Dollar General 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

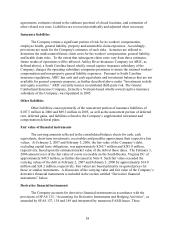

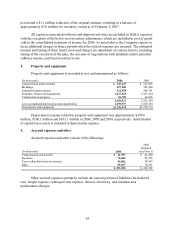

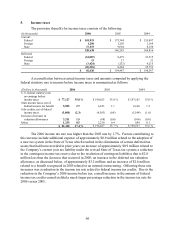

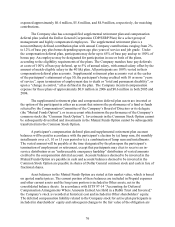

5. Income taxes

The provision (benefit) for income taxes consists of the following:

(In thousands) 2006 2005 2004

Current:

Federal $101,919 $ 175,344 $ 155,497

Foreign 1,200 1,205 1,169

State 17,519 9,694 8,150

120,638 186,243 164,816

Deferred:

Federal (34,807) 8,479 21,515

Foreign 13 17 21

State (3,424) (252) 4,215

(38,218) 8,244 25,751

$ 82,420 $ 194,487 $ 190,567

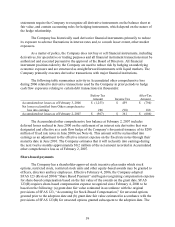

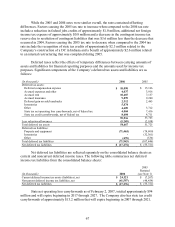

A reconciliation between actual income taxes and amounts computed by applying the

federal statutory rate to income before income taxes is summarized as follows:

(Dollars in thousands) 2006 2005 2004

U.S. federal statutory rate

on earnings before

income taxes $ 77,127 35.0 % $ 190,625 35.0 % $ 187,165

35.0 %

State income taxes, net of

federal income tax benefit 5,855 2.7 6,223 1.1 8,168

1.5

Jobs credits, net of federal

income taxes (5,008) (2.3) (4,503) (0.8) (5,544)

(1.0)

Increase (decrease) in

valuation allowances 3,211 1.5 (88) (0.0) (106)

(0.0)

Other 1,235 0.5 2,230 0.4 884 0.1

$ 82,420 37.4 % $ 194,487 35.7 % $ 190,567 35.6 %

The 2006 income tax rate was higher than the 2005 rate by 1.7%. Factors contributing to

this increase include additional expense of approximately $0.9 million related to the adoption of

a new tax system in the State of Texas which resulted in the elimination of certain deferred tax

assets that had been recorded in prior years; an increase of approximately $0.9 million related to

the Company’ s current year tax liability under the revised State of Texas tax system; a reduction

in the contingent income tax reserve due to the resolution of contingent liabilities that is $2.0

million less than the decrease that occurred in 2005; an increase in the deferred tax valuation

allowance, as discussed below, of approximately $3.2 million; and an increase of $2.6 million

related to a benefit recognized in 2005 related to an internal restructuring. Offsetting these rate

increases was a reduction in the income tax rate related to federal income tax credits. Due to the

reduction in the Company’ s 2006 income before tax, a small increase in the amount of federal

income tax credits earned yielded a much larger percentage reduction in the income tax rate for

2006 versus 2005.

66