subject to earlier vesting in certain circumstances such as a change in

control), and expire no more than 10 years following the grant date. The number of options

granted is generally based on individual job grade levels, which are determined based upon

competitive market data. Dividends are not paid or accrued on stock options.

Unvested options generally are forfeited upon the cessation of employment with the

Company. In the event employment terminates for a reason other than cause, death, disability or

retirement, any outstanding vested options issued under the plan generally may be exercised for a

period of three months. In the event employment terminates due to death, disability or

retirement, the option recipient (or the recipient’ s legal representative or beneficiary) generally

may exercise any outstanding vested options issued under the plan for a period of three years.

Notwithstanding the foregoing, no option may be exercised beyond its initial 10-year expiration

date.

Restricted stock awards and restricted stock unit awards granted under the plan generally

vest ratably over three years (subject to earlier vesting in certain circumstances such as a change

in control). Unvested restricted stock and restricted stock unit awards generally are forfeited

upon the cessation of a grantee’ s employment with the Company. Recipients of restricted stock

are entitled to receive cash dividends and to vote their respective shares, but are generally

prohibited from selling or transferring restricted shares prior to vesting. Recipients of restricted

stock units are entitled to accrue dividend equivalents on the units but are not entitled to vote,

sell or transfer the units or the shares underlying the units prior to both vesting and payout.

Dividends or dividend equivalents, as the case may be, are paid or accrued on the grants of

restricted stock and restricted stock units at the same rate that dividends are paid to shareholders

generally. Dividend equivalents on restricted stock units vest at the same time that the underlying

shares vest.

The plan provides for the automatic annual grant of 4,600 restricted stock units to each

non-employee director that vest one year after the grant date (subject to earlier vesting upon

retirement, change in control or other circumstances set forth in the plan) and generally may not

be paid until the individual has ceased to be a member of the Company’ s Board of Directors.

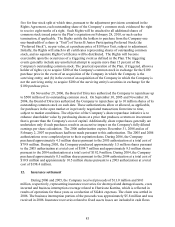

In the past, the Company had various stock and incentive plans under which stock

options were granted. Stock options that were granted under prior plans and were outstanding on

February 2, 2007 continue in accordance with the terms of the respective plans.

On February 3, 2006, the vesting of all outstanding options granted prior to August 2,

2005, other than options previously granted to the Company’ s CEO and options granted in 2005

to the officers of the Company at the level of Executive Vice President or above, accelerated

pursuant to a January 24, 2006 action of the Compensation Committee of the Company’ s Board

of Directors. In addition, pursuant to that Compensation Committee action, the vesting of all

78