Dollar General 2006 Annual Report Download - page 41

Download and view the complete annual report

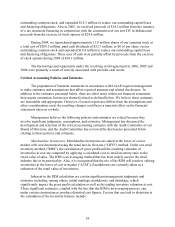

Please find page 41 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• applying the RIM to a group of products that is not fairly uniform in terms of its cost

and selling price relationship and turnover;

• applying the RIM to transactions over a period of time that include different rates of

gross profit, such as those relating to seasonal merchandise;

• inaccurate estimates of inventory shrinkage between the date of the last physical

inventory at a store and the financial statement date; and

• inaccurate estimates of LCM and/or LIFO reserves.

To reduce the potential of such distortions in the valuation of inventory, we expanded the

number of departments we utilize for our gross profit calculation from 10 to 23 in 2005. Other

factors that reduce potential distortion include the use of historical experience in estimating the

shrink provision (see discussion below) and the utilization of an independent statistician to assist

in the LIFO sampling process and index formulation. As part of this process we also perform an

inventory-aging analysis for determining obsolete inventory. Our policy is to write down

inventory to an LCM value based on various management assumptions including estimated

markdowns and sales required to liquidate such aged inventory in future periods. Inventory is

reviewed on a quarterly basis and adjusted as appropriate to reflect write-downs determined to be

necessary. The estimated amount of the below-cost inventory write-downs for the strategic

merchandising initiatives discussed above in the “Executive Overview” is based on

management’ s assumptions regarding the timing and adequacy of markdowns and the final

adjustment may vary materially from the estimate depending on various factors, including timing

of the execution of the plan, retail market conditions and the accuracy of assumptions used by

management in developing these estimates.

Factors such as slower inventory turnover due to changes in competitors’ tactics,

consumer preferences, consumer spending and unseasonable weather patterns, among other

factors, could cause excess inventory requiring greater than estimated markdowns to entice

consumer purchases, resulting in an unfavorable impact on our consolidated financial statements.

Sales shortfalls due to the above factors could cause reduced purchases from vendors and

associated vendor allowances that would also result in an unfavorable impact on our

consolidated financial statements.

We calculate our shrink provision based on actual physical inventory results during the

fiscal period and an accrual for estimated shrink occurring subsequent to a physical inventory

through the end of the fiscal reporting period. This accrual is calculated as a percentage of sales

at each retail store, at a department level, and is determined by dividing the book-to-physical

inventory adjustments recorded during the previous twelve months by the related sales for the

same period for each store. To the extent that subsequent physical inventories yield different

results than this estimated accrual, our effective shrink rate for a given reporting period will

include the impact of adjusting the estimated results to the actual results. Although we perform

physical inventories in virtually all of our stores on an annual basis, the same stores do not

necessarily get counted in the same reporting periods from year to year, which could impact

comparability in a given reporting period.

39